You must be ready for volatility when you invest in cryptocurrency. It is possible for a cryptocurrency's value to fluctuate rapidly within hours. If you don't prepare, your coins may not sell for profit. This could lead to a huge loss.

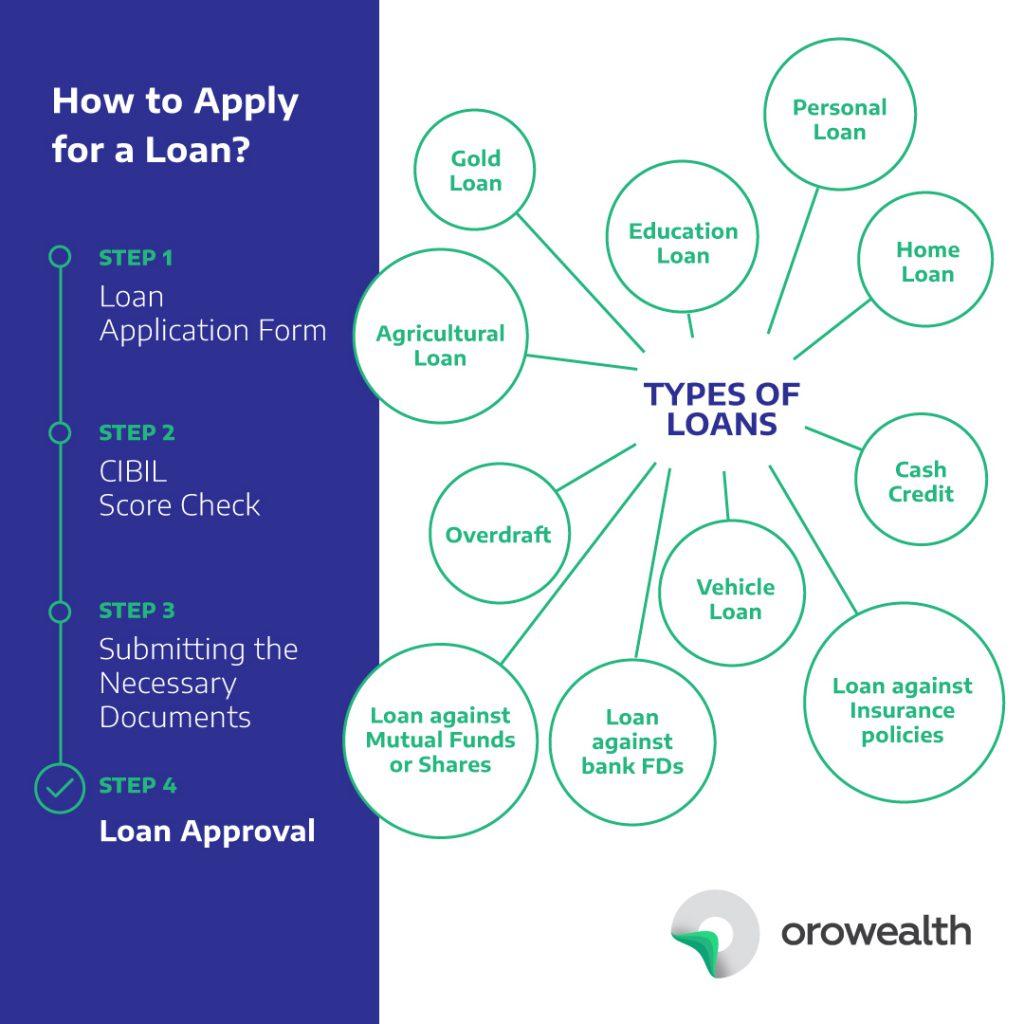

You should ensure that you have all of your financial affairs in order before you decide to invest in cryptocurrency. A portfolio with diversification and an emergency fund should be established. Your credit score should be maintained. A drop in credit scores can be very damaging.

While cryptocurrency investments may offer high returns, they also come with high risk. To reduce the risk, it is essential to be educated. Learn about the topic through white papers and articles. These will help you understand the investment case and the potential risks. Also, do your research and read the fine print before you open an account.

A lack of regulation is one the greatest issues with crypto. Many cryptocurrencies are supported by cash flow or hard assets, but there are many more that are not. Because the crypto market fluctuates so much, be prepared for substantial losses.

You must understand the tax implications when investing in crypto. For example, if you're a US resident, you'll pay capital gains tax on any profits from a crypto investment. However, this is not the only danger. There are many industry scams that can prove dangerous.

Another important thing to remember before investing in cryptocurrency is security. Security is a key consideration when you are considering investing in cryptocurrency exchanges. While some exchanges offer secure storage, it is important to confirm their authenticity before making any purchases.

