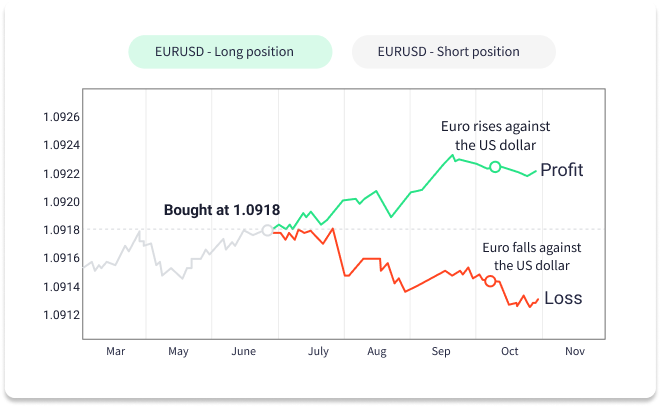

FX investing refers to the trading of currencies for profits. You can do this through a forex broker. This is a company which provides a platform for currency trading. While it's a great way for you to make some extra money, it is not recommended for everyone.

How to Invest in Foreign Currency

Forex, also known as foreign exchange, is the most liquid and largest financial market on the planet. Its prices depend on the supply-demand ratio of traders. They are also affected by central banks policy, interest rates, and political conditions within individual countries.

A forex broker that is reputable should offer a broad range of investment options. These funds are designed to help you protect yourself against currency fluctuations and provide a positive return on your investment.

Forex can be traded in many markets, including spot, forwards, and futures. Spot market is the most popular way to trade forex. This allows you to purchase and sell any currency at the current exchange rate. Most transactions take less than two days to complete and are settled by the market maker (a bank or another financial institution).

The spot market represents the most basic Forex market. It is used by traders, investors, as well as businesses that trade large amounts. It is the primary trading platform for banks, insurance firms, pension funds, and large corporations that trade large amounts of currency.

Leverage is an important aspect of the foreign exchange market. It allows you to leverage the amount of money you have in your account to trade larger lot sizes than you would be able to otherwise. You will need to invest a little cash upfront to make a trade.

You can either buy foreign currencies from an online brokerage or a traditional broker. The commissions charged by forex brokers can be quite high, depending on the currency chosen and the size of your account.

Fidelity offers an online forex platform called MetaTrader 4, a convenient way to trade and manage your forex portfolios from the comfort of your home or office. It is simple to use and learn, and is available to all Fidelity customers.

If you want to get started in forex, check out a reputable online broker that is regulated by the U.S. Securities and Exchange Commission (SEC) and has a good reputation. You can test your trading skills with paper trades. It works just like a stock exchange game.

You can also attend a conference to get more information about the forex market, its strategies, and other topics. This conference is a great way to network with other traders and get valuable information about the market.

FAQ

How can I invest Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! To get started, you only need to have the right knowledge and tools.

There are many options for investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Trading forex or Cryptocurrencies can make you rich.

It is possible to get rich trading forex or crypto. However, you need to use a strategic approach. You need to be aware of the market trends so you can make the most of them.

Also, you will need to be able to spot patterns in prices. This can help you determine where the market is heading. It is important to trade only with money you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Cryptocurrency prices are often volatile, so the key is to make sure that your entry position fits with your risk appetite and exit plan - meaning that if there becomes an opportunity for profit-taking or limiting losses, then do so.

Since cryptocurrency markets are largely unregulated and present substantial risks, researching potential exchanges and coins is essential before signing up for any wallet or platform.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. A solid knowledge of the conditions that affect different currencies is essential.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. If you put in enough effort and have the right education, you can potentially make a lot of money trading forex or cryptos.

Frequently Asked Questions

Which are the 4 types that you should invest in?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

There are two types of stock: preferred stock and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. While bonds offer more stability and lower risk than stocks, the returns are usually lower than those of stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

Which is safer, cryptography or forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can be a volatile investment and could cause significant losses if it's not managed correctly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Cryptocurrency prices are fairly unpredictable due to the limited number of units available along with existing regulations surrounding cryptocurrencies around the world while forex markets tend to move more steadily so investors have more control over their investments. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. They offer customizable trading platforms, live data feeds, and research resources like real-time analytics to make well-informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which platform is the best for trading?

Many traders find it difficult to choose the right trading platform. It can be confusing to choose the right one, with so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. The interface should be intuitive and user-friendly.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down the search for the right platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) is one of the most widely used trading platforms. cTrader, eToro tradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM thinkOrSwim app Store are all others.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

How can I ensure security for my online investment accounts?

Online investment accounts should be safe. It is crucial to safeguard your data and assets against unwelcome intrusions.

First, ensure the platform you are using is secure. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on untrue links or downloading unfamiliar software. These could result in malicious downloads and the eventual compromise of your funds. Also, make sure to review your account activity regularly so you can be aware of any unusualities and detect threats quickly. If necessary, take immediate action.

Thirdly, it's important to understand the terms and conditions of your online investment platform. You must be familiar with the fees associated to investing as well any restrictions or limitations that may apply to how you use your account.

Fourth, make sure you do thorough research about the company before investing. To get a better idea of the platform's functionality and user feedback, you can look at ratings and reviews. Finally, make sure you are aware of any tax implications associated with investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.