Trading energy is a great option to make money off fluctuations in energy commodities' prices. It also allows you to diversify your portfolio by investing in different types of energy products.

The profitability of an energy company can be affected by many factors, including local economies, interest rates, production costs, and competition. Utility profits may drop if gas prices rise. This is due to the fact that higher gas prices will cause sales declines.

Petroleum, natural gas and gasoline are the main energy commodities. These commodities can also be traded using futures, options, ETFs, ETNs, CFDs, or shares in energy-related companies.

Crude oil is the most popular commodity for trading in the energy markets and it is an essential part of the global economy. It is used to produce everything, including gasoline, diesel fuel and heating oil.

Its price varies widely as a result of many factors, tracked by commodity exchanges around the world. It is traded in the intra-day, day ahead and balancing powers markets.

While electricity is a unique product, it does not carry the same characteristics as a commodity. It doesn't even have a physical store. The process of delivering and consuming electricity involves many factors.

In the past decade, renewable energy became an important part of the global market for energy. It is a source of energy that is sustainable and can replace fossil fuel-based sources.

The development of new technologies is fueling this shift in the industry. There is also a growing demand for alternative energy. It is a rapidly growing area of the industry that offers exciting opportunities for traders.

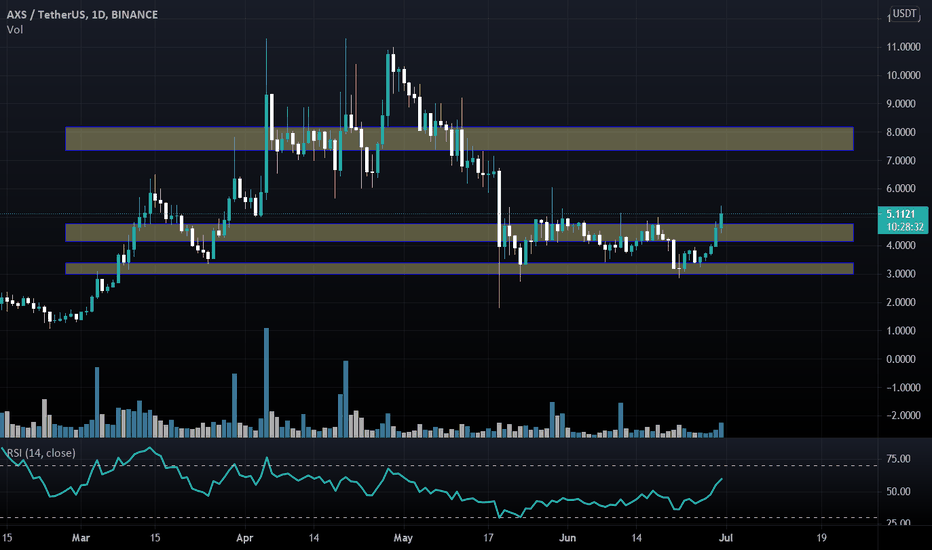

Trend or momentum-based technical analyses are used by the best energy traders to analyze the prices for the major commodities. This type is commonly used to long on breakouts of a trend. However, it can also work when paired with volatility-based trailing stops.

The prices of crude oil and natural gases have experienced huge swings over the past few years. These swings can sometimes be difficult to predict. They can also lead to big losses.

These swings could be a great opportunity for a long-term investment, but they can also pose risks as they can cause abrupt changes in the prices. It is therefore important to think about all factors that could impact the price of these commodities.

You can reduce this risk by trading over-the-counter (OTC) to minimize your exposure. This alternative to a formal marketplace is flexible and offers more customization.

OTC trading can be volatile, even more so than exchange-traded transactions. OTC transactions can be more volatile than trading in an exchange.

Trading energy is a profitable investment, but it can also be an unprofitable investment. It is crucial to fully understand the influences that can affect the price of an oil commodity. These factors could include global politics, weather and travel trends as well data and forecasts.

FAQ

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

What are the disadvantages and advantages of online investing?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There might be restrictions or a minimum deposit required for certain investments.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

It is important to research both sides of the coin before you make any investment. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Frequently Asked questions

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be divided into two groups: common stock and preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Security is essential when investing online. Online investments can be dangerous. You need to know the risks and how to mitigate them.

You must be mindful of who your investment platform or app is dealing with. You want to work with a company that has positive customer reviews and ratings. Before you transfer money or give personal data, be sure to investigate the background of anyone or any company with which you may work.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. Your devices should be disabled from auto-login to prevent others from accessing your accounts without your consent. Avoid phishing attacks by not clicking on links from unknown senders and never downloading attachments unless they are familiar to you. Also, ensure that you double-check the website's security certificate before you submit any personal information.

If you want to make sure only trusted people have your finances, ensure that all bank applications are deleted from old devices. Change passwords at least once a month. You should keep track of any account changes that could alert an identity theftist such as account closure notifications and unexpected emails asking for additional information. It's also smart to use different passwords for each account so that a breach in one won't lead to breaches in others. Last, but not least: Use VPNs to invest online as they are free and easy to set-up!