Privacy issues are another risk. You will need to secure your personal information, as cryptocurrencies are not subject to regulation like stocks. It is recommended to use a physical wallet as it is more secure. You should also keep up to date on the latest developments in your cryptocurrencies.

Consider the possibility of not meeting your financial obligations. This could result in foreclosure or repossession of your property, and it can also affect credit scores.

While buying a new coin is a good idea, it's important not to go too far. A 10% decrease in value will have a greater impact than a 95% drop. You might also not realize the potential for a huge return on your investment if you sell your coins early.

Although investing in crypto can help diversify your investments it is not for everyone. If you are new to the industry, take your time and get to know everything. The first step in learning about the industry is to find an educational source that you trust.

After you have learned all you can about the industry you can begin to apply for a job. You should do your research and create a plan to take over your new job. You should not be afraid of asking for advice from others as they may have an impartial view of your market.

FAQ

Is Cryptocurrency Good for Investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

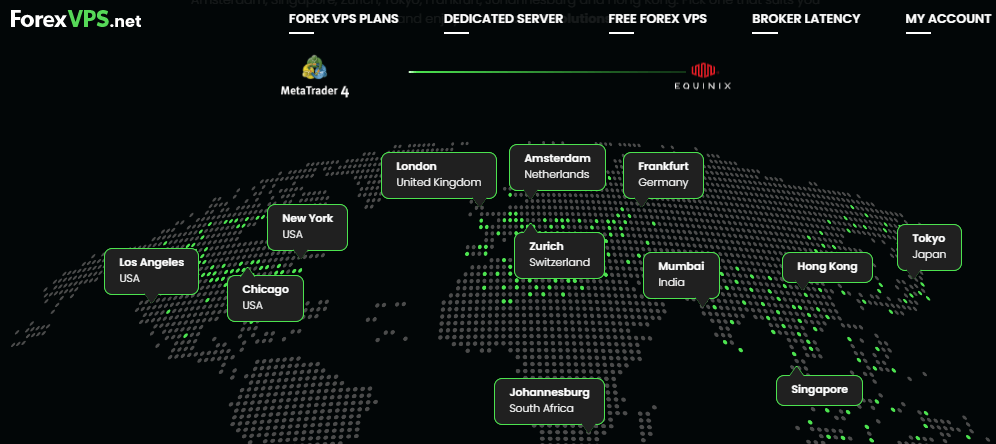

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which is better forex trading or crypto trading.

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

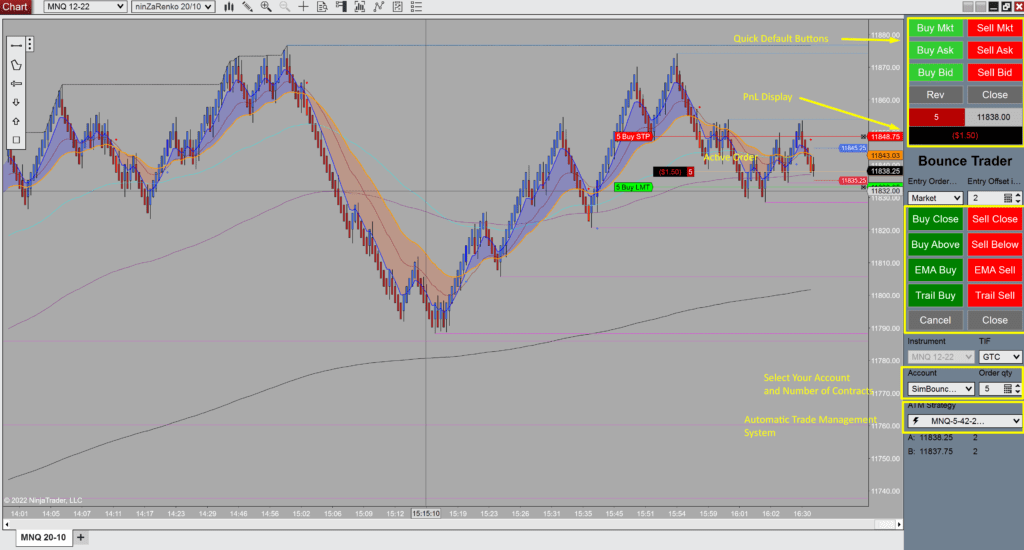

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

How can I invest Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, gather any additional information to help you feel confident about your investment decision. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which is harder, forex or crypto.

Each currency and crypto are different in their difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

The decision about where to store your money can be complicated. Your valuable assets require a strong security system and you have a few options.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You can also keep your investments in traditional bank or investing accounts. There are also self-storage options that allow you safe storage of gold, silver, and other valuables, outside your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?