Robinhood investing is a new approach to online stock trading that focuses on simplicity and ease of use. Investors with low capital or beginners love the app-based platform. It has a variety of stocks and options as well as cryptocurrencies, which can all be used for trades in the United States.

The Robinhood app can be downloaded free from Google Play and the Apple App Store. Robinhood accounts can be created quickly and clients are able to get started with the app within minutes.

Robinhood allows investors to invest in shares of companies on the US stockmarket. Investors can choose from 5,000 equities, ETFs, and options. These can be traded on a delayed or real-time basis. Limit orders and entry of options trades are also possible for traders that need a margin account.

The company aims to make saving for retirement easier by adding IRA matching. It also recently partnered with an IRA administrator, which will allow customers to open an IRA through the Robinhood platform.

Options allow you to purchase or sell shares at a set price for a specific period of time. This is a good way to profit from a stock's volatility, although you can lose money if the stock goes down in value too quickly.

You can buy and sell options on the Robinhood app, and these can be traded in both real-time and delayed markets. You can purchase calls and put options, and you can set your maximum loss and gain when placing limit orders.

This option is particularly useful for investors who wish to diversify their portfolios through a range of options. However, you should be aware that a put option may expire worthless, and a call option will not.

The options market can be complex so it is essential to be well-informed. It's easy for people to lose money. Understanding how options work and the risks associated with them is crucial.

Numerous legal issues have raised concerns about online brokers in the recent past. Many of these issues center around the practice of selling order information to third parties, such as high-frequency traders. This is a regulation that the SEC has set up and you should be aware of it before making any investments.

FAQ

Which is more difficult forex or crypto currency?

Both forex and crypto have their own levels of complexity and difficulty. Crypto is more complex because it is newer and related to blockchain technology. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

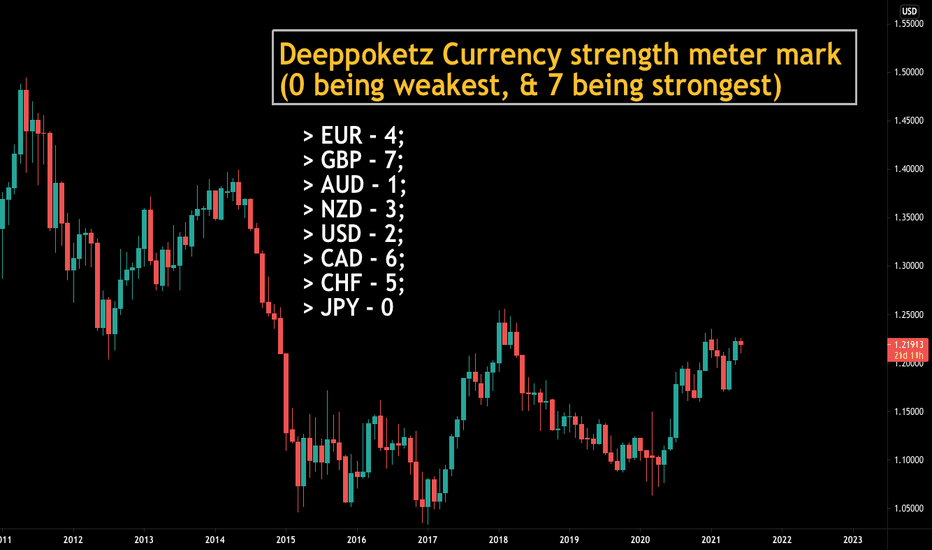

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Cryptocurrency: Is it a good investment?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which forex or crypto trading strategy is best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases it's crucial to do your research before making any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Is it possible to make a lot of money trading forex and cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. You should also trade with only the money you have the ability to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protecting yourself starts with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not respond to unsolicited emails or phone calls. Fake names are often used by fraudsters. Never trust anyone based solely on their name. Before making any commitments, investigate all investment options thoroughly and independently.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Don't forget to remember that "Scammers will attempt anything to get personal information." Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

Secure online investment platforms are also essential. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.