Day trading stocks is a great way to make money, whether you are a beginner or an expert investor. These include price volatility, liquidity, and trends.

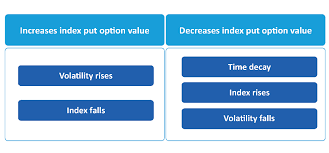

Volatility refers to the risk that a security's value will fluctuate. A high level of volatility can spread the stock’s value over a large number of values, which provides an opportunity to day traders. Make sure the stock's volatility is sufficient to suit your needs.

Traders have the ability to profit from price changes by buying volatile stocks at low prices and then selling them as their value rises. This strategy will allow you to make a larger profit and lower your risk than long-term trades.

Although there are many stocks available, these stock picks are best suited to the trader type you are. These stocks have three traits in common: they have been trending at least for a year, they are well-known worldwide, and they provide substantial value for your investment. These traits will give you an advantage over your rivals.

Tesla is a solid stock as one of America's largest electric vehicle producers. There are several divisions within the company that focus on autonomous vehicles and sustainable energies. It's also frequently featured in the news. Elon Musk's tweets may impact the stock's performance.

AMC Networks is another stock that is getting a lot of attention. It is a global entertainment company. Its share has increased by 2000% within a short period of time. This is especially impressive given that it started at just $2 in 2021. The company is gaining momentum with a market value of more than $24 billion.

Netflix is another streaming company that has been very popular. With more than 200,000,000 subscribers, Netflix offers a range of award-winning TV and movie shows. Netflix has a large global reach because it is available in a number of languages. Netflix's share of the streaming market is set to rise with increasing demand.

Finally, Nektar Therapeutics can be a volatile stock that is subject to price swings. Although the company produces many types of options, its stock fluctuates often. It's actually a great stock to have in your portfolio.

NIO is one among the most traded stocks. It is a company which is accelerating product innovation to meet the EV boom. They have partnered with other companies to expand their supply chains and are launching new vehicles next. NIO's growth plan includes increasing sales coverage.

DocuSign has been a pioneering company that creates solutions for various industries. Their software makes it easy to electronically transact agreements. They also produce lightweight materials to aid corporations. In recent years, the company has seen its profits rise and continues to innovate its products. DocuSign can be a great addition to your portfolio and provide a good return over time.

FAQ

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading is easier than investing in foreign currencies upfront.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is also important to understand the different types of trading strategies available for each type of trading. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it's important to understand both the risks and the benefits.

Which is more difficult forex or crypto currency?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

What are the disadvantages and advantages of online investing?

Online investing offers convenience as its main benefit. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Is Cryptocurrency a Good Investing Option?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

How do forex traders make their money?

Yes, forex traders are able to make money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investing is a risky venture. Online investments can be dangerous. You need to know the risks and how to mitigate them.

Start by being mindful of who you're dealing with on any investment app or platform. Be sure to choose a reputable company with good ratings and customer reviews. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

Make sure that only trustworthy people have access to your finances by deleting all bank applications from old devices when getting rid of them and changing passwords every few months if possible. Track any account changes that could alert an ID thief, such as account closing notifications or unexpected emails asking you for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. And lastly, use VPNs while investing online whenever possible -- they're usually free and easy to set up!