Chicago has been the centre of a large world of grain trading since more than 126 year. This is where traders still come to trade and get paid. The CBOT, a global exchange, offers a variety of markets and contracts in a range commodities including wheat, corn and soybeans.

Wheat (W), one of the most traded futures on CBOT, is also the most liquid. Although wheat is the primary use, it is also used in flour and for industrial applications like starch or adhesives.

Wheat is not only a major source for income for many traders but also an essential component in the food supply chains. It provides significant amounts of protein to livestock and poultry. The byproducts can also be used in a wide range of consumer products.

The Commodity Futures Trading Commission ("CFTC") regulates trading in wheat. CBOT owns multiple contracts, including Chicago Soft Red Winter and KC Hard Red Winter wheat futures.

Other wheat futures prices are affected by the SRW/HRW wheat price. These contract price fluctuations can be significant due to weather conditions and market sentiment that affect the supply.

There are many different ways to trade wheat options, each one being suited for a particular risk management strategy. Some traders use the contract as a hedge while others like to speculate about the direction of wheat prices.

Corn (C) is the third most traded futures on the CBOT and serves as a key ingredient in many of the foods we consume every day. The primary ingredient of animal and plant feed is corn, but it is also used in ethanol fuel and other chemicals.

CME offers several corn futures. They include Chicago Board of Trade's (CBOT), as well as the CFTC-regulated Chicago Mini Corn. The CME's CME Mini Corn futures contracts offer the opportunity to trade smaller, more flexible contracts with minimal risk. CME's Mini Corn Futures are an excellent product for investors, traders, and farmers who wish to hedge against the risk of high corn prices, or monitor market activity in this market.

FAQ

Which forex trading platform or crypto trading platform is the best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. Diversification of assets and managing your risk will make trading easier.

It is important that you understand the different trading strategies available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Trading forex or Cryptocurrencies can make you rich.

Trading forex and crypto can be lucrative if you are strategic. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Trading with money you can afford is a good way to reduce your risk.

To be able develop a long-term profitable strategy, it takes experience, knowledge, skills in risk management, and discipline.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Frequently Asked Fragen

Which are the 4 types that you should invest in?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

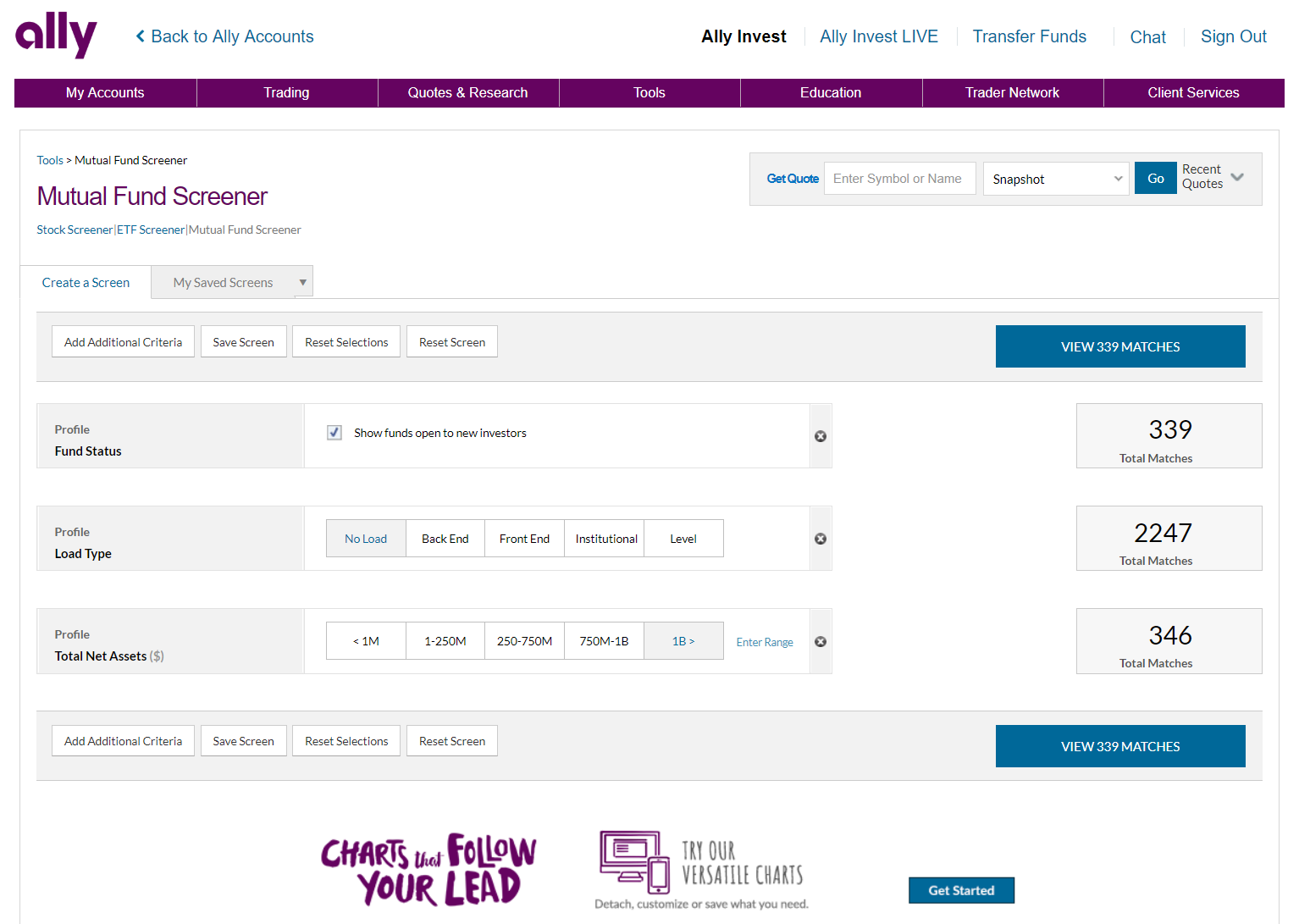

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

How can I invest Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is crucial to know the basics about cryptocurrencies and how they work before investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which trading site for beginners is the best?

It all depends upon your comfort level in online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. These sites offer customizable trading platforms, live data feeds, research resources, and real-time analytics for well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protect yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Keep in mind that fraudsters will try everything to get your personal details. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

You should also use safe online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.