IQ Option, a Cyprus investment company, offers traders a number investment products and tools to help grow their assets. IQ Option allows traders to trade in a variety currency pairs and offers a range payment services including PayPal, Skrill Neteller, Bank transfer, Skrill and Cash U.

IQ Option is a solid choice for both investors new to the market and experienced ones. The platform is intuitive and well-designed. It can be a bit slow. It does however have some unique features that make it stand out from the rest. Its charting tools, as well as its ability to create a medium- or long-term strategy are just a few of the highlights.

The IQ Choice mobile app can be downloaded for Android or iOS devices. Although it is more powerful than the desktop version, it takes some time to load up and navigate. It does not have many of its competitors' features.

IQ Option, like all online brokers, is subject to European financial regulations. This means that if you live in an EU country, you can enjoy the benefits of higher leverage limits and more professional trading options. For account verification, you will also need to provide personal information and a photo ID.

IQ Option is renowned for its simplicity of use and high-quality trading software. You can try demo trades before you make real trades. IQ Option even provides multilingual support for customers from other countries. Many prestigious awards have been given to the company for its innovation, efficiency, and professionalism. It has been awarded Best Binary Options Broker Europe and Most Innovative Binary Option Platform.

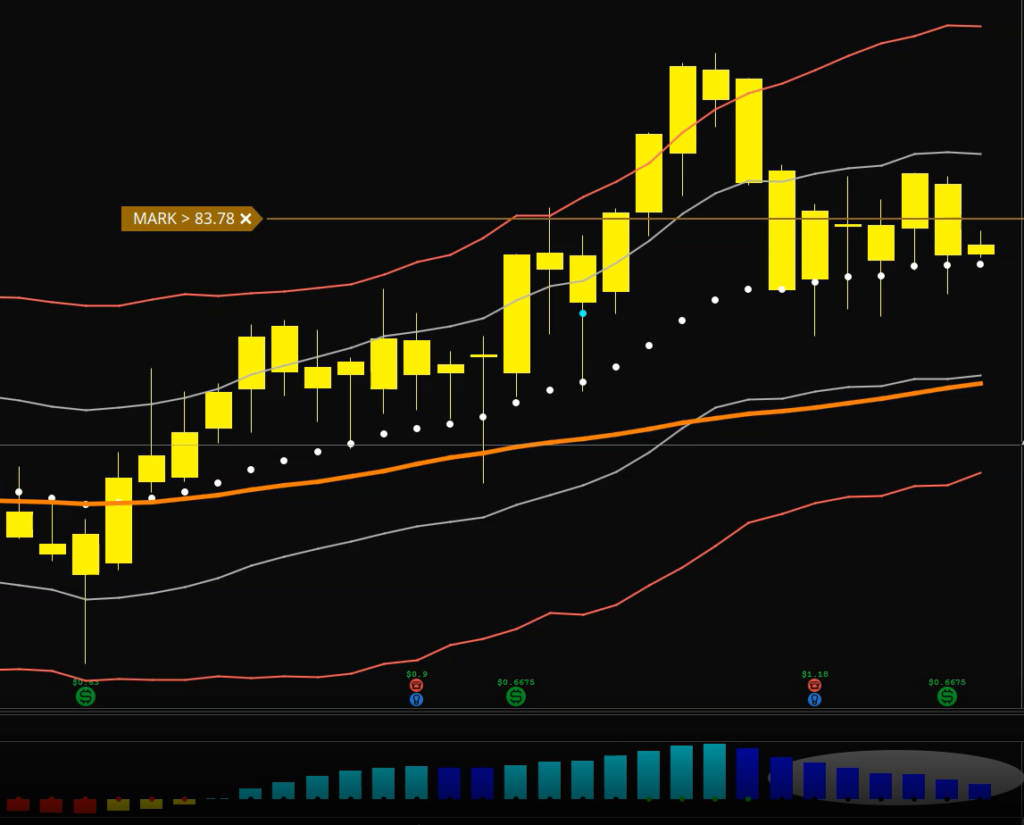

IQ Option is a well-known company that has been around almost ten years and continues to be a leader in the industry. Although it is smaller than its competitors, IQ Option has a decent range of assets and features. These include four commodities as well as twenty-five Forexs. Also, its platform boasts a large selection of charting tools, including area charts and candlestick charts.

IQ Option doesn't charge a fee to withdraw money or deposit funds. Depending upon the deposit method, you can anticipate a turnaround of approximately 1-2 business days. You can withdraw money to your IQ Option account if you are an ewallet owner by using the IQ Option mobile app. You also have the option to make a Wire Transfer by going to a bank. IQ Option is not regulated in the United States but is registered with British Financial Conduct Authority.

IQ Option's customer services department employs 83 people who have been trained to answer any questions regarding their products or services. They offer several contact options, including phone, email, chat, or a web form. IQ Option claims to be able to resolve all tickets in less than 46 seconds. Unfortunately, this is not true. Some users have complained that they have difficulty reaching their account managers. Other than that, reports show that IQ Option doesn't respond to all emails.

FAQ

How can I invest Bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. You only need the right information and tools to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which trading site for beginners is the best?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Where can I find ways to earn daily, and invest?

While investing can be a great way of making money, it is important to understand your options. There are many other investment options available.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Which is harder crypto or forex?

Different levels of difficulty and complexity exist for forex and crypto. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Which is safe crypto or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which is best forex trading or crypto trading?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts should be safe. It's vital that you protect your data, assets and information from unwelcome intrusion.

First, you want to make sure the platform you're using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

It is important to use strong passwords and limit your access to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Thirdly, make sure you understand your investment platform's terms and conditions. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, be sure to research the company where you plan on investing. Look at user reviews to get a feel for how the platform works. You should also be aware of the tax implications when investing online.

These steps will ensure your online investment account is protected against any possible threats.