Moomoo has a brokerage firm that specializes only in stock trading. You can easily invest with a variety of features offered by Moomoo. The company offers US stock trading without commission and extended trading hours. The platform also includes an app that allows stock traders to trade on their mobile devices. You can also access live market data and financial information via the app.

Moomoo, a member of Securities Investor Protection Corporation is insuring customer funds upto $500,000. Moomoo is a registered brokerage-dealer with FINRA and the United States Securities and Exchange Commission. In less than five minutes, you can open a company account. To register, you need to provide your Social Security #, an email address that is valid, and a username.

Moomoo offers a wide range of services, including real-time trading, a mobile app, and advanced charting tools. Access to Shanghai Stock Exchange, Shenzhen Stock Exchange, Hong Kong Stock Exchange are all available through Moomoo. Investors who are short on time can use the platform to access the markets.

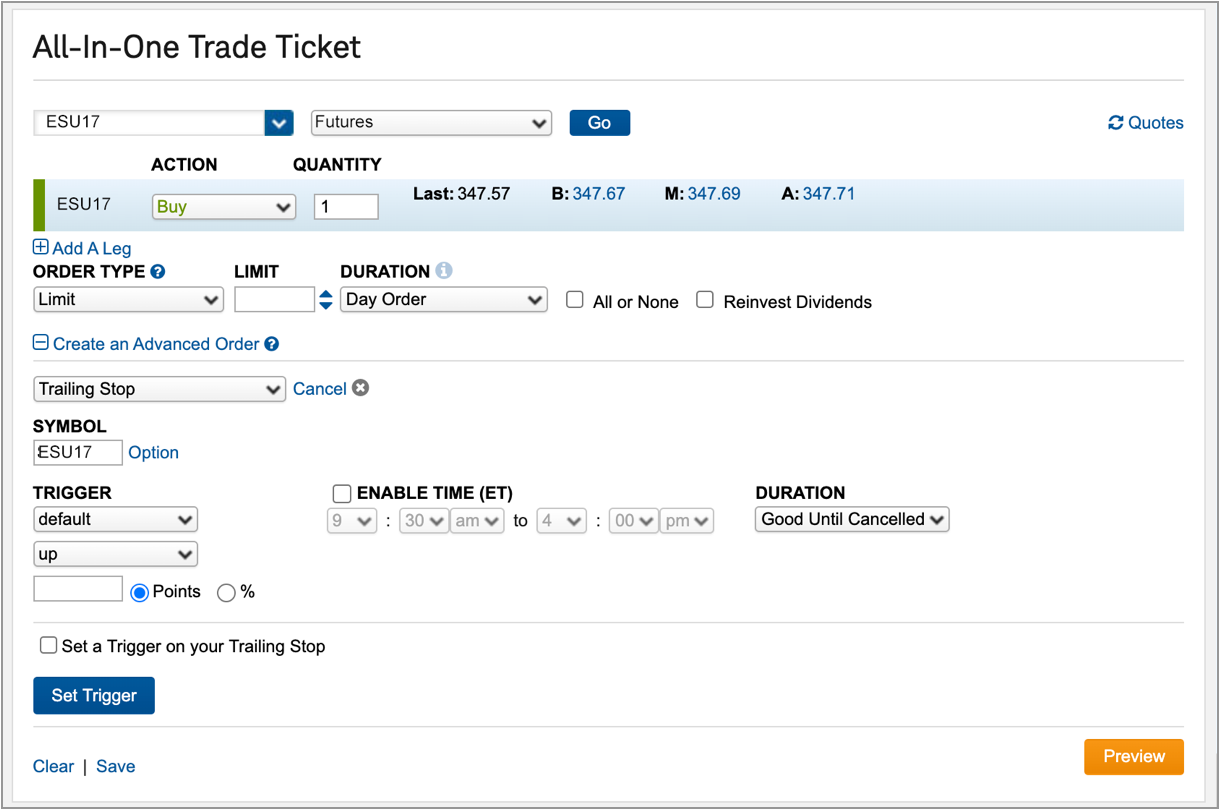

Moomoo not only offers comprehensive charting, but also individual margin accounts. Customers can purchase and sell stocks and ADRs as well as REITs. Customers can place up to 40 orders simultaneously. A market monitor powered by AI provides regular updates to users on prices. Moomoo's users can monitor the markets using a variety o technical indicators. This allows them to spot price changes before they occur.

Moomoo provides a broad range of services as well as competitively priced fees. It doesn't require a minimum monthly balance, nor does it charge a monthly fee. Additionally, Moomoo offers a commission free trade promotion for 180 days. The brokerage charges 6.8% for all levels of debit for U.S stocks, and 2% for China-A-shares.

The app allows users unlimited access to live quotes and the ability to create custom alerts. You can also track prices and share updates with other traders using the app. You can also find investing tips on the company's blog.

Moomoo is a reliable and legitimate brokerage. Its trading platform has been designed to accommodate investors of all levels. This has made it the preferred choice for many investors across the globe. It's important that you remember that all types of investments come with risk. Do your research before investing.

Moomoo terms and conditions are important to understand if you want to use it for trading. This will help to decide which route is right for you. You must remember that you cannot predict which direction the market will go and that every trade you make is an opportunity to take a chance.

In the event that you encounter any problem or issue, Moomoo provides 24-hour live support chat. It is also available by email during US trading hours.

FAQ

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

First, you need to know that there are many ways to invest. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. Keep an eye on market developments and news to stay current with crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Is Cryptocurrency an Investment Worth It?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is more secure, forex or crypto?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded like any other currency on exchanges and has been subject to speculation investments because of its volatile price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Forex and Cryptocurrencies are great investments.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. You should also trade with only the money you have the ability to lose.

For long-term success, you will need to combine experience, knowledge, risk management skills, and discipline.

There are many factors that can cause volatility in cryptocurrency prices. Therefore, it is crucial to ensure that your entry position aligns with your risk appetite. Also, make sure you plan for exit if there is an opportunity to profit from the market.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Understanding the different currency conditions is crucial.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which trading platform is the best for beginners?

All depends on your comfort level with online trades. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can my online account be secured?

Safety is a must when it comes to online investment accounts. It is vital to secure your assets and data against any unwelcome intrusions.

First, you want to make sure the platform you're using is secure. Look for encryption technology, two-factor authentication, and other security measures that will provide maximum protection against potential hackers or malicious actors. Also, a policy should be created that describes how the sharing of personal information with them will go.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking suspicious links or downloading unfamiliar software--these can lead to malicious downloads and ultimate compromises of your funds. You can also monitor your account activities to make sure you are alerted to any irregularities.

Thirdly, make sure you understand your investment platform's terms and conditions. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Look at user reviews to get a feel for how the platform works. Finally, make sure you are aware of any tax implications associated with investing online.

By following these steps, you can ensure that your online investment account is secure and protected from any potential threats.