The forex market is a highly active and dynamic trading market. Forex market is highly dynamic and moves according to the laws supply/demand. Many traders seek to profit from these fluctuations in exchange rates. To be successful forex trading, you need to understand how indicators can help identify trends or reversals.

Forex indicators are a valuable resource for novice and professional traders. They can help you set key limits, track trends, and predict reversals. They cannot however guarantee trading success. They can lead to significant losses. Indicators can help you determine when it's time to enter trades, but it is better to rely on fundamental analysis as well as patience.

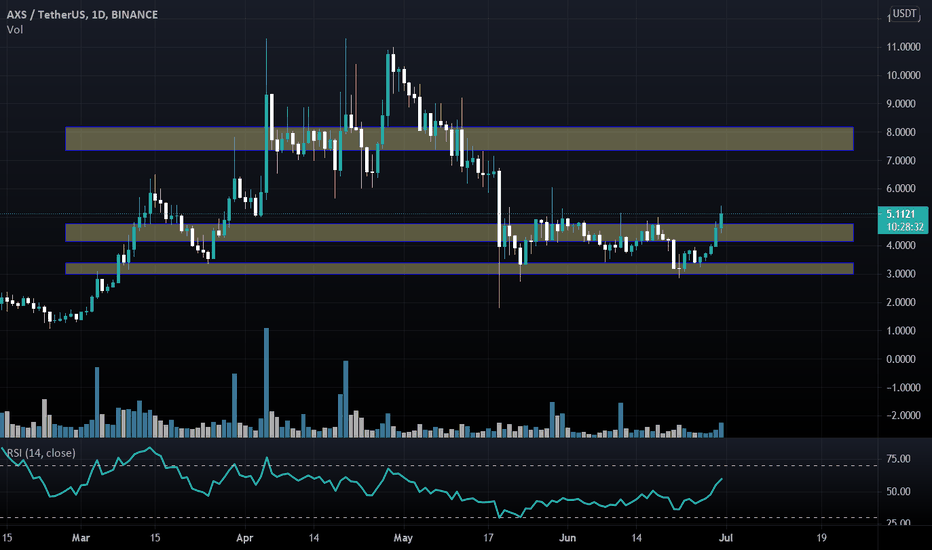

One of the most popular types of forex indicators is the RSI. It uses a 100 point scale in order to measure buying and selling trends. When it is above 30 it indicates a trend change. It will fall below 30 if the trend is expected to reverse. If it bounces back to 30 it indicates that the trend is still in place.

Bollinger Bands is another useful forex indicator. These bands display an upper and a lower band that are determined by the standard deviation of the price relative to the moving average. You can use the bands to determine whether an asset has been priced reasonably by analysing its volatility.

Technical analysis relies heavily on support and resistance. When a trend breaks past these levels, it may raise or lower the price. The same goes for a decrease in value. This can result in more buyers than sellers.

There are other popular indicators that can be used to evaluate a market's current state. OBV (On-Balance Volume) and RSI can be used to evaluate a market's current state. Both of these tools can confirm a trend, while RSI can also indicate potential reversals.

Other than these indicators, there are many common types of Forex indicators. Some indicators show market trends visually, others display the market in a more general way. Many of these indicators may be free to use. Others have a minimal price and more functionality.

These tools can also be used to automate Forex trading. They can analyze multiple charts and then send alerts by email to traders. Many of them are very simple and don't require advanced knowledge about the forex market.

Forex Trendy, an automated trading program, is a good option if you are looking to trade automatically. You can scan up thirty-four currencies and receive trade alerts based off patterns. It is not intended to replace a comprehensive trading strategy but has proven useful for many.

No matter what Forex trading program you choose to use, there is no guarantee of success in the future. You must be patient and realize that the market can move in any direction.

FAQ

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Is it possible to make a lot of money trading forex and cryptocurrencies?

Yes, you can get rich trading crypto and forex if you use a strategic approach. You must stay on top of trends to know the best times to buy or sell in order to make any money in these markets.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Also, you should only trade with money that is within your means.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Therefore having a robust understanding of the conditions affecting different currencies is imperative.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Frequently Asked Fragen

What are the 4 types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

How do forex traders make their money?

Forex traders can make good money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection begins with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Lastly, always remember "Scammers will try anything to get your personal information". You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

Also, it is important to invest online using secure platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before you invest, make sure to read the terms and conditions for any app or site you use. Also, be aware of any fees or charges.