Robinhood stock, an online stock brokerage company, offers a trading platform geared towards younger investors. It is an online stock brokerage company offering commission-free trading. Its stock price fluctuated lately but it is up 24% only on Monday.

Robinhood is an excellent choice for investors of all levels, whether they are newbies or veterans. Its mobile-friendly platform allows for easy navigation and is very user-friendly. You can start from just $10.

Over the past year, the hood stock price has trended upwards. The app's increasing user base and zero-commission trading have made it an increasingly popular spot to trade stocks, especially among millennials.

Robinhood gives you a $50 credit for opening a new Robinhood account. This will give you a $50 stock value between $5 and $200. You can either use the stock to purchase shares in your favorite company or to sell it after a few business days. The value of the stock fluctuates based on market movements, so it's a risky way to invest, but if you can get lucky, you might end up with a stock that's worth much more than the initial $5-$200 value.

Robinhood Offers Free Stock

The company's primary model of business is a loss leader. They make their profits from interest paid on your cash balances. However, they charge higher margin rates than other brokers. It also receives Payment For Order Flow for routing your trades to exchanges where high-frequency traders prey on you.

How to Get Your Free Stock

While it's easy to get your free stock, it does require you linking your bank account as well as opening an account. You will receive a random selection of stock from settled shares. It could be valued anywhere from $5 up to $200. You can either keep it or sell it in a matter of days. However the value on your 1099MISC report must be updated for the cash value 30 days later.

Robinhood gives you the opportunity to earn more stock each year by referring friends. Referral Bonus can be described as $500 in free stock per year.

Signing up with the Robinhood stock application will give you a referral number and the referral link. Follow these steps to claim your free stock: Click the link to visit Robinhood.

Once you've linked your bank account, you'll need to wait for the promotion to kick in. Your new account will be approved in less than one day. Once it is ready, you can start the free stock.

To qualify for the offer, you can't use the stock from any other account. But once you're a verified account holder, you can start earning up to $1,700 in free stock over the first year.

FAQ

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Additionally, it's important to keep your risk as low as possible by trading only with money that you can afford to lose.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

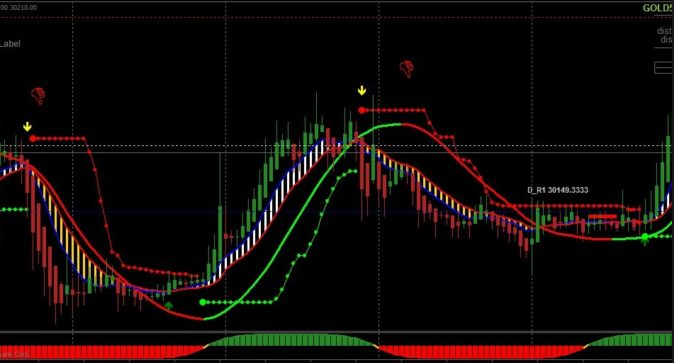

Because forex trading involves the prediction of fluctuations in currency rates via technical analysis/fundamental economic analysis, this type of trading requires special knowledge that has been acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Which platform is the best for trading?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also have an easy-to-use interface that's intuitive and user-friendly.

You will need to have access to multiple account types, low fees, reliable customer support, and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This information will help you narrow down your search and find the best trading platform.

Once you've found the right platform, be sure to check out additional features, such as stock screening tools or backtesting, alert systems, etc. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex is a well-established currency with a stable trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Which is better forex trading or crypto trading.

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both instances, it is crucial to do your research prior to making any investments. With any type or trading, it is important to manage your risk with proper diversification.

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

What are the disadvantages and advantages of online investing?

Online investing is convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

It is also important to understand the different types of investments available when considering online investing. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protect yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Never respond to unsolicited phone calls or emails. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. Before making any commitments, thoroughly research investment opportunities independently.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Don't forget to remember that "Scammers will attempt anything to get personal information." Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

It's also important to use secure online investment platforms. Look out for sites that are regulated and respected by the Financial Conduct Authority. Secure Socket Layer, which protects your data while it travels over the Internet, is a good encryption technology to look for. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.