Commodity derivatives trading involves the purchase and sale of commodities. It can be done through the spot market, a contract for a future date, or as a forward. This type investment is great for people who do not wish to own the commodity but still want to profit from a future deal. The price of a commodity may fluctuate due to a variety of reasons. Changes in supply and demand can also affect the price of a commodity. In order to make a smart decision in commodity derivatives trading, it is important to know the different types of contracts.

Commodity derivatives trading can be regulated by the United States Commodity Futures Trading Commission. There are two types: commodity derivatives that can be traded on an exchange or over-the-counter. Each exchange has its own regulatory body.

A variety of exchanges offer commodities-derivatives. These include the New York Mercantile Exchange, which had the largest share of the global commodity derivatives turnover in 2003. The US exchanges held a significant portion of individual commodity products like oil, energy, or agricultural products.

Commodity derivatives can be traded in a variety of ways, including as a futures contract, options, or as a swap. Commodity futures contracts are a type investment that can help to manage market sentiments and price risk. Derivatives are a way to manage price risk. A gasoline refiner may use a commodity contract to offset the risk from a cash buy of wheat.

Many institutions invest in new ways to diversify and increase their returns. This has led a rise in the popularity of financial derivatives. Although the growth in the financial derivatives market is faster than those of physical commodity, it has not been constant. For example, while equity-related futures and options increased substantially during a five-year period, traditional commodity futures and options only increased slightly.

The commodity derivatives marketplace has one of its key features: the transactions are booked at an agreed price. The value of one unit can vary depending on the type and trade of the derivatives. This can lead to triggered marg calls. Sometimes traders look for other investors to cover the transaction. Risk management orders are important when dealing in commodity derivatives.

Because of the news that can affect the price of a commodity's derivatives market, it can be extremely volatile. Oil, for instance, may be affected by news about the growth of the United States' economy. Similarly, a sudden increase in oil prices can spur the demand for the commodity. To increase liquidity, speculators can bid up the prices.

MiFID II has brought many changes to commodity derivatives trading. The regulators now have the power to impose position limits. They will also now be able ask for all the relevant information about derivatives users. They will have access to information about exposure and size, and can monitor positions held by different groups. ESMA is also able to publish summary reports on the management controls, position limits and other information.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which trading website is best for beginners

All depends on your comfort level with online trades. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

Which forex or crypto trading strategy is best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both cases, it's important to do your research before making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

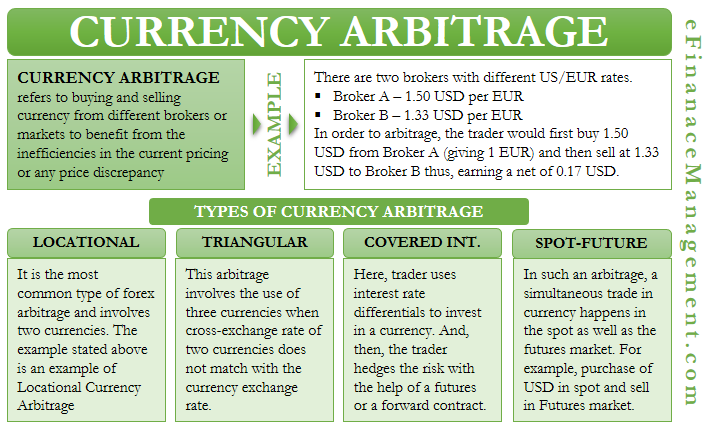

It is important to be familiar with the various types of trading strategies that are available for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

Online investing is not without its challenges. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important for online investors to be aware of all the investment options. Investors have many choices: stocks, bonds or mutual funds. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

What is the best trading platform for you?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down your search to find the right trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Frequently Asked Fragen

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts are a matter of safety. It's vital that you protect your data, assets and information from unwelcome intrusion.

You want to ensure that the platform you use is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. A policy should outline how personal information shared with them will be managed and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Look at user reviews to get a feel for how the platform works. Finally, be sure to know about any tax implications that investing online can have.

These steps will ensure your online investment account is protected against any possible threats.