You might want to earn passive income from forex trading, so you may consider opening a PAMM Account. This trust management account provides investors with a variety of benefits. It provides a high level of control while providing the added advantage of minimal involvement.

A PAMM account allows you to assign money to a professional trader who will invest it on your behalf. The trader will use your funds to make trades and you will get a share of the profits. You have the option to either allocate a percentage of your funds to a particular manager or trade your own fund, whichever is more convenient. These accounts can be offered by many brokers. Be sure to take the time and evaluate all features before you signup.

The first thing you need to consider is the amount of risk you are willing to assume. This means that you should only open a account if you can deposit a minimum amount. But this is not the only thing to consider. You can reduce your risk by choosing a broker with tight spreads, low commissions, and other features. You can also use an Islamic account that is not subject to swaps. You should also consider the financial situation and trader experience when choosing a PAMM bank account.

Although PAMM accounts are not for everyone it can be great for clients with diverse needs. For instance, an individual with a small budget might enjoy the micro account, while an experienced trader might like to manage a number of trading accounts simultaneously. It is possible to manage multiple accounts, although it can be complicated.

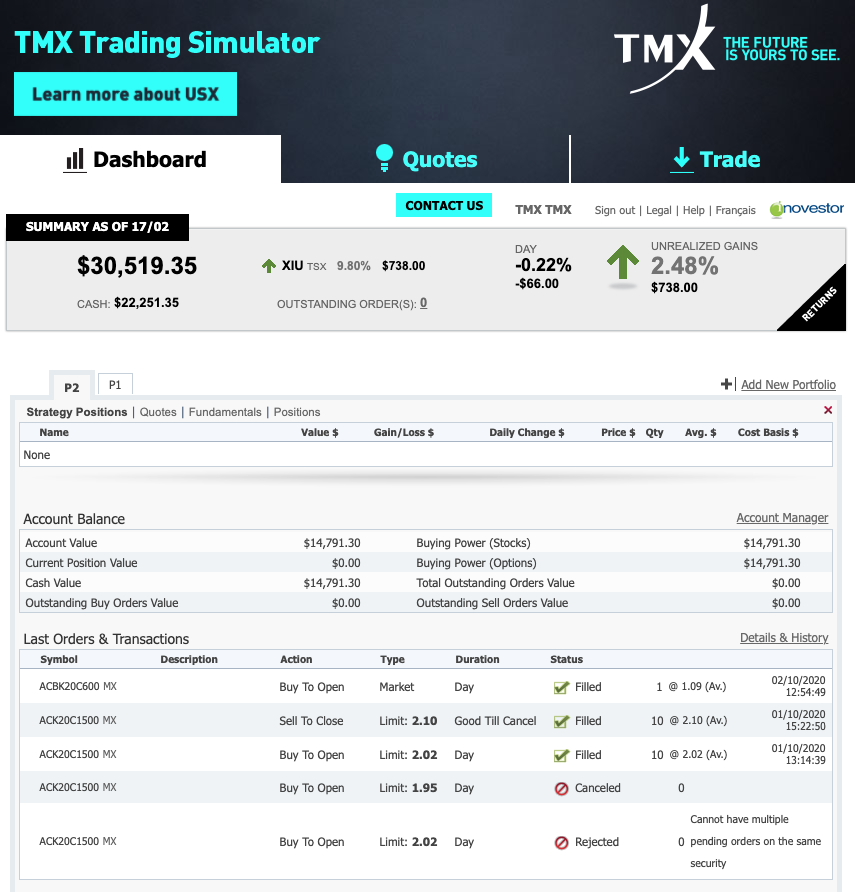

A demo account is a great way for novice traders to experience the PAMM system. The simplest version will allow you deposit and withdraw funds in a secure, user-friendly way. The MAM module can be used by traders to enhance their MetaTrader4 platform.

In addition, the PAMM account has a slew of other features, including the use of EAs (Expert Advisors), automated strategies and indicators. You can also access many different markets, including stocks indexes, cryptocurrencies, and other stock exchanges, for a nominal fee. You can also request a swap-free Islamic Islamic account.

You can also test new forex strategies with a PAMM account. This is especially important if you're considering an Expert Advisor (EA). As you become more proficient at Forex trading, you may decide to open an account with a more sophisticated and advanced system. You will enjoy a more stable trading environment which will result in better results. Similarly, a seasoned investor may want to switch to a different money manager, and PAMM accounts offer the ability to do this without compromising your safety.

FAQ

Frequently Asked Fragen

What are the different types of investing you can do?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Can one get rich trading Cryptocurrencies or forex?

You can make a fortune trading forex and crypto if you take a strategic approach. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Which trading site is best for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How can I invest bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You just need the right knowledge, tools, and resources to get started.

You need to be aware that there are many investment options. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

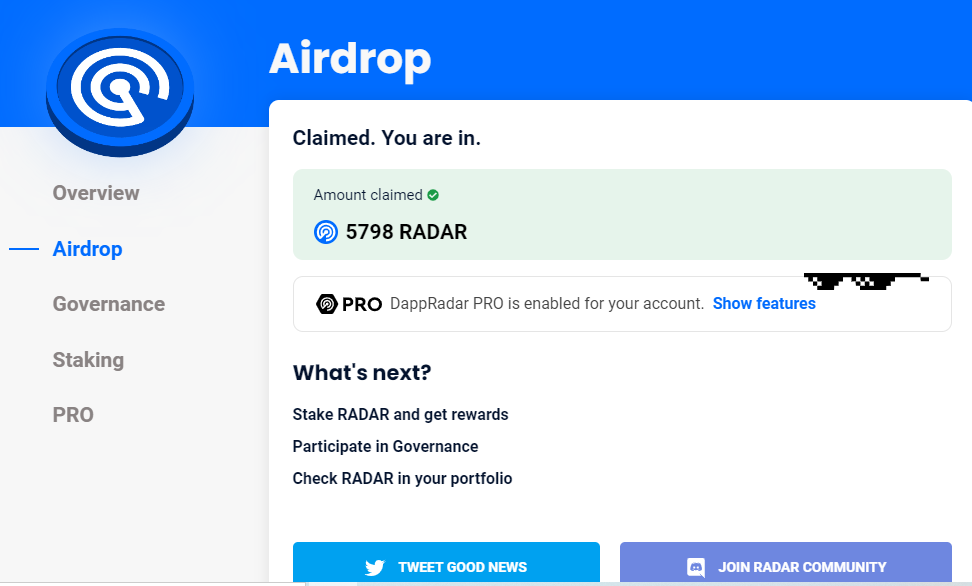

Next, research any additional information you may need to feel confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Cryptocurrency: Is it a good investment?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

In both instances, it is crucial to do your research prior to making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

Understanding the various trading strategies for different types of trading is important. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Automated trading systems and bots may also be used by some traders to help them manage investments. Before investing, it's important to understand both the risks and the benefits.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. A strong security system is essential for your valuable assets. There are several options.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. There are some risks associated with using a digital option as electronic breaches could occur.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

Finally, consider looking at specialized investment companies that provide secure custody services designed specifically for large asset portfolios.

It is ultimately your decision. What will work best for you, and provide the security and safety that you require to protect your investments.