A commodity account is an account that contains various investments, including cash, securities, and other investment property. The best way to diversify portfolios is by investing in commodities. While commodities can be risky, investing in them can bring you large returns if your actions are well planned and done correctly. Before you decide to invest, make sure you understand the process. A commodity account is required to trade in these markets.

You can reap many benefits from investing in commodity options or futures. Tradeable commodities include agricultural products, metals energy, precious metals and metals. Traders should understand how commodities are priced and how that is affected by supply and demand and weather.

Opening a commodity account is a straightforward process. You may have questions about the legalities. An attorney can help you with more details. You can make money by having a commodity account when the market is moving in favor of you.

Also, it is important to understand how to properly manage funds in your safekeeping accounts. It is important to have a system for liquidating unfulfilled positions. A bank can serve as a fiduciary to help you manage your safekeeping account. However, the bank might not always be able to access your funds in the event of a market disruption. This could worsen the effects of disruptions in the market.

The Division of Trading and Markets was made aware of several institutions making use of commodity markets. These institutions need to meet the requirements of the regulations. They must be able and able to make withdrawals, meet any other account location requirements, have sufficient capital to support these operations, among others.

Staff and the SEC have been looking into whether registered investment companies are allowed to engage in commodity transactions. Although safekeeping account regulations have not been adopted by the SEC, it is anticipated that FCMs would be subject to capital requirements that are higher than those currently in effect.

The Division of Consumer Financial Protection concerns also about the handling of safekeeping account funds. These accounts are thought to be able to provide special treatment for bankruptcy victims. Consequently, the Division is concerned about restrictions on the ability of FCMs to obtain immediate access to their customer's funds. The Division is also worried about the possibility of a pension fund or regulator influencing banks to deny withdrawals from safekeeping accounts.

The DOL issued an advisory view on the matter. This opinion clarifies some of the confusion over the requirements for safekeeping under ERISA. In general, safekeeping accounts are the funds that must remain separate under the Act. Once funds have been placed in a safekeeping bank, the FCM has to treat them as undermargined when computing the adjusted capital of the FCM.

A commodity account control agreement should be carefully negotiated to protect your own interests. Lenders could be put at risk if the agreement is not written in a standard format.

FAQ

Frequently Asked questions

What are the 4 types?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

Stocks can be broken down into common stock or preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds can be loans made by investors to governments or companies for interest payments. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which trading site for beginners is the best?

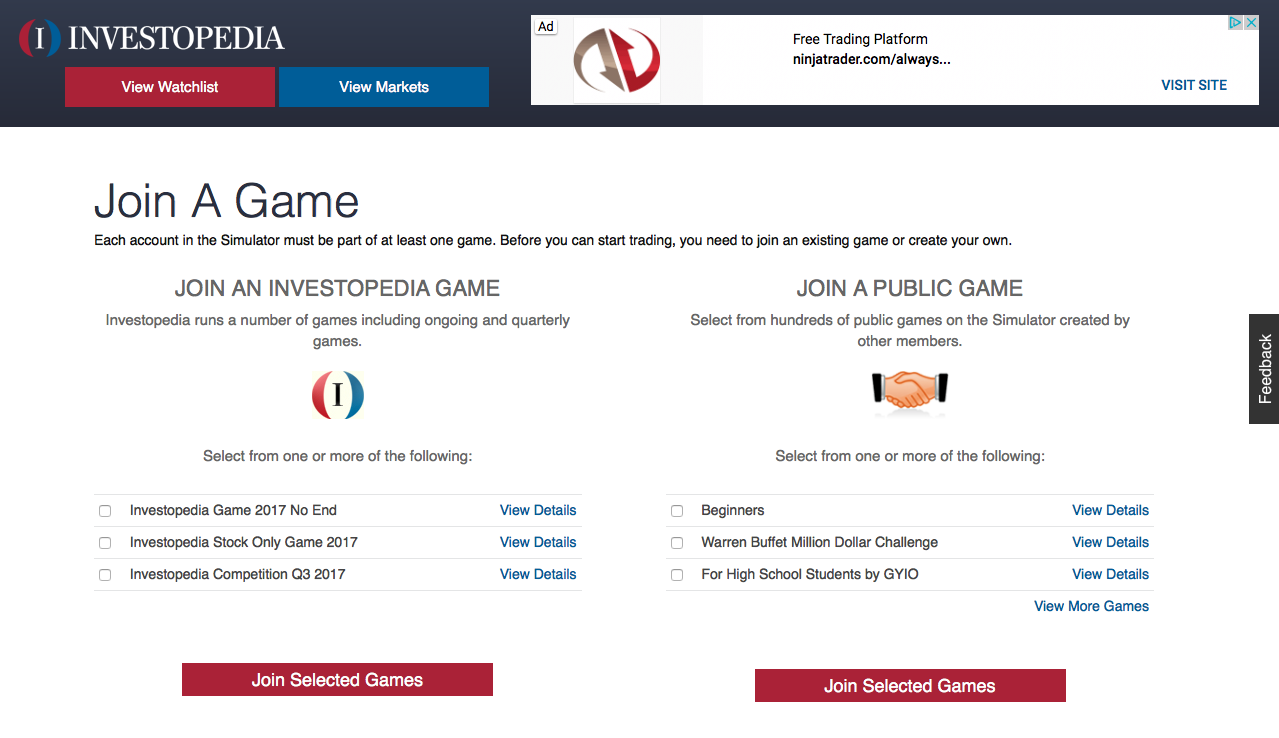

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter which route you choose, be sure to read customer reviews before you make a decision. This will give you an insight into the service and experience of each site.

How can I invest bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, research any additional information you may need to feel confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which forex trading platform or crypto trading platform is the best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

On the other hand, crypto trading offers an almost immediate return as prices can fluctuate quite rapidly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

Both cases require that you do extensive research before investing. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before investing, it is important that you understand the risks as well as the rewards.

Is Cryptocurrency a Good Investing Option?

It's complicated. It is complicated. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. It is definitely worth investing in cryptos if you have the knowledge and ability to make informed decisions regarding this asset class.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

It is important to do your research before investing online. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.