Forex ea trading software automates forex trading for you. These programs use technical indicators and other data in order to identify potential trades and then execute them automatically. Their own strategies can help you make more profit from trades.

Best Forex Robots for Traders Who Have Low Experience

Good robots are designed to be easy to use for all levels of experience. They come with all settings and instructions necessary to get started trading. Some can even be used with a demo trading account to allow you to try them out before going live. The best forex bots will include all the information required to set them up. This includes a list of compatible currency pairs as well as chart timeframes.

Forex eas that are reliable and accurate will help you maximize your profits. It can be the difference between winning or losing trades.

When it comes to choosing the best Forex ea, you need to look for one that has been tested on real trading accounts and verified by third parties. This will ensure you know that it is a safe and reliable robot.

A variety of verified trading account are used to back most of the top forex EAs. This allows them to make consistent and reliable profits over time. This is important because it allows you to be certain that the results reflect the EA's performance, not just backtesting data.

This will help to determine whether or not it is a good idea for you to invest in this system. This will help you understand the system and its functions so you can make an informed decision about which system is best for you.

A good EA will have a variety of strategies that are designed to work across a range of different markets, so you can be confident that it is a stable and reliable system. It should be able deal with market volatility and predict future price movements accurately.

An excellent forex ea must also be capable of managing trading strategies that include multiple instruments. This will allow your portfolio to be more diverse and decrease risk.

These strategies include wave analysis, hedging, and other options. You should also be careful not to take on too many risks with the EA. A large loss can quickly wipe away any profits that you may have made.

Moreover, the best forex ea should be able to adjust its strategy to different market conditions and a range of trading times, so that you can trade in any type of environment. It must be able protect your account from loss if the system crashes.

FAQ

Which trading website is best for beginners

All depends on your comfort level with online trades. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Are forex traders able to make a living?

Yes, forex traders are able to make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Which forex or crypto trading strategy is best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

It is important to research both sides of the coin before you make any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important that you understand the different trading strategies available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

How can I invest Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need are the right tools and knowledge to get started.

There are many options for investing. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

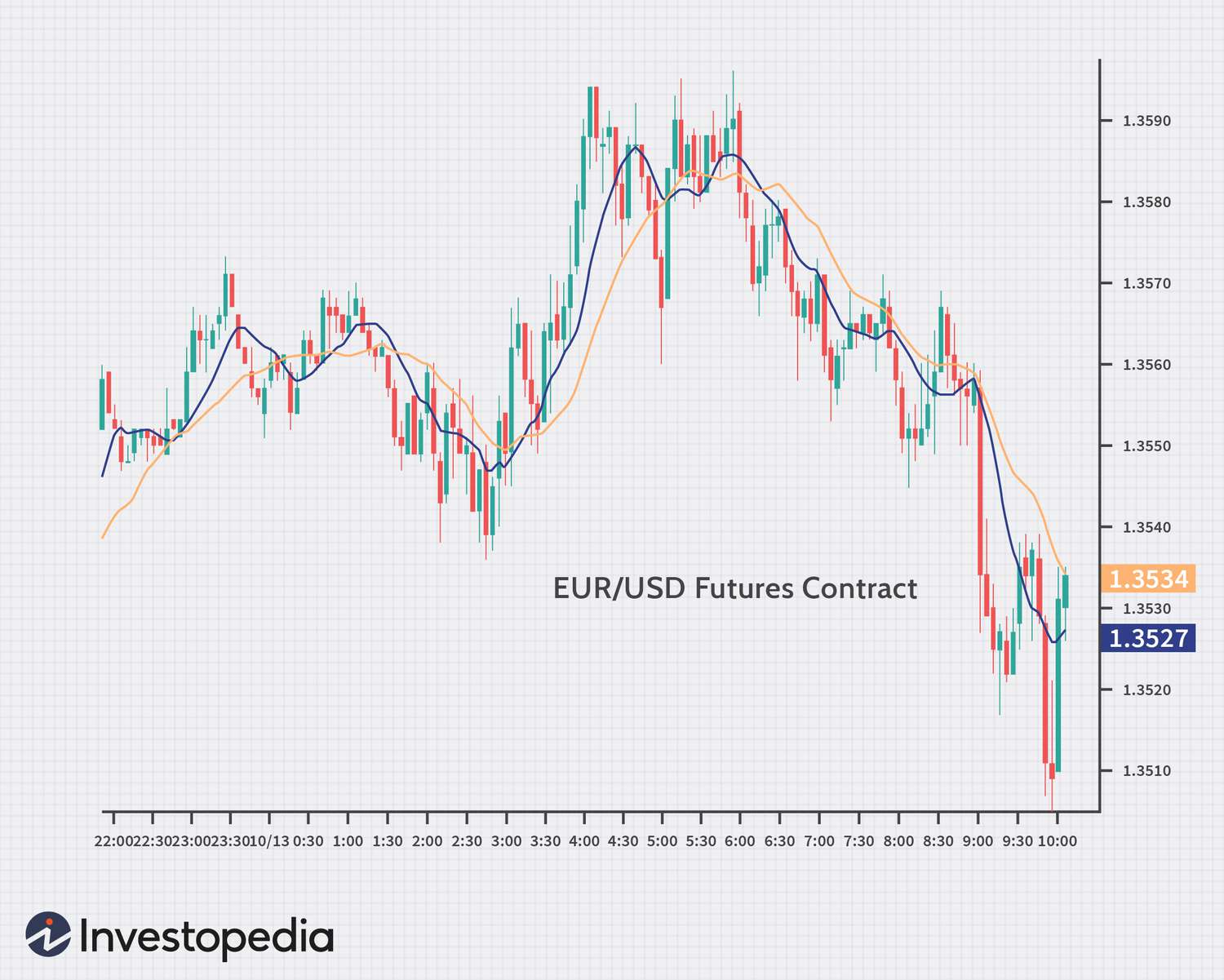

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts require security. It's essential to protect your data and assets from any unwanted intrusion.

First, make sure that your platform is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Check your account activities regularly to be alert of any unusual activity.

Thirdly, make sure you understand your investment platform's terms and conditions. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, be sure to research the company where you plan on investing. You can read user reviews and ratings about the platform to see how it works and what users have said about it. Finally, be sure to know about any tax implications that investing online can have.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.