A forex VPS can be the perfect solution if you are looking to automate your trading. VPS providers that are reliable and secure can provide high-performance connectivity and security. It allows you to remain focused on your trade.

Forex VPS Services are an affordable option for traders. Many retail investors cannot afford to spend large sums of money on their accounts. But, they still have the same benefits as institutional traders from Forex VPS Hosting.

Forex VPS allows for lightning fast trading. These servers have a powerful SSD and are optimized for performance. They also include anti-malware and antivirus software. This protects your data.

You have many options when it comes to hosting providers offering Forex VPS. ScalaHosting, AccuWeb Hosting, Kamatera and AccuWeb Hosting are some of the best choices. You will find that each company offers different features so be sure to choose the one that best suits your needs.

Kamatera offers the option to choose from a Linux or Windows server, which is a difference from other Forex VPS providers. In addition, it offers load balancers and firewalls. With Kamatera, you don't have to worry about latency. Kamatera is reliable, fast, and secure.

NYCServers is another great choice. They are a leader in Forex VPS providers and have been providing great customer support over the years. The shared and dedicated servers offer great value, so users can choose to have them both. The servers provide excellent performance and are supported via an ultra-low latency networking.

ScalaHosting provides a 30-day money-back assurance. Their forex VPS solutions are fully managed. Also, their servers are KVM-based, meaning that they provide superior performance and security. Traders may also benefit from the baremetal and MT5 broker options.

Forex VPS hosting can solve many traders' problems. It minimizes latency to maximize your profits. There are no interruptions to your trades, and you don’t even need to be physically connected. You can monitor your trades from any device and remain in control.

Forex VPS hosts allow traders to have their own applications. This is an advantage for those with limited technical knowledge. Regardless of your experience level, you will be able to enjoy a smooth trading experience with Forex VPS.

For those who require additional support, a Forex VPS hosting host can offer managed service. You can rest assured your forex VPS host is in the best hands and will solve any problems that you may face. A help desk is available to you at any hour of the night.

Consider several factors when selecting a Forex VPS host. While money should not be your primary concern, it's important to understand what you can expect from a VPS host.

FAQ

What is the best forex trading system or crypto trading system?

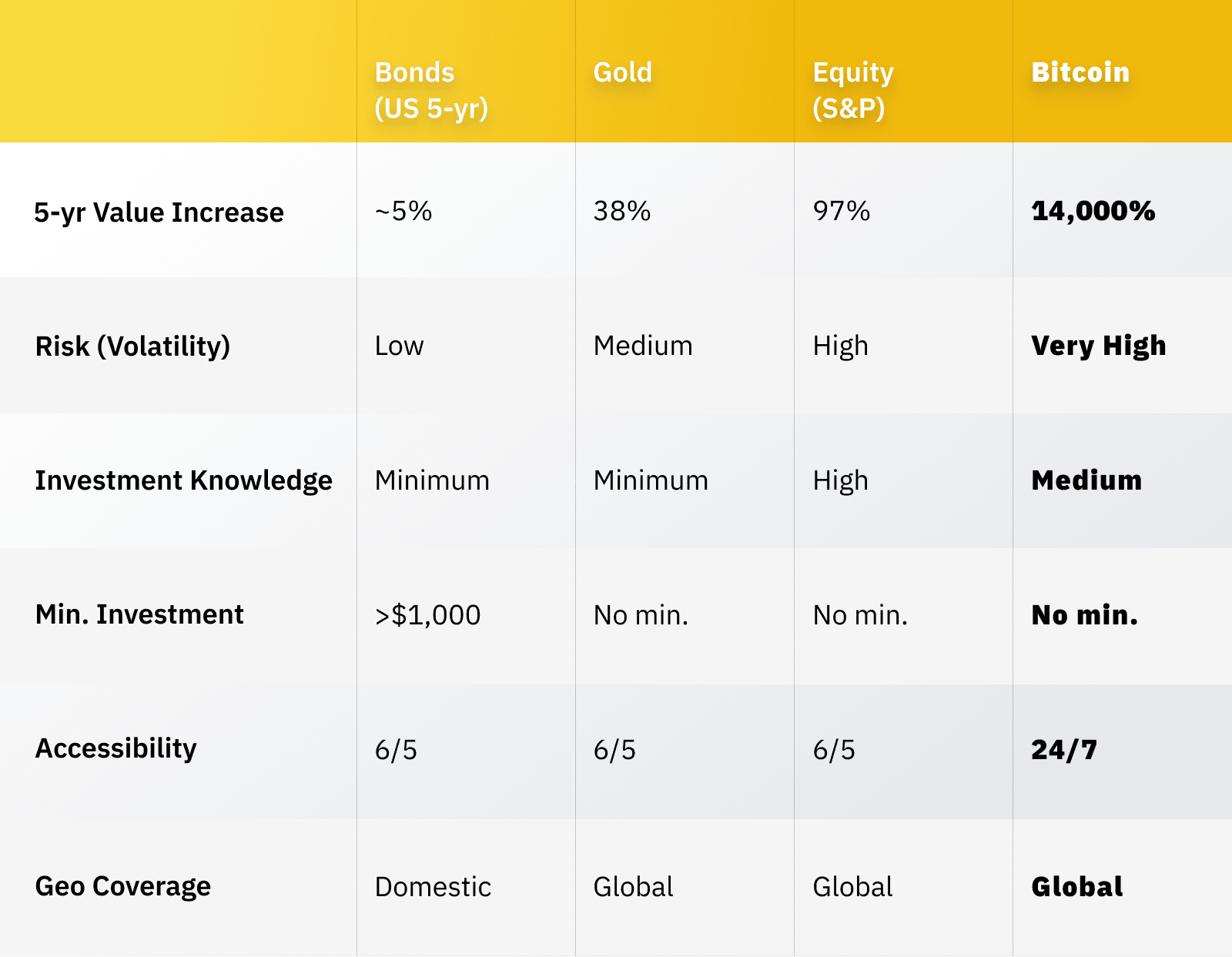

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are other ways to make money than investing in the stock market.

One option is to invest in real property. Investing in property can provide steady returns with long-term appreciation and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which trading site is best suited for beginners?

It all depends upon your comfort level in online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. Online investing allows you to manage your investments anywhere with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This will help you narrow your search for the right trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

Money can be complex but so can the decisions about how to store it. You have several options when it comes to protecting your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. However, electronic breaches can occur and there are potential risks when you use a digital option.

You could also choose to store your money in physical currency like gold or cash. This is less secure but more manageable and requires more storage and protection.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

You make the final decision.