Crude oil is one of the most liquid commodities. Crude oils are widely traded and have many uses. From producing gasoline to making plastics, petroleum and pharmaceuticals, there is no shortage of applications for crude oil. The price of the commodity changes almost second by second, based on global demand and supply.

Two main options and futures are available for oil trading: options and futures. Buyers and sellers sign a contract for oil futures. They agree to buy or deliver oil at a certain time in the near future. The buyer agrees to pay a certain price in exchange. Oil prices are volatile so traders need risk management to invest.

Oil futures are the easiest way to buy and trade oil. They are also popular among speculative trader. However, trading futures requires large margins. In order to trade, some brokers will require 10%. Traders can find a broker that suits their needs. Before moving to a live trading account, traders can test their strategies in a demo account.

Oil is volatile, so beginners should be cautious about their exposure to it. Using a trading strategy based on fundamental and technical analysis can help a beginner gain a deeper understanding of the market. Traders can spot the most crucial turning points in the market by studying factors that influence supply and demande. Traders can also use breakout strategies to profit from market gyrations.

Oil futures trade on the New York Mercantile Exchange(NYMEX), and the Intercontinental Exchange. Both of these exchanges are considered the "big three" oil markets in the U.S. The official websites of these exchanges are an excellent resource for anyone who is just starting out in the industry.

Options are similar to futures, but they do not require the sale of the underlying asset. When the option expires, the buyer or seller has the right to buy or sell the underlying asset.

If you have not been following the oil markets, you might be surprised to know that a major percentage of the world's oil is produced by countries that are members of the Organization of the Petroleum Exporting Countries. The primary goal of OPEC is to control the world's supply of crude oil. Traders will have a chance to see how OPEC meetings are conducted.

Trading oil has many benefits beyond the obvious. There are many reasons to be interested in oil, including the possibility of higher stock price and the ability to hedge against negative price movements. Also, there is the potential to make substantial profits in a market that is declining.

Options and futures both offer great ways to trade crude oils. With futures, you can invest in a contract that will provide you with the ability to buy or sell 1,000 barrels of oil at a fixed date in the future. This allows you to profit from price changes and decreases, while protecting your investments.

FAQ

Can you make it big trading Forex or Cryptocurrencies?

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. It is important to trade only with money you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

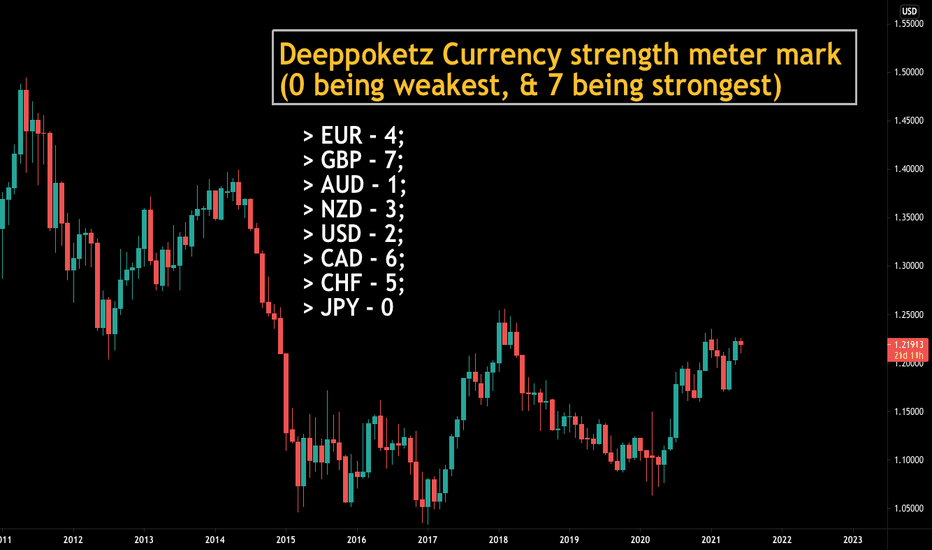

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

Online investing is a complicated process. It is important to be familiar with the various types of investments that are available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Frequently Asked Fragen

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

There are many options for investing. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, research any additional information you may need to feel confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which trading platform is the best?

Many traders can find choosing the best trading platform difficult. It can be confusing to choose the right one, with so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

How do forex traders make their money?

Forex traders can make good money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I protect my personal and financial information when investing online?

Online investments require security. Online investments can be dangerous. You need to know the risks and how to mitigate them.

It's important to be aware of who you are dealing directly with on any investment platform or app. It is important to only work with a reliable company that has received positive reviews and ratings from customers. Research the background of any companies or individuals you work with before transferring funds or providing any personal data.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. To ensure your account security, disable auto-login on all devices. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Keep track of any account changes that might alert an identity thief such as account closure notifications or unexpected emails asking for additional identification information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!