Non-Fungible Tokens - NFTs are digital currencies that are recorded on a blockchain. NFTs can traded across a network like a currency is traded on a stock trading platform. They offer artists security and immutability.

An NFT can include any digital content. It could be anything from a videogame to an image of a cat. This makes them ideal for both collectors and investors. They are an asset class that is growing quickly. The value of one digital parcel was $514 million in 2018, according to the 2018 Census.

But, wash trading is on the rise. Wash trading occurs when the same person, or entity, sells and purchases back the same asset repeatedly in order to create artificial demand. It is also fraud because it is sometimes impossible to accurately value an asset.

Wash trading is an illegal form of trading, but it is still practiced in some markets. Although it may be hidden, the real effects of wash trading can still be seen. The SEC has not yet investigated NFT markets as fraud fronts, but it has made it its priority to monitor them for signs and manipulation.

There are two major forms of wash trading. One is to trade the same token with multiple accounts. Another option is to resell a token at a price higher than its actual value. These practices can be viewed as misleading and could lead to regulatory action.

Another common form of wash trading is to trade the same NFT between multiple wallets. This is used to artificially increase the token's volume and hence its price.

The biggest problem with wash trading is that it can be used to claim rewards that are not deserved. An example: A hacker could steal $1.7million worth NFTs from the MetaMask account of a company last fall. Alternatively, a crypto whale might sell an NFT at a price that is far above its true value.

Although wash trading does not exist in the traditional stock market, it does occur in the NFT market, and can be detected by strong connected components. OpenSea NFT, the largest market, has seen a significant drop in trading volumes since February.

As a new asset, the SEC is likely to catch up. But until then, NFTs are largely unregulated. To protect themselves against hackers, NFT traders must have a digital wallet. Research is important before purchasing an asset.

An NFT investment can be a good idea if you do your research. If you decide to invest in NFTs, do your research thoroughly and make your own decision. You can find an array of marketplaces online, allowing you to select the one that best suits your investment needs.

FAQ

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing comes with its own set of disadvantages. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Cryptocurrency: Is it a good investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Where can you invest and make daily income?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. Online trading is possible if you're comfortable with the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is harder forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. A good understanding of technical indicators is essential to identify buy and sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

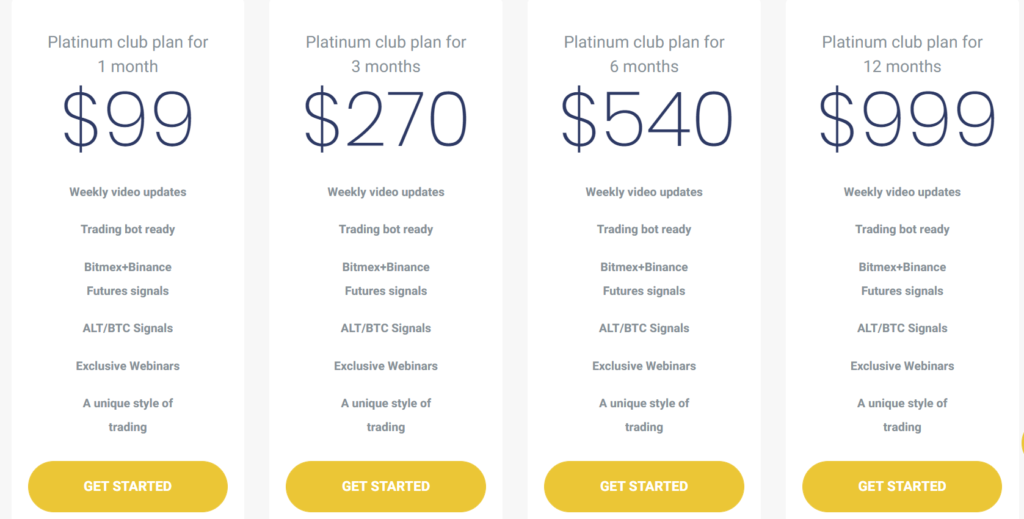

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

It is important to do your research before investing online. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

You should understand the investment risk profile and be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.