Live es futures

The S&P 500 Index Futures are a popular and liquid product. They are traded electronically and offer deep liquidity and 24-hour market access for traders speculating on the S&P 500 index.

Trading ES stock futures is simple and profitable when you have a trading system that works - and when you know how to execute trades correctly and manage your money properly. Using our trade setups, you will learn to get better fills and to place your entry orders at the right time with proper stops.

ES options are a great option to diversify your trading portfolio, and protect yourself against potential downside risks. They are highly liquid and can be used to both hedge market exposure and spread strategies.

Scalping ES futures refers to the art of profiting from intra-day price fluctuations in the underlying market. It is a trading strategy that offers high returns and low risk.

You can profit from small price movements in the underlying stock/index by understanding your price ranges. It is going to take some effort to identify price ranges for different markets.

Looking at historical data can help you determine your price ranges. Another is to look at the average intraday range. You may need to do some complex math to determine the range that you can expect for a given market. You also want to consider the probability that a market is going to go up or down before you decide whether to enter a trade. These traders can trade up to five points per trade.

FAQ

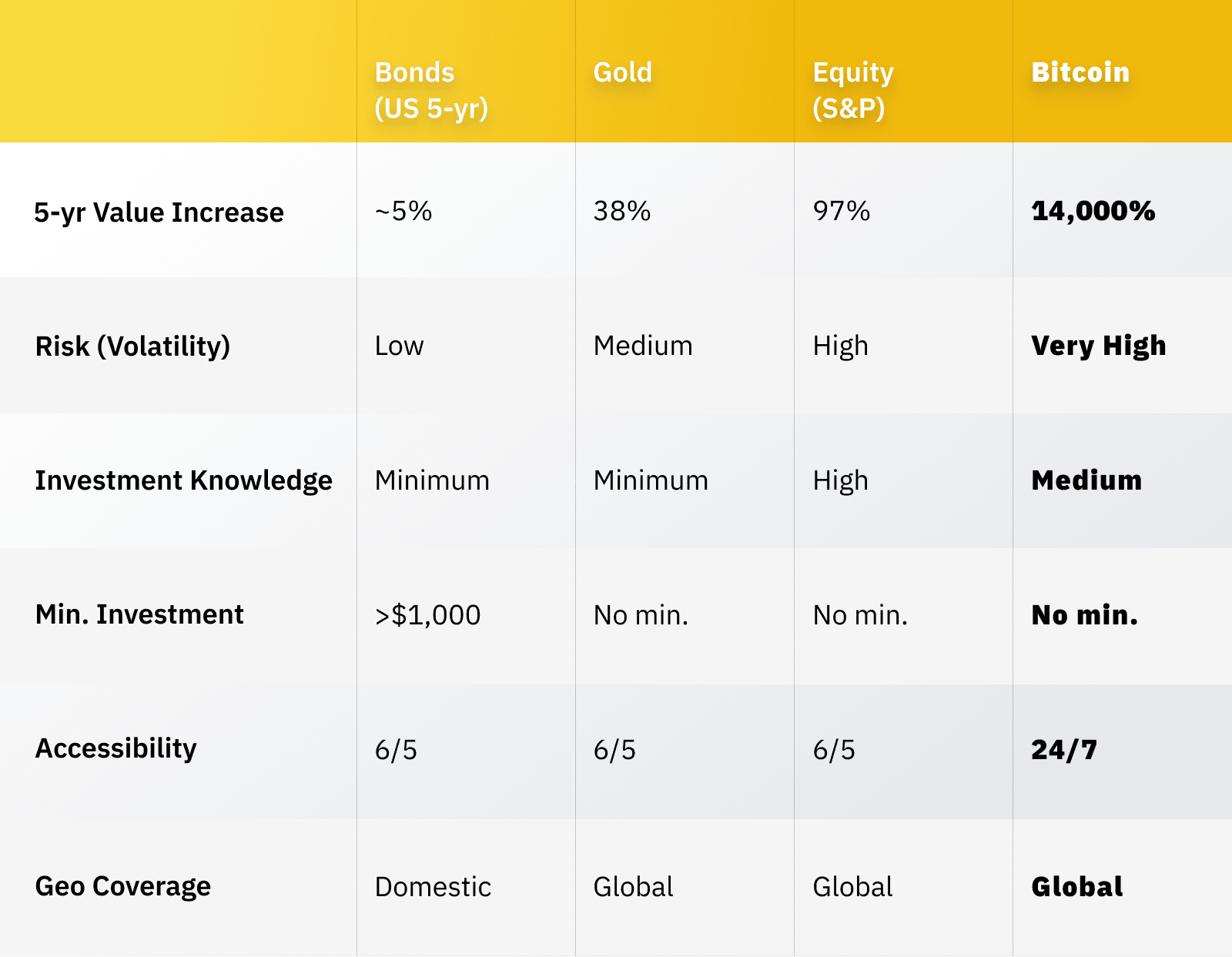

Which is more secure, forex or crypto?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex is a high-risk investment that can lead to large losses if it is not managed properly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

How can I invest in Bitcoin?

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

You need to be aware that there are many investment options. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. With so many different platforms to choose from, it can be hard to know which one is right for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5/MT5 (MT4/MT5), cTrader and eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive brokers TD Ameritrade AvaTrade IQ Options Questrade Investopedia trade idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkingOrSwim App Store are just a few of the popular trading platforms.

Can forex traders make any money?

Yes, forex traders can earn money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Forex trading is a disciplined business. Setting rules for how much money you're willing and able to lose per trade can reduce losses and help ensure success. Furthermore, strategies such as leverage entry signals can help increase profits that are not possible without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Which is better forex trading or crypto trading.

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. It requires a smaller capital upfront, plus forex markets are global and open 24/7.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. Any type of trading can be managed by diversifying your assets.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which trading site is best suited for beginners?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

There are many sites that let you trade on your own if you have some knowledge and want to take more control of your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Unsolicited email or phone calls should not be answered. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Keep in mind that fraudsters will try everything to get your personal details. Protect yourself from identity theft by being mindful of different types of online phishing schemes and suspicious links sent via email or online ads.

It's also important to use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.