The new crypto interest account is a great way to make a large return on your cryptocurrency holdings. While these accounts are similar in concept to savings accounts, the rates can be quite high and can sometimes reach the double digits.

Your investment goals, objectives and risk profile will dictate which account you choose. Some accounts focus more on capital preservation and others, short-term savings. Before making a decision, you should consider your liquidity options as well as account maintenance fees.

Coinbase, a popular exchange, offers a high-interest crypto savings account. It functions much like a traditional bank account. You can deposit any amount in crypto, and you will receive a fixed rate or variable interest rate depending upon the type of deposit.

This type crypto interest account is great for long-term traders who are able to invest in crypto assets. It's also a simple way to generate passive income while waiting for a cryptocurrency's price to increase.

It is important to remember that the crypto interest rates you receive will depend on the volatility of the specific cryptocurrency. It is possible to avoid investing in cryptos with significant price fluctuations.

Numerous crypto platforms such as BlockFi and Gemini offer interest-bearing accounts which can produce higher yields than traditional savings account. These accounts have a higher risk of failure than traditional banking services. You should weigh your options before making a decision to open a cryptocurrency interest account.

Compounded interest options are the best way for crypto investors to earn interest. They increase the value of their loaned assets over time. Although this is more expensive for the lender, it gives loanees an incentive to repay your money on time and avoid default.

There is no compound interest available on every cryptocurrency platform. Therefore, it's a good idea for you to compare the different platforms before you choose one. A good idea is to make sure that you have access to a variety of coins when lending on the platform.

Some crypto lenders offer interest on both a base loan and a percentage the accrued. This is a great way of maximising your profits and making more money with your crypto investments. It's also easier than ever to find an account that accepts the coin you wish to invest in.

A peer-to -peer lending service offers loans against several cryptocurrencies. Although they may not suit everyone, these accounts can be a great way for you to earn interest on inactive assets and reduce your portfolio's volatility.

To increase your wealth, you can open a cryptocurrency savings account. This allows you to invest in cryptos through margin trading and asset-rebalancing. This is known as "yield farming" and can help increase your crypto holdings' value over time.

FAQ

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Forex and Cryptocurrencies are great investments.

Yes, you can get rich trading crypto and forex if you use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

What are the benefits and drawbacks of investing online?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

It is also important to understand the different types of investments available when considering online investing. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There might be restrictions or a minimum deposit required for certain investments.

Which trading site is best for beginners?

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

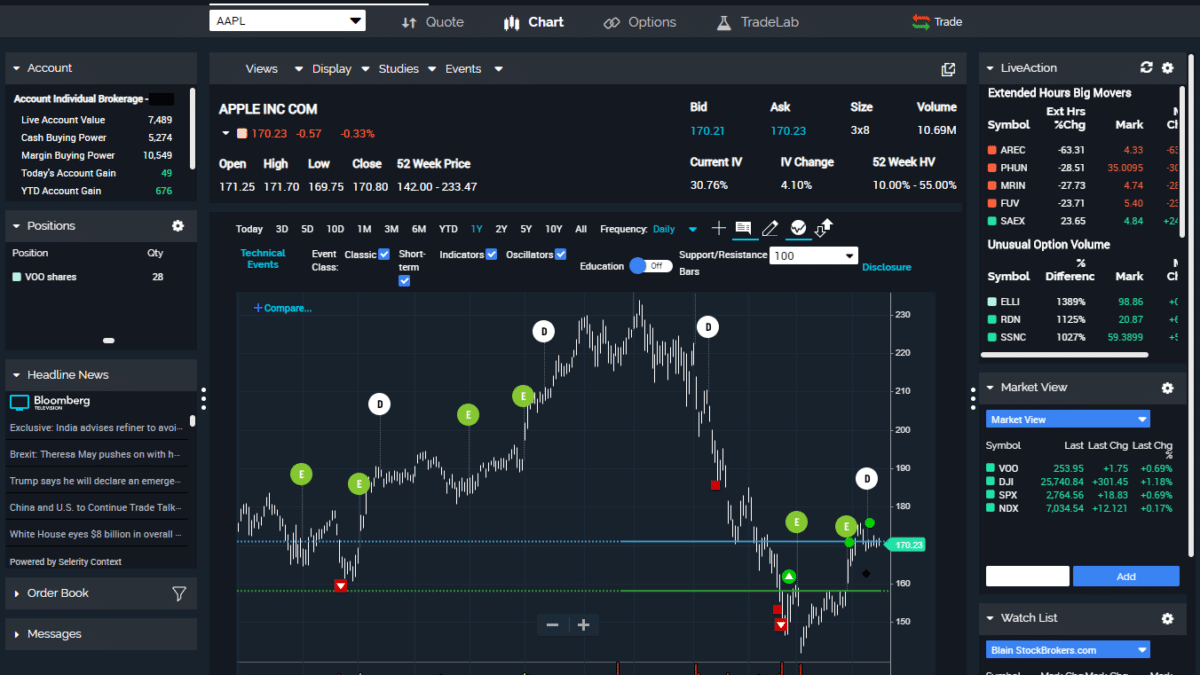

Which is the best trading platform?

Many traders find it difficult to choose the right trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection starts with yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Unsolicited email or phone calls should not be answered. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Remember that scammers will do anything to obtain your personal information. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It is also important that you use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.