DappRadar, a decentralized app aggregator and community, is called DappRadar. It offers insight and actionable information to market participants. It boasts over 9,000 applications across 30 protocols. Among the features are the Portfolio Tracker and the NFT Value Estimator. It also offers many token utilities.

DappRadar has introduced the RADAR token as one of its new tokens. The DappRadar platform provides premium access via the RADAR token. It is based upon the Ethereum blockchain. RADAR aims reward users for participating in the ecosystem and curating it.

The DappRadar platform provides a number of services, including payments and governance. It is expected to become the main store for dapps. DappRadar is now home to over 1,000,000 unique users.

The company's goal is to make dapp ecosystems more transparent. It hopes this will lead to better user experience and better understanding. To do this, DappRadar has implemented a contribute-to-earn mechanism, where users are rewarded with tokens for submitting reviews, contributing to conversations, and curating content. A smart contract manages claims and withdraws. This will enable the platform to increase its coverage and offer better portfolio tools.

Another upcoming feature is the NFT Collection Explorer. This tool provides data about the most popular NFTs and their creators. It also tracks the evolutions and changes in collections. Digital asset collectors can easily combine the information to view all aspects of the dapp eco-system in one place.

DappRadar uses an SSL certificate, which encrypts data when it passes from the user's browser over to the server. The DappRadar website also includes a community that monitors Twitter servers and Discord for any abusive or criminal actors.

DappRadar's platform also partnered LayerZero. LayerZero provides cross-chain staking between EVM-compatible network networks. They have also introduced the proxy token, which minimizes the fees associated staking.

DappRadar plans to also introduce a smart contract, which will allow it to expand its coverage and make it easier for new projects to be listed. Users will also be able to vote and propose recommendations. In the future, the company plans to introduce a token rewards scheme.

The RADAR token will likely be airdropped to select long-term and loyal dapp users. It will also be available for purchase via DappRadar’s token wallet. There are a total of 10 billion tokens in the system, with a circulating supply of 576,191,039.

Considering the volatility of crypto, investing is a very personal matter. Some analysts have predicted that DappRadar's token would reach zero in one year. However, this price prediction is usually inaccurate. You should never put money at risk. Always do your research.

Experts predict that the DappRadar platform will continue to decline over the next few years, despite its significant growth. The Wallet Investor forecasted that the DappRadar token would drop to $0.160 next year. However, DappRadar's current position indicates that it has a bright outlook.

FAQ

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

What are the benefits and drawbacks of investing online?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important to understand the different types of investments available when considering online investing. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Some investments may also require a minimum investment or other restrictions.

Where can I invest and earn daily?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't need to invest all of your savings in the stock exchange - there are many other options.

You can also invest in real estate. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

How can I invest bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

First, you need to know that there are many ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, gather any additional information to help you feel confident about your investment decision. It is essential to understand the basics of cryptocurrency and their workings before you dive in. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Frequently Asked Question

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

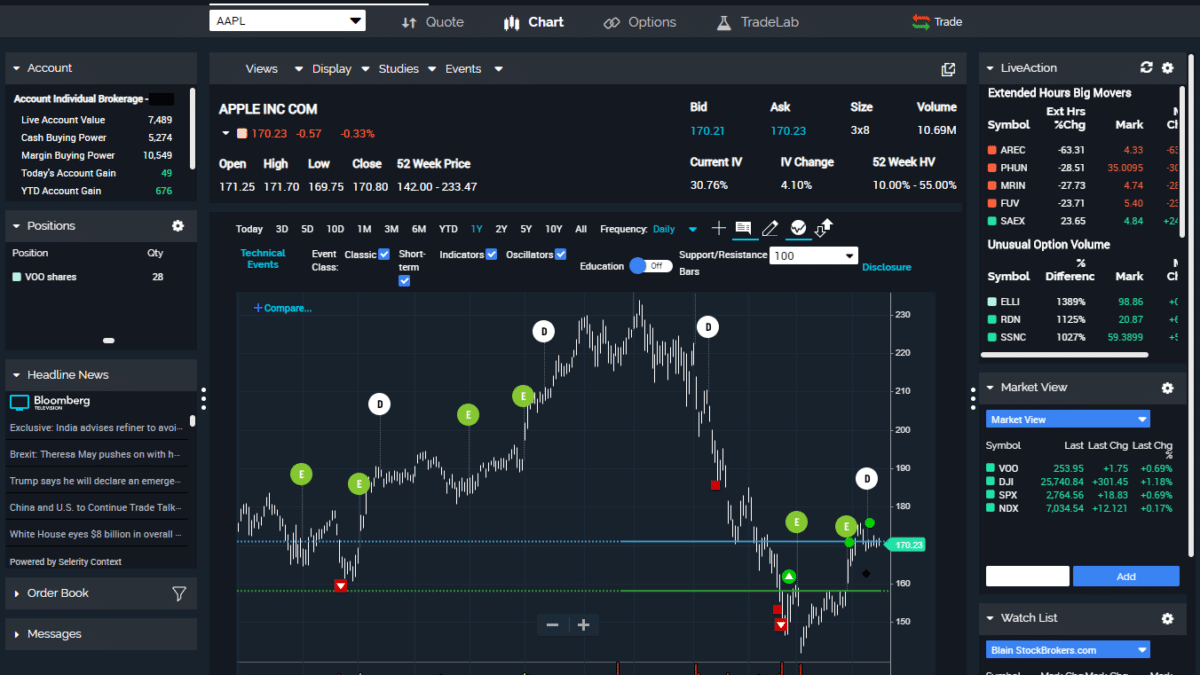

Which trading site is best for beginners?

All depends on your comfort level with online trades. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Research is critical when investing online. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, be aware of any restrictions or industry regulations that may apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Be skeptical of promises of substantial future returns or future results.

You should understand the investment risk profile and be familiar with the terms. Before opening an account, confirm the exact fees and commissions on which you might be taxed. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.