FX Blue Trade Copier is a tool that allows you to copy trades across multiple MT4 accounts. You can use it for automating your trading and reducing the time spent doing manual tasks. It can solve many of the most common problems associated with Forex trading.

Aside from the fxblue trade copier, there are many other options available to you. Signal Magician, a third-party solution, can also copy trades between accounts through the internet. Local Trade Copier is another option that offers advanced features. You may also consider the following options depending on your requirements.

FX Blue Personal Trade Copier might not offer the simple method of copying trades. It doesn't include all the features that modern traders would need. Personal Trade Copier does not automatically adjust the lot size in risk-based fashion. This feature can be useful for traders who are using multiple MT4 terminals on the same PC.

The Local Trade Copier EA follows the same pattern. It is a complex product that requires many parameters. However, it's easy to install, set up, and manage. You can set the maximum number of orders to be copied, and the stop loss or take profit levels. You can program it to copy trades only at specific times of the day. You can also program it to automatically adjust between different pricing models.

Forex Copier has the ability to help you increase your profit, regardless of whether or not you are an expert. You can even test the program in the demo version. Once you create a live account you can copy your trades up to 2 master accounts.

When choosing the trade copier you want, make sure it supports multiple platforms. You'll usually need to verify that both the master as well as the receiver accounts are running on one computer. You also need to verify the system's processing speeds. Using a VPS (virtual private server) is ideal for this, as it provides a private virtual computer online.

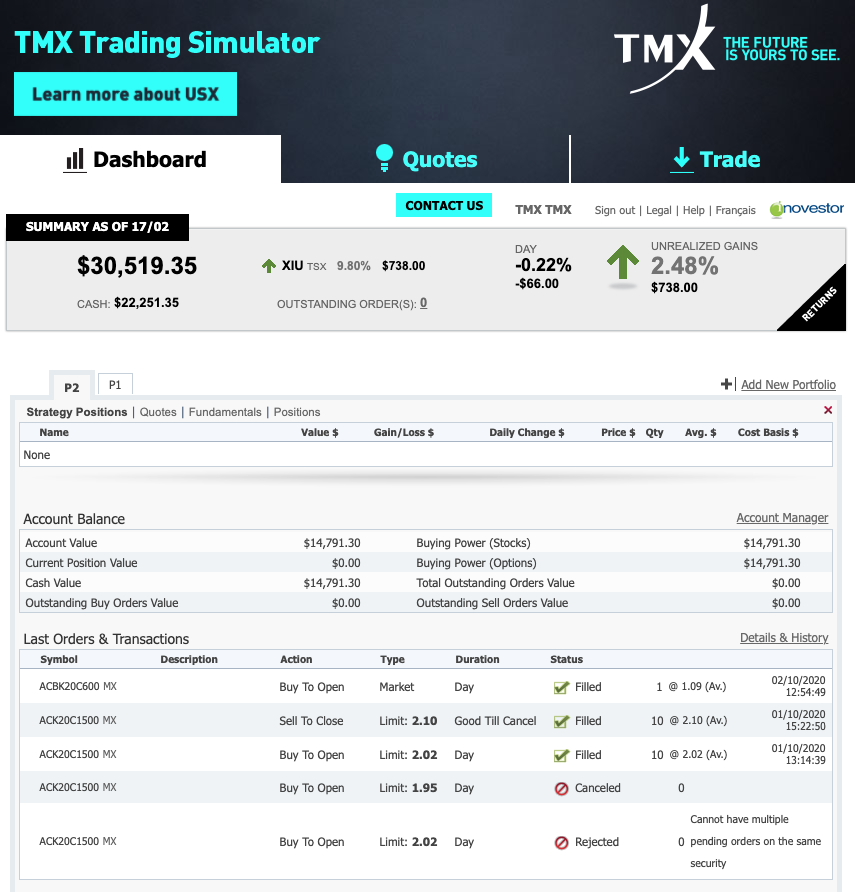

Finally, check out the current orders section. This section shows you the most recent trades within your account. There you can group them together, and then double-check that they are correct.

All in all, the FX Blue Trade Copier is a good choice for most retail traders. Local Trade Copier is an option if you require more advanced features. It's also an alternative to the fxblue trading copier.

As for the FX Blue Personal Trade Copier, it can help you to adjust your lots based on the relative equity of the accounts you're copying from. It is also reliable and provides a variety of risk management tools.

FAQ

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need are the right tools and knowledge to get started.

First, you need to know that there are many ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

There are also potential gains if one is willing to risk their investment and do some research.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Which trading website is best for beginners

Your level of experience with online trading will determine your ability to trade. You can start by going through an experienced broker with advisors if this is your first time.

They take the guesswork out when it comes to choosing companies and make solid recommendations that will help you build a steady portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Where can you invest and make daily income?

While investing can be a great way of making money, it is important to understand your options. There are many options.

One option is to invest in real property. You can earn steady returns while also enjoying long-term appreciation and tax advantages by investing in real estate. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you are comfortable with the risk, you can trade online using day trading strategies.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

Which is more safe, crypto or forex

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which is harder forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Never forget that scammers will try any means to steal your personal data. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

You should also use safe online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.