Globally, commodity markets play an important role in the lives and livelihoods of billions. Not only are they a place for investors, but they also provide diversification and hedging to other financial markets. There are many commodities available, including food articles and ag products as well as metals, energy and raw materials such sugar, wheat and soy. Traders can take part in the market regardless of its complexity.

The first thing that you should understand about the commodities market is that it's not an all or nothing proposition. Some commodities like crude oil tend to be heavier towards the bottom of the market. This is due in part to the fact that some oil refining units have had to remain closed because of the Arctic freeze. This has led to lower prices.

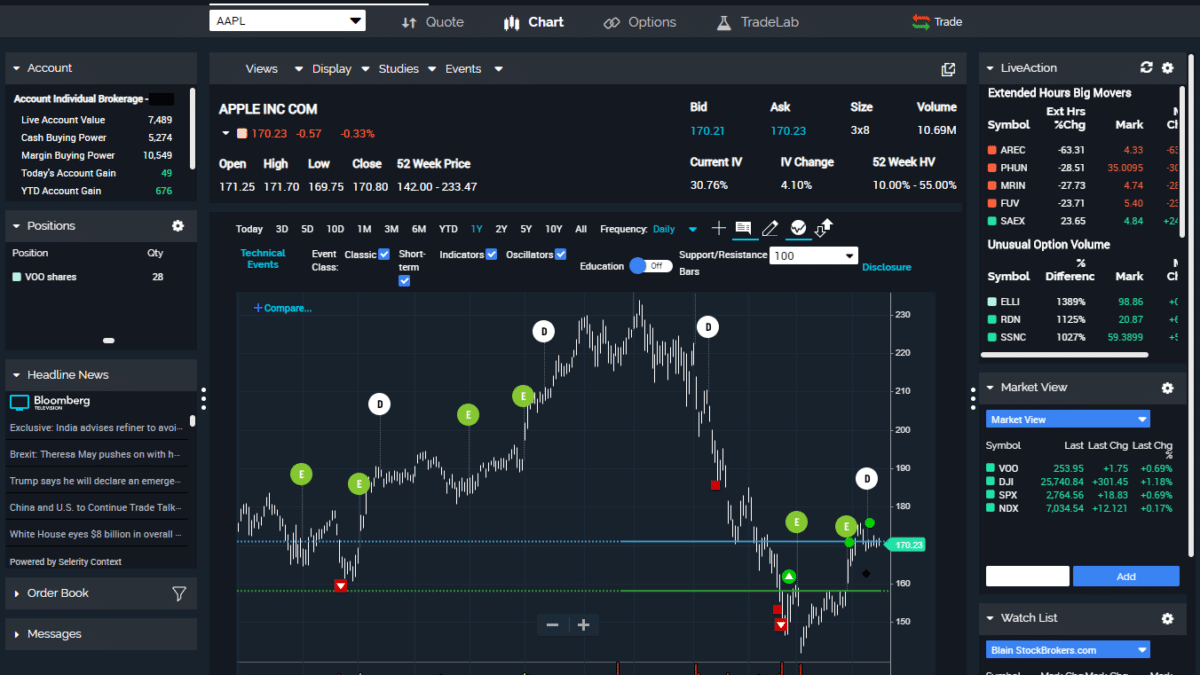

You can buy small amounts of commodities online through an internet broker. This is the easiest way to get involved. A reliable broker will be able to provide detailed data as well as a dedicated researcher to assist you in making your choice. Ask your broker to provide a risk profile analysis. If you're not familiar with the risks associated with investing in commodities, it may be a good idea to seek advice.

It is hard to estimate how much money you can expect to make. The best strategy is to use data for educated decisions. It may surprise you to learn that crude oil prices can swing back and forth between the living and the dead.

The distribution of ag-related services and goods is one of the greatest challenges facing the industry. Most of this activity takes place in a highly fragmented market that is often not liquid. These factors can result in a poor outcome for farmers. Fortunately, there are some major players in ag who are trying to reduce this problem.

The commodity market has been a major financial player over the past few year, but it's not immune from government policies. India has seen a lot of reforms. The country is also strengthening its institutions in derivatives trading.

It is worth noting that even small companies can take advantage of the commodity market. A small manufacturer could buy one or two totes from the exchange, and then pay a fair price. Larger companies might buy bulk oil on the spot marketplace at a similar rate.

In the end, though, the most interesting part of the commodity market is that it's a lot of fun. Follow the guidelines in the book Commodity Investing to maximize your return. You will learn many smart strategies to invest in order to make more money in a highly competitive market.

Commodity trading is not for everyone. It is not surprising that gold has surged in anticipation that the US Federal Reserve will reduce its rate-hiking cycle. Silver is not faring as well.

FAQ

Which forex trading platform or crypto trading platform is the best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. With any type or trading, it is important to manage your risk with proper diversification.

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

Can forex traders make any money?

Yes, forex traders are able to make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Although forex trading can be difficult, it is possible to make consistent profits with the right strategies and knowledge. Before you risk real capital, it is important to find a mentor who is knowledgeable about risk management.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are many options.

Real estate is another option. Property investments can yield steady returns, long-term appreciation, and tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Which trading platform is the best for beginners?

It all depends on your level of comfort with online trading. It's a good idea to begin with an experienced broker who has expert advisors if you are completely new to online trading.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many offer interactive tools to help you understand how trades work.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. Forex has been around since the beginning and has a solid trading infrastructure.

Forex trading has fewer risks than cryptocurrency trading. Crypto markets move in unpredictable ways and can change quickly. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

What are the benefits and drawbacks of investing online?

Online investing offers convenience as its main benefit. Online investing allows you to manage your investments anywhere with an internet connection. You can access real-time market data and make trades without having to leave your home or office. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing has its limitations. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

When considering investing online, it is also important that you understand the types of investments available. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

When you invest online, it is crucial to do your homework. It is important to research the company offering the opportunity. Check that they are registered with appropriate financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. You can find customer reviews online that give insight into the experience of customers with the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Know the risks associated with your investment and the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Conduct due diligence checks to make sure that you're receiving what you paid for. In the event that your investment does not go according to plan, make sure you have an exit strategy. This could reduce losses over time.