Automated forex trading is a convenient way to trade the forex market without having to monitor price action manually. It can also help reduce your risk of losing money, which is a common problem among retail traders.

There are many options for automating forex trading, including robots as well as expert advisors. Both types have their advantages and disadvantages, so it's important you understand the key points to consider when selecting an automatic program.

Selecting a trading system

You should ensure that the forex trading platform has been tested thoroughly and has a proven record of success before investing. This will give your decision a solid base and make sure it is able to deal with real market conditions.

You can also search online for customer reviews to see what other users have to say about the systems. It's also a good idea to request screenshots or video walkthroughs of the software functioning in the market, buying and selling currency pairs.

It is a good idea to try an EA in a demo account before you commit to buying it. This will enable you to find the best strategies for you trading style. Additionally, the software can easily be modified to suit your needs.

Forex Expert Advisors are computer programs that generate trading signals. It is based upon a mathematical model that has many yes/no rules.

Forex traders looking to maximize profits and minimize losses can use an expert advisor. They can even gain control over your account to automatically determine the amount of risk that you should place on each trade.

Some EAs can be used as full-time trading assistants. Others provide signals to help you manage your strategy and allow you to do the rest. EAs for hedging and breakout can be used to open opposite positions, reducing your risk.

Another type of expert advisor is adaptive EAs. They react in different ways to volatility. Their ability to react quicker than a trader is a major advantage for busy traders.

No matter which trading method you use, it is important to be open with yourself about what your level of knowledge and experience are. This will help you avoid getting overconfident in your ability to trade successfully and keep you on track with your strategy.

FAQ

Which trading platform is best?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

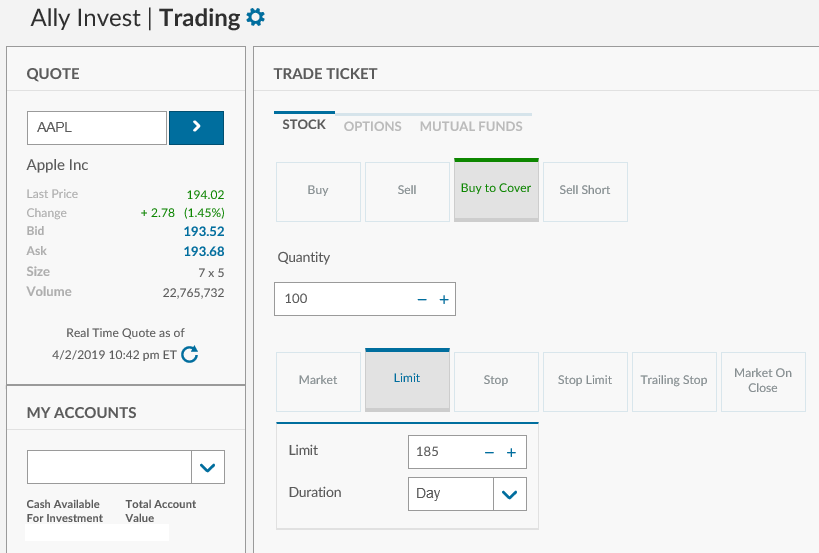

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

How Can I Invest in Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. You only need the right information and tools to get started.

You need to be aware that there are many investment options. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Can you make it big trading Forex or Cryptocurrencies?

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. You should also trade with only the money you have the ability to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Understanding the different currency conditions is crucial.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

Which is more difficult, forex or crypto?

Different levels of difficulty and complexity exist for forex and crypto. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

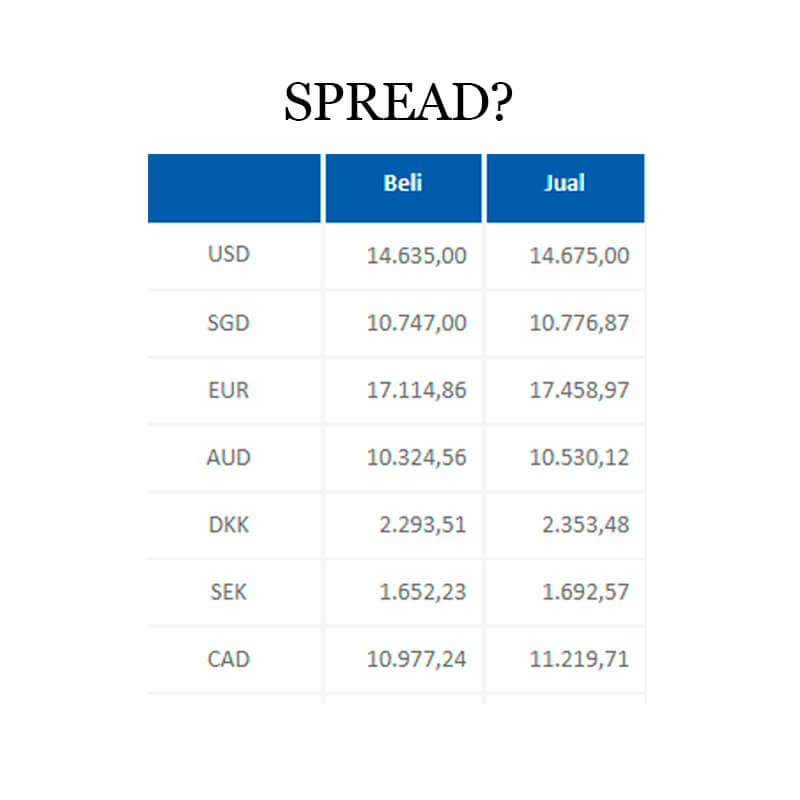

Forex traders must understand the dynamics of foreign exchange pairs. This includes how prices change based on news events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best options for storing my investment assets online?

While money can be confusing, the decision to where it should be stored can be just as complex. You have many options for protecting your valuable assets.

Storing your investment assets online provides easy access from any device and you can keep an eye on them quickly and easily. The downside is that there may be electronic thefts.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You have other options, such as traditional banking accounts or investing accounts, as well as self storage facilities that allow for safe storage of precious metals and other valuables.

Finally, you may consider looking into specialized investment firms that offer secure custody services specifically designed for protecting sizeable asset portfolios.

Ultimately the decision is yours--what works best for you and provides the security and safety necessary to protect your investments?