Bonus offers from Forex brokers to encourage you deposit money to your account. This is a great incentive to boost your trading account, and increase your profits. Before you open an account, make sure to read the terms and conditions. Not all brokers are created equal and some may have hidden terms. Therefore, it's best to do your research and find a broker that will suit your trading style.

Forex brokers offer many types and kinds of bonuses. They can range from a free bonus for your first deposit to a welcoming bonus. The best forex bonus programs are available for those who want to get started. Also, ensure you're investing with a reputable platform. You want to choose a broker that will give you a smooth experience.

A no deposit bonus is usually given to new forex accounts. A no deposit bonus, which is a cash amount that is not deposited to your account before you invest any money, is what you will get. The bonus is generally a percentage on the total amount you deposit.

You may also receive an incentive to trade actively. A broker may offer you a bonus depending upon the number of trades that you make. Another option is to get reimbursed for trading expenses. You will need to speak to your broker to find out how to claim your bonus.

The best bonus is one you can actually use. Some brokers might require that you make certain trades in order to withdraw the bonus money. You may also need to deposit a certain amount in order to receive your bonuses. If you can meet these requirements, your forex account will be able to make more money.

Bonuses are an excellent marketing tool for brokers. They are a great tool to bring in new clients and enhance your reputation. Many people are curious about forex and would like trading. Brokers have many options to offer customers because of this.

One of the biggest reasons for this is the fact that people are more aware of the possibilities of trading. This is because they are more aware of the potential for trading. This may sound like a great thing, but it is important to research and choose a safe and reliable platform.

A rebate is another important aspect to consider when selecting a broker. You can withdraw your rebate bonus profits, not unlike a non-deposit bonus. You will need to make sure your broker offers flexible payment options. Most forex brokers do.

If you're looking for a forex broker with bonus, look for one that offers the most competitive bonuses and has a solid reputation. These bonuses can help you increase your profits as well as provide a pleasant user experience.

FAQ

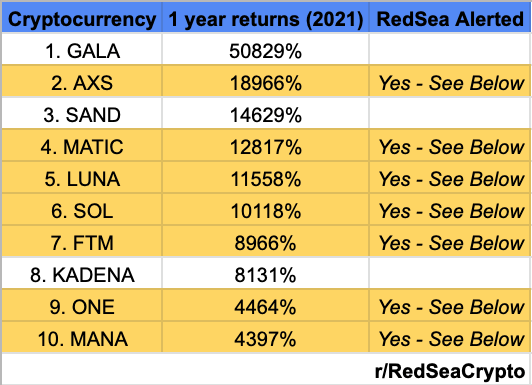

Is Cryptocurrency a Good Investment?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

How do I invest in Bitcoin

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

You need to be aware that there are many investment options. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. You may choose one option or another depending on your goals and risk appetite.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. To stay on top of crypto trends, keep an eye out for market developments and news.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Can forex traders make any money?

Yes, forex traders are able to make money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

A lack of a strategy or plan can lead to many traders failing. However, if one is disciplined they can maximize their chances at making money in foreign exchange (forex).

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

Which trading platform is the best for beginners?

Your level of experience with online trading will determine your ability to trade. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers provide interactive tools to show you how trades function without risking any money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

Frequently Asked questions

What are the 4 types?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

There are two types of stock: preferred stock and common stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Which is more secure, forex or crypto?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. When deciding which option between Cryptocurrency and Forex is safer, it will depend on your risk appetite and experience with each investment option.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. A strong security system is essential for your valuable assets. There are several options.

You can easily access your investment assets online from any device. It also makes it easy to keep track of them quickly and easily. The downside is that there may be electronic thefts.

Alternatively, keeping your money in physical forms like cash or gold is more secure, but it's also harder to keep track of and requires a higher level of maintenance for storage and protection.

Another option is to keep your investments in traditional banking and investing accounts. You also have the option of self-storage facilities, which allow you to store valuables such as gold, silver or other precious metals safely outside your home.

You may also want to consider specialized investment firms offering secure custody services that are specifically designed to protect large asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?