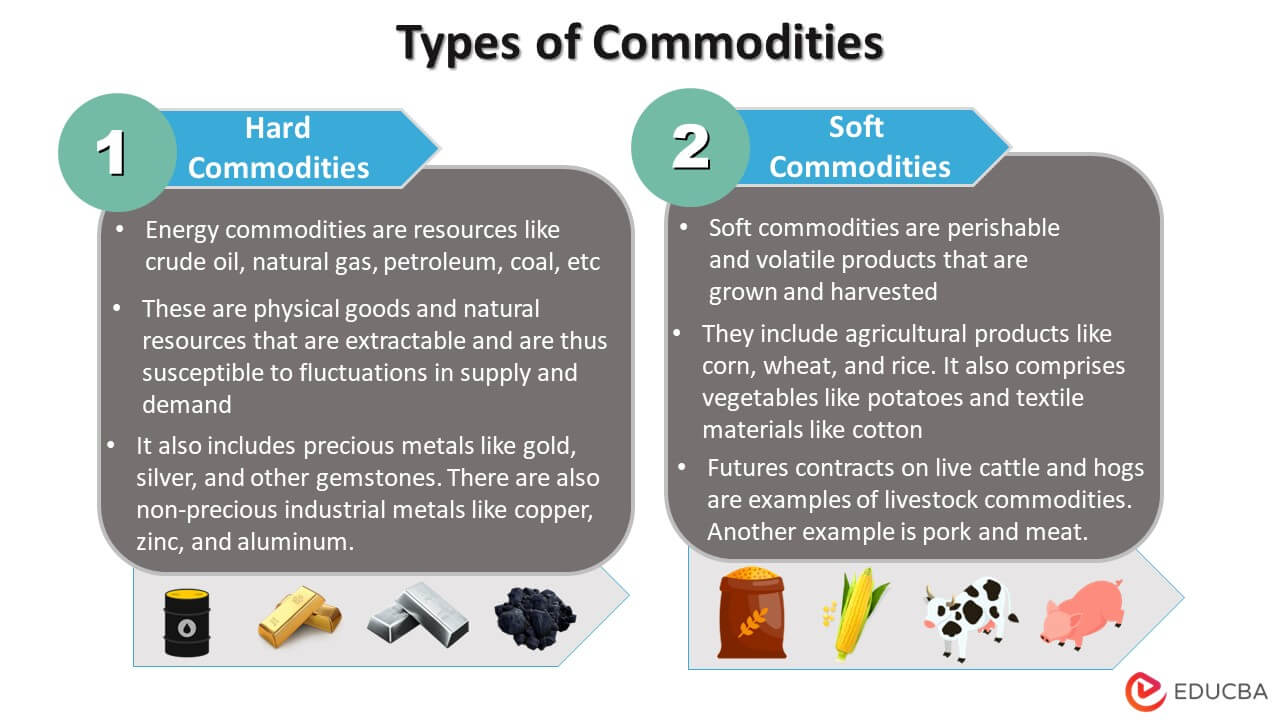

Agricultural commodities are essential for human living, and they are traded worldwide. These commodities are always in demand, and the market is expected to continue growing. The prices of these commodities could fluctuate due to many factors like political and economic disturbances.

It is crucial that you understand how to trade agricultural commodities effectively. Agri trading is an excellent way to diversify your portfolio and invest. Moreover, it also allows you to earn a higher income.

Many trading firms trade agricultural commodities. These companies are licensed by the relevant authorities and are registered. These companies offer many services to traders. These companies can offer technical support and trading strategies to assist you in making informed decisions.

Many trading companies have their own research departments. They can provide data and reports about the various factors which affect the price agricultural products.

These companies will provide you with a variety of information and tips about the best times to buy and sell the different products. They will help determine the best margin for each transaction.

The global agricultural commodities market is a significant market. It is essential to learn how it operates. It is important to understand the different trading platforms and brokers available in this industry.

Futures contracts have become a very popular method to trade agricultural commodities. You can trade them on a variety of markets. Both beginners and experts can use them.

Many Swiss companies specialize in trading in agricultural commodities. They are well-known for their transparency and reliability, as well as having a lot of experience.

Global agri-food trade is growing, and there are many technological innovations that can improve it. These include electronic sanitary and phytosanitary (SPS) certification, which can save costs and time for producers and consumers.

Grain is an important crop for the global economy. It is also in high demand. Grain is used to make animal feed. It is also the main ingredient for foods such as wheat, soybeans and rice.

The price of grain depends on many factors. These include supply, demand, production and availability. These trade regulations can also affect the grain's price.

Among the top agricultural commodity trading companies are Archer-Daniels-Midland Company, Wilmar International, and Bunge Limited.

In recent years, Swiss-based traders also entered the agricultural sector. They are now focusing on global value chains as well as mergers and acquisitions.

These traders need to be capable of quickly adapting their operations in order to keep pace with demand for various agricultural commodities. They also need to be able to ensure the quality of the products they are trading.

Agricultural commodities are an integral part of our daily lives. They have been traded on the international markets since the dawn of civilization. Despite the fact that these commodities are vital to the human population, they can be highly unpredictable. It is therefore important to keep up with the latest news and developments in the agricultural industry.

FAQ

Do forex traders make money?

Yes, forex traders can earn money. Although success is possible in the short-term it is not likely to last long. Long-term profits are usually a result of hard work and dedication. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

It's not easy to trade forex, but it is possible with the right knowledge strategies to produce consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which trading platform is the best?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

What are the disadvantages and advantages of online investing?

Online investing is convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, online investing does have its downsides. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms may not offer as much security as traditional brokerages. Therefore, investors should be aware of the risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which trading website is best for beginners

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers offer interactive tools that allow you to see how trades work, without having to risk any real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Is Cryptocurrency a Good Investment?

It's complicated. It is complicated. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you verify the legitimacy or an online investment opportunity?

It is important to do your research before investing online. You should research the company that is offering the opportunity. Make sure they are registered with financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Know the risks associated with your investment and the terms and conditions. Before you open an account, check what fees and commissions might be taxed. Due diligence checks are necessary to ensure you are receiving the services and terms you agreed to. You can also make sure that you have an exit strategy for any investment that doesn't go according the plan. This will help reduce long-term losses.