A currency strength meter is a type of numerical scale that measures a currency's strength against its peers. It is used to help traders gauge the relative strength of currencies, and whether or not it is a good idea to buy or sell. The strength of a currency can be a reflection of a number of factors, including interest rates and economic releases.

There are many types of currency strength meters. Some are simple and don’t use weighted calculation, while others include weightings or other indicators to give a more comprehensive picture of a currency’s strengths. Each one performs the same basic function of calculating price movements over time.

If you are a trader, you need to be aware of the latest market trends. This includes news and economic releases, as well as the movements of a range of currencies. Also, you will need to consider your risk tolerance, your broker's commission and the size of your current position. Even though it isn't the best indicator, a currency strength measure can be an important part of the puzzle.

A currency strength meter can also help you gauge the likely future strength of a pair. The meter will often tell you which two currencies are stronger, weaker, or more likely to reverse in the future. It gives you the ability to choose the best ranges for currency trading pairs.

While a currency strength meter may look like an overly complicated tool, it's actually pretty easy to use. It doesn't need complex algorithms or special settings, which is something that many forex tools don't offer. It simply compares the average gains and losses of a pair to those of other pairs. The currency strength meter, for example, will tell you how strong USD is against TRY or how strong EUR is against GBP.

A currency strength meter is a valuable tool that can be used by anyone. This will allow traders to understand the performance of their currencies and to identify which currency is most likely rise or fall.

A currency strength meter can ultimately be an effective tool to make decisions. But, you need to know how it works before you start using it to your advantage. To do that, you will need to know what the meter is measuring and what the formula is.

Using a currency strength meter can give you a quick and easy overview of a wide range of currencies, without having to manually calculate every single one. This meter can help you save a lot of time and money if it is used correctly.

Whether you're a seasoned investor or just starting out in the market, a currency strength meter is a must-have.

FAQ

Which trading platform is best?

Many traders can find choosing the best trading platform difficult. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This will help you narrow your search for the right trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

What are the advantages and disadvantages of online investing?

Online investing has the main advantage of being convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Can one get rich trading Cryptocurrencies or forex?

Trading forex and crypto can be lucrative if you are strategic. You need to be aware of the market trends so you can make the most of them.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Also, you should only trade with money that is within your means.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Understanding the different currency conditions is crucial.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which forex trading platform or crypto trading platform is the best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

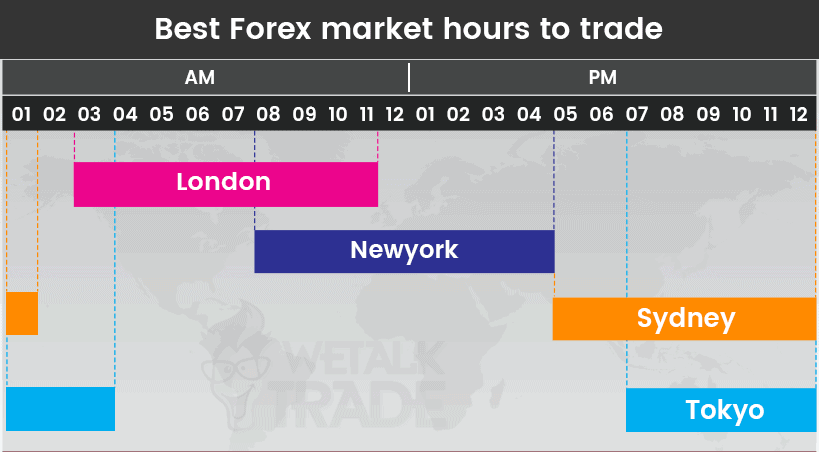

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Forex traders can make money

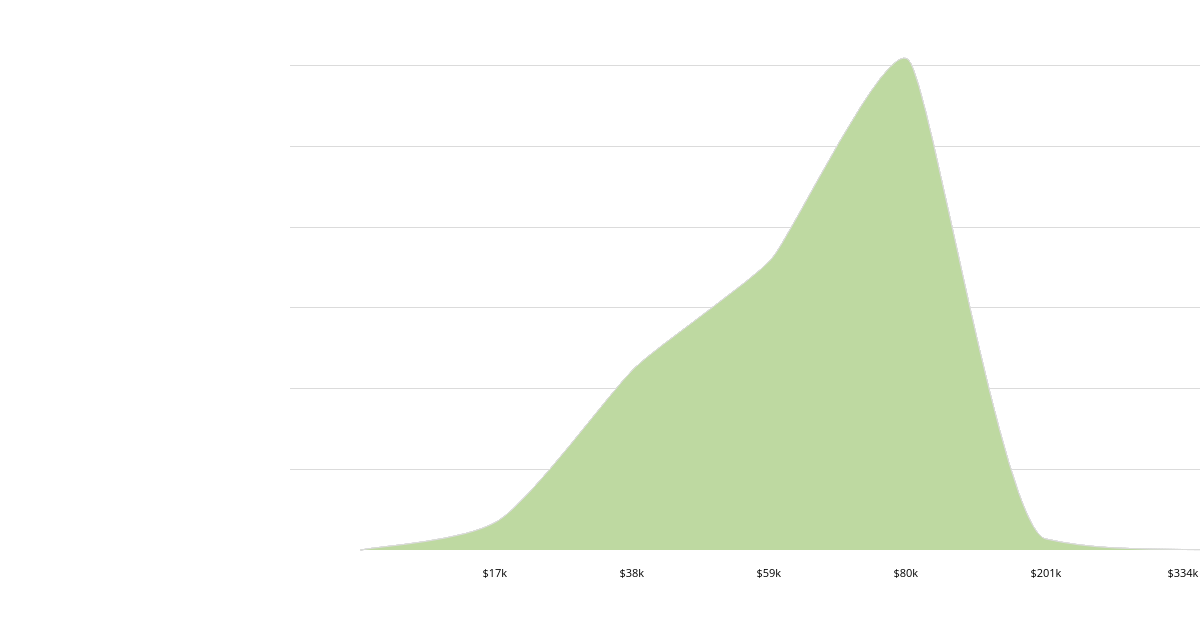

Yes, forex traders are able to make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail due to a lack of a structured plan or approach but with discipline, one can maximize their chances of making money in the foreign exchange (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Research is critical when investing online. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. Ask yourself if it's too good to be true and beware of claims that imply a guarantee of future results or substantial returns.

Learn about the investment's risk profile and review the terms and condition. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!