NFT is a trading platform

The best way to invest in crypto is by trading in nft (non-fungible tokens). These are digital currencies that enable people to purchase and sell assets online in the same way as physical currencies like Bitcoin.

Before you can trade NFTs, it is important to determine what type of digital asset you want. It could be music, art or sports trading cards. Or even a collectible character from a video game. Once you have decided what type of digital asset you are interested in, the next step is to find a reputable NFT marketplace.

Binance NFT Marketplace has many advantages that make it a great place where you can trade NFTs. It offers low NFT trading costs, high liquidity and exclusive NFT drops. Binance NFT Market is the ideal place to begin trading NFTs whether you are an expert or beginner.

Binance NFT Marketplace offers a great way to learn about NFTs in general. This platform provides a complete list of digital collectibles and an easy-to use trading interface.

NFT Launchpad - a brand new NFT marketplace where users are able to flip nfts (including popular collections like Lucky Block, Punk Dogs and Punk Dogs) is another great place you can find NFTs. This marketplace accepts auction listings and fixed-price transactions, making it an excellent place to buy or sell NFTs.

NFT Auctions

NFT auctions can be used to trade NFTs in a similar way as an eBay listing. These auctions typically last for a certain period of time, and the person who places the highest bid wins the NFT. This can make them a great option for beginners because they are not as risky as buying and selling directly, but they do require some thought on the part of the seller.

To make a successful NFT auction, you should first create a high-quality listing that is attractive to potential buyers. It should contain information about the NFT and a description of its operation, as well as any documentation. It should also contain a floor price, and an end time.

This is an important aspect to any NFT auction. You must set a price that is reasonable for buyers, but not too low that it is unprofitable. The minimum amount you are willing and able to accept should be the same.

An auction can also be made more successful by setting a ceiling price and a specific time to close. This will ensure that you don't get scammed by an unscrupulous buyer or seller.

NFT is a rapidly-growing market with little regulation. This makes it important to be cautious about shopping. DeVore advises that you look for creators with verified accounts, and ensure they have a proven track record in selling NFTs.

Also, make sure you look for platforms which offer multiple currencies as well a variety NFTs. It is important to have a safe place to keep your NFTs. In particular, hardware wallets are considered to be one of the safest storage options in the industry, and they can be easily connected with MetaMask.

FAQ

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Can one get rich trading Cryptocurrencies or forex?

Trading forex and crypto can be lucrative if you are strategic. You need to be aware of the market trends so you can make the most of them.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. You should also trade with only the money you have the ability to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which trading platform is the best?

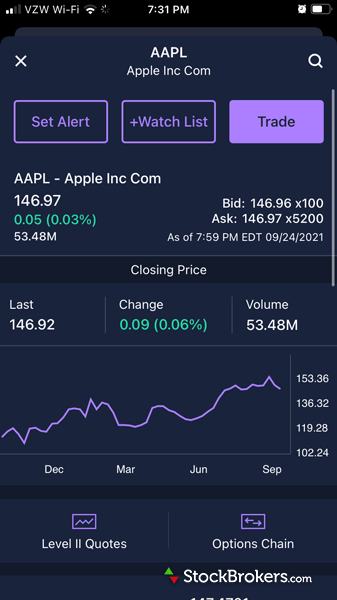

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which trading site is best suited for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

You can also trade independently if your knowledge is good enough. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

How do I invest in Bitcoin

While it can seem daunting to invest bitcoin, it is really not that difficult. You just need the right knowledge, tools, and resources to get started.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

However, crypto trading can offer a very immediate return due to the volatility of prices. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to be familiar with the various types of trading strategies that are available for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it is important that you understand the risks as well as the rewards.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

Research is critical when investing online. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. Be skeptical of promises of substantial future returns or future results.

Learn about the investment's risk profile and review the terms and condition. Verify exactly what fees and commissions you may be taxed on before signing up for an account. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.