Crypto stocks can be an investment vehicle that allows investors to gain exposure in the booming cryptocurrency market, without needing to directly purchase the underlying asset. Cryptocurrencies are digital currencies which use cryptography for transactions and give users some governing control over the blockchain network where they are stored.

It can be great to invest in stocks of companies involved on cryptocurrency, but investors need be aware that there are risks. Stocks are subject to extreme volatility and can lose a lot in a short time.

Cryptocurrency Mining is a process that requires sophisticated equipment to solve complex mathematical issues. It's an energy-intensive activity, but it can bring in large amounts of revenue to some companies.

Nvidia Corp. is just one company that has a stake in this business. It produces GPUs (graphical processing devices) that are used frequently in bitcoin mining.

As the technology is becoming more familiar, the company has experienced strong growth. Its shares grew 150% in one-year and are projected to rise further in 2021.

Stocks of Stablecoin

Cryptocurrency has just become a popular asset class. The volatility that comes with it can make predictions difficult about when the price will increase or fall. It is crucial to pick a stablecoin company that can be expected to keep up over the long-term.

Nvidia Corporation

Nvidia is a global semiconductor manufacturer that creates graphics cards used in computer gaming. It also manufactures a range of high-performance computers and chips.

The stock is also well-known for its expertise in cryptocurrency. Since the introduction of its cryptocurrency mining technology, the company has been a leader within the sector.

Riot Blockchain, (RIOT), is another leader in crypto mining. This mining and infrastructure company operates via its Bitcoin Mining, Data Center Hosting and Electrical Products and Engineering segments.

The company generated $19.1billion in revenue for the fiscal year that ended September 2021. It also reported a loss of $34 million for the quarter ending October 2021.

How to Choose a Broker

An account with a broker is necessary to trade in cryptomining stocks. This intermediary connects to the exchange, and allows you order a number of shares at specific prices.

It is vital that you choose a reliable broker to help you invest in crypto mining stocks. It should be able to provide you with the necessary information and charts to help you make an informed decision.

How to choose a cryptocurrency stock

When it comes to choosing a crypto stock, look for a company that has strong leadership and low debt ratios. Consider the company's past performance and future prospects to determine if it is worth your investment. It is also important that the company you choose is diverse so that there is not too much risk in any particular investment.

FAQ

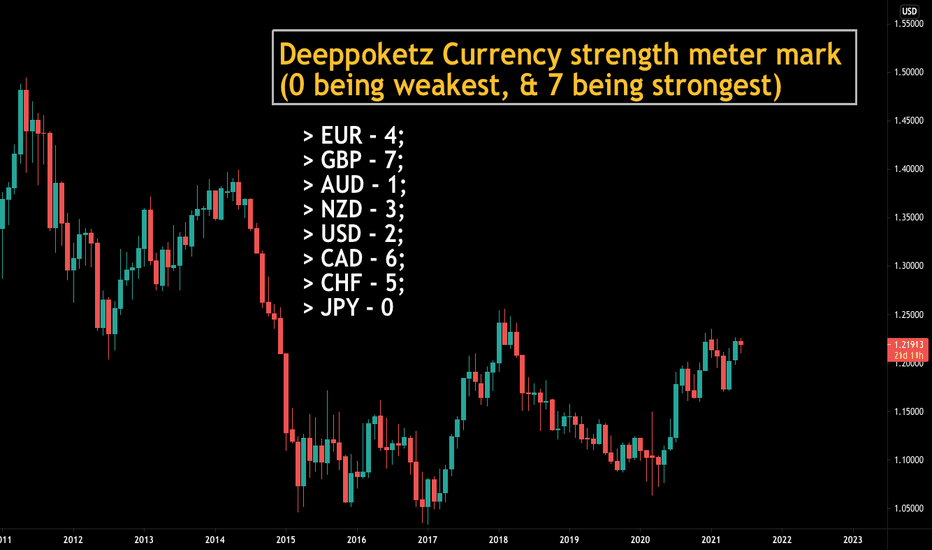

Which is harder forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to invest in real property. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Forex and Cryptocurrencies are great investments.

Yes, you can get rich trading crypto and forex if you use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Understanding the different currency conditions is crucial.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

Should I store my investment assets online or do I have other options?

The decision about where to store your money can be complicated. There are many options to protect your valuable assets.

Online storage of your investment assets allows you to access them from anywhere and can be accessed quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

Other options include keeping your investments in traditional banking or investing accounts as well as self-storage facilities that allow you to safely store gold, silver, or other valuables outside of your home.

Finally, you might consider investing in specialized firms that offer safe custody services specifically designed to protect large portfolios of assets.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.