If you want to trade in the forex market successfully, you need to have a strategy. There are many strategies that you can use, but it is crucial to understand which strategies are most effective for your situation. Basic concepts such as market manipulation and fundamental analysis are important. You might also be able to use simple strategies that utilize the knowledge of capital administration.

A forex bank trading strategy starts with identifying the top players on the market. This will help you determine the likely price levels. The next step in the process involves analyzing the markets' sentiment. When a trader has a good sense of how the market is going to move, he or she will be able to buy or sell.

Next, you'll need to identify currencies most likely to be undervalued. The Federal Reserve's Economic Data Database provides basic information. For those with more experience, technical analysis can be used to determine the reasons behind price movements.

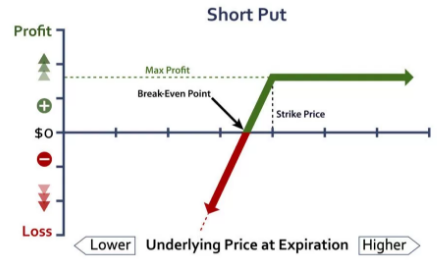

Once you have identified the currencies which are undervalued, it is time to start looking for ways you can capitalize on these price levels. Hedging and portfolio trading are the most popular options. Portfolio trading involves investing in multiple currencies. While hedging is where a trader buys one currency and then sells another, portfolio trading is when a trader invests in several currencies.

This strategy will ensure that you don't lose money on the market. Key data on both currencies will be important. Geopolitical events can increase uncertainty and expose portfolios to loss.

The Dow theory is a common strategy for banks. It uses 80% foundation analysis and 20% technique analysis. It's based on the belief that volume confirms trends.

The market size is another important aspect to be aware of. It is essential to know the size of the market before a major move occurs. Larger markets are more likely to move in the direction of the trend, while smaller markets will be more volatile.

Depending on the amount of time you have available, you may want to consider using a variety of trading styles. These include swing trading (day trading), portfolio trading, and carry trading. These trading styles are typically carried out on weekly or daily charts.

The largest player in exchange trade is the bank. They are the most powerful players in exchange trade and have the ability to create liquidity. This allows them to make trades and rebalance positions every month.

Because banks hold such large positions, they have three options to influence the markets. False Break is one example. This occurs when the market breaks out of a support/resistance area. A large percentage of the market will be out if a price breaks through a resistance or support area. This is when banks and smart money enter the market.

FAQ

Frequently Asked Question

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

How can I invest bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You just need the right knowledge, tools, and resources to get started.

You need to be aware that there are many investment options. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, research any additional information you may need to feel confident about your investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

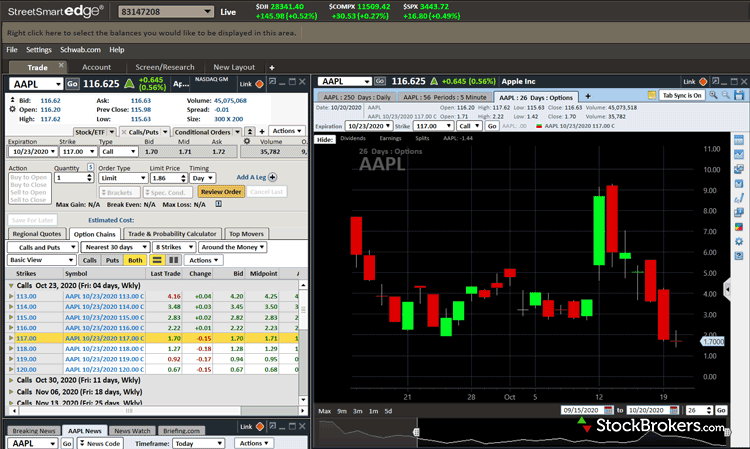

Which platform is the best for trading?

Choosing the best trading platform can be a daunting task for many traders. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down your search to find the right trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Can you make it big trading Forex or Cryptocurrencies?

You can make a fortune trading forex and crypto if you take a strategic approach. You need to be aware of the market trends so you can make the most of them.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Forex traders can make money

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When investing online, research is essential. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. Be skeptical of promises of substantial future returns or future results.

Know the risks associated with your investment and the terms and conditions. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!