Chicago Mercantile Exchange in Chicago (CME) is one of the most important options and futures markets in the world. CME markets a wide array of benchmark products, covering all major asset class categories, including energy, foreign currency, foreign exchange and agricultural commodities. It also pioneered the CME Globex Trading System, a global electronic trading platform that is used to trade over 90% of the exchange's total volume.

Today - Future of CME Group

CME is a major derivatives clearinghouse. Its primary businesses include CME Group, the world's largest derivatives marketplace; CME Clearing, which provides clearing and settlement services for exchange-traded contracts and over-the-counter derivatives transactions; and the CME Globex Trading System, an electronic trading platform that is used by most of its members.

Globex, an open-access trading market that is available 24/7, allows you to trade virtually anywhere in the world. Globex has a large selection of options products and traditional futures that are traded via open outcry.

CME Globex began as an electronic trading system that allowed global futures and options to be traded. It was established to enhance trading efficiency, extend trading hours and complement the exchange’s open outcry systems.

Agricultural Markets

CME Group is the operator of the Chicago Board of Trade's (CBOT), Kansas City Board of Trade's (KCBT) Designated Contract Markets. These markets provide futures on corn, soybeans and other agricultural commodities. CBOT/KCBT markets provide liquidity and transparency for both farmers and traders in these commodities.

CME increased its hours to 21 hours per day on Sunday, May 20, for a variety of oil and grain futures options and options. Based on feedback from over 4,000 farmers, traders and commercial customers, this change was made.

The new hours provide traders and investors with more time to manage the risk in the oilseed and grain markets. It also enhances liquidity and improves market performance. Liquidity improves market performance by allowing for more price discovery and movement, as well as reducing transaction costs.

USDA Reports & Trading Hours

During the next several weeks, trading in CME Group's futures markets will be influenced by the release of key agricultural reports from the United States Department of Agriculture. These reports will immediately influence prices and lead to massive spikes in trading activity.

CME Group is continually changing its rules and regulations to govern its markets. This will mean that trading hours will keep evolving. These changes are usually made to address customer feedback or to meet regulatory requirements.

Trading Hours on Globex

CME Globex, which handles 90% of its trading volume, is responsible for nearly all of CME's electronic trading. It is the world's largest electronic trading platform. It is also the only system that supports all of the exchange's products, including its proprietary trading system, CME SPAN.

FAQ

Are forex traders able to make a living?

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading is not an easy task, but it can be done with the right knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

What are the pros and cons of investing online?

Online investing offers convenience as its main benefit. Online investing allows you to manage your investments anywhere with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Which forex or crypto trading strategy is best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading involves investing in different currencies and is an accessible option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

It is important to research both sides of the coin before you make any investment. Diversification of assets and managing your risk will make trading easier.

Understanding the various trading strategies for different types of trading is important. For example, forex traders could use technical analysis or foundation analysis to help make decisions. Crypto traders may choose arbitrage or margin trading to maximise their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Most Frequently Asked Questions

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four main types of investing: stocks, bonds and mutual funds.

Stocks can be broken down into common stock or preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Which is more difficult forex or crypto currency?

Different levels of difficulty and complexity exist for forex and crypto. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

How can I invest Bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. All you need are the right tools and knowledge to get started.

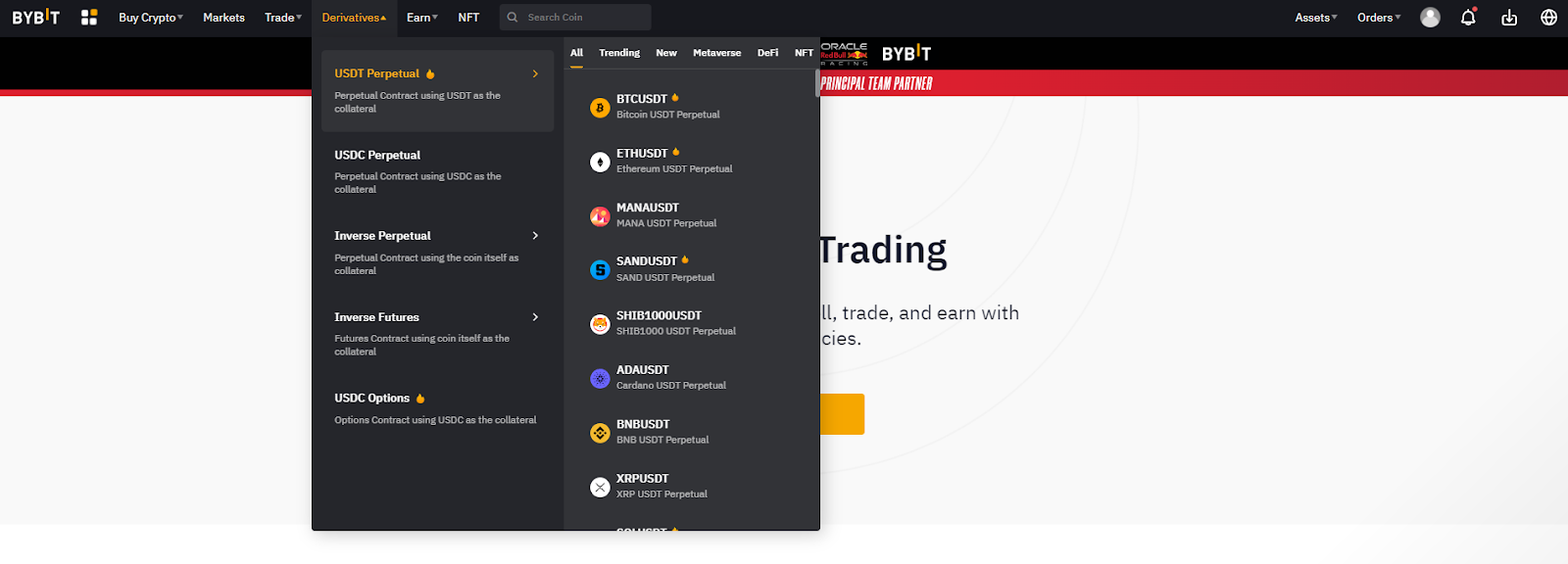

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Online investment is not without risk. Online investments pose risks to your financial and personal data. Take steps to reduce them.

You must be mindful of who your investment platform or app is dealing with. Make sure you're working with a reputable company that has good customer reviews and ratings. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Secure passwords and two-factor authentication should be used on all accounts. Also, make sure to regularly check for viruses. Disable auto-login settings on your devices, ensuring no one can access your accounts without your knowledge or consent. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. To prevent a breach of one account, it's smart to have different passwords for each account. The last thing is to make use of VPNs for investing online when possible. These are often free and easy to setup!