The relationship between cryptocurrencies & stock markets is being given a lot of attention. The research findings are multifaceted and are considered to have significant implications for investors. While there is disagreement about the nature of the relationship between these asset types, researchers have developed a range of methods for assessing it. Portfolio managers will need to be able to calculate the relative risk spread between cryptocurrencies, and stock markets so they can build optimally balanced portfolios.

As the global monetary systems evolve, cryptocurrencies have become an increasingly important investment tool. Many scholars have investigated the relationship between cryptocurrency and the stock exchange, using Bitcoin as the base of their research. In fact, the market for this asset is worth $200 billion, and a recent Bloomberg analyst predicted that it could reach $20,000 by 2020.

To investigate the relationship between cryptocurrencies and stock markets, researchers use three different methodologies. There are two types of approaches: an empirical and a sample-based. These two methods are used to investigate the relationship between cryptocurrencies, stock markets, and different countries. This research can help you determine the risk share between these assets and to guide your risk-on investing strategy.

First, the empirical approach is a case-based approach, with a sample of a selected number of cases of the stock and crypto markets. They used a variety of cryptocurrencies, as well their disaggregated stocks indexes, to study the correlation between returns on each investment and the stock exchange. The results showed that cryptocurrencies and stocks market depend on each other in a dynamic way. The country, the market environment, as well as the time period of the study, all have a different impact on these dependencies. They concluded that the Clayton copula is the best representation of the relationship between cryptocurrencies, and the stock exchange. This is not a good fit when the market falls or is flat.

Second, the sample based approach is more conservative in estimating risk spillover between cryptocurrency and stock markets. The researchers can combine a small sample of data with multiple methods to provide a more precise estimate of the impact of cryptocurrency on stock markets. Although there was a positive relationship between S&P 500 and a selection of cryptocurrencies, the results show that the link between cryptocurrencies to the stock markets is less strong than it should be.

Third, when both stock markets and cryptocurrencies experience dramatic downward movements, the Clayton copula (time-varying Clayton copula) is the best. This relationship is not evident when markets are bullish. Despite this, the authors suggest that a stronger downside risk spillover is a good indicator that the cryptocurrencies are not suitable for hedging the stock market.

Finally, the time-varying approach reveals a positive correlation of cryptocurrencies with the FTSE MIB/SSE indices. These indexes measure rapidly industrializing nation, which may indicate that these indices could be of potential benefit to stock investors.

FAQ

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. To help manage their investments, traders may use automated trading systems or bots. It is important to understand the risks and rewards associated with each strategy before investing.

Which platform is the best for trading?

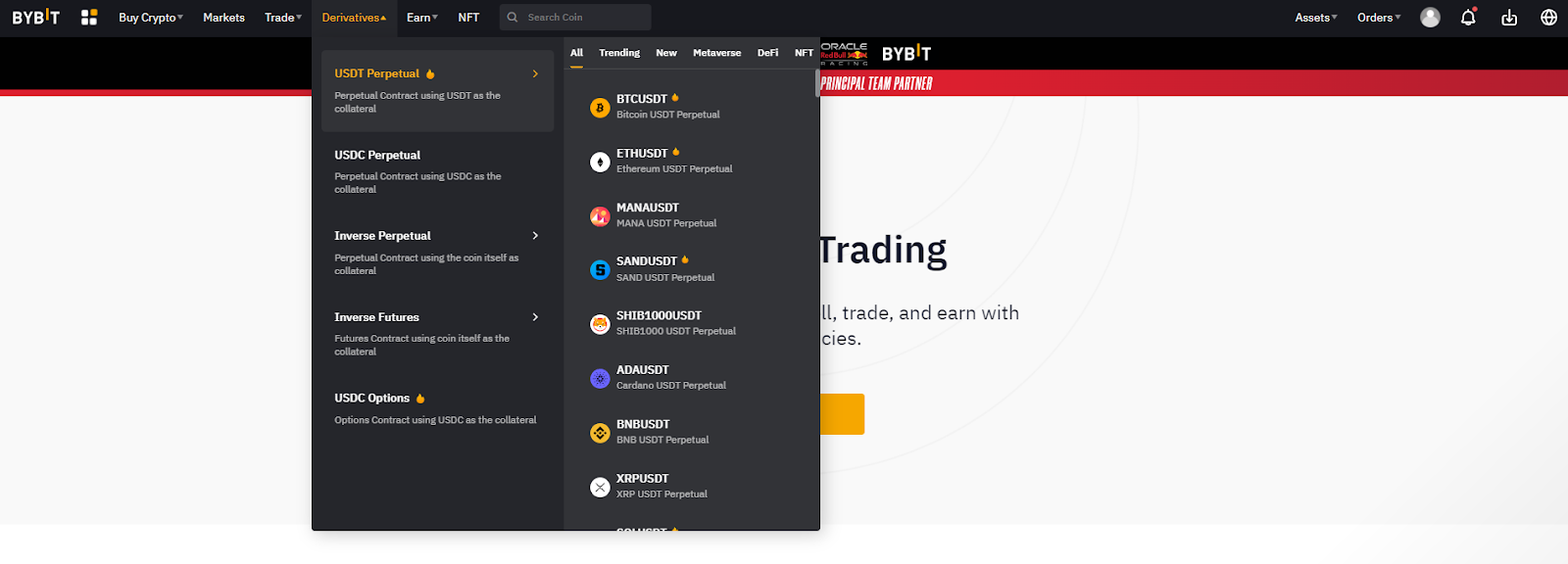

Many traders can find choosing the best trading platform difficult. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

A trading platform that is the best should have all the features you require, such as advanced chart analysis tools, market data and order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. For those who want to try virtual money before you invest your real money, look out for free demo accounts.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Is Cryptocurrency a Good Investment?

It's complicated. It is complicated. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

There are also potential gains if one is willing to risk their investment and do some research.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Forex and Cryptocurrencies are great investments.

Trading forex and crypto can be lucrative if you are strategic. To really make money in either of these markets, you need to stay ahead of the trends and know when the best time to buy and sell is.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. Trading with money you can afford is a good way to reduce your risk.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

The cryptocurrency market is largely unregulated and presents substantial risks. Before you sign up for any type of wallet or platform, make sure to research the coins and exchanges.

Furthermore, forex trading involves predicting fluctuations of currency exchange rates through technical/fundamental analysis global economic data. This type trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is about taking calculated chances, being willing and able to learn continuously and finding the right strategy that works for your needs. With enough dedication and the right education, you could make a fortune trading forex or cryptos.

Which trading website is best for beginners

It all depends upon your comfort level in online trading. If you're completely new to the online trading process, it would be a great idea for you to go through an established broker with experienced advisors.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many offer interactive tools to help you understand how trades work.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Frequently Asked Fragen

What are the different types of investing you can do?

Investing can help you grow your wealth and make money long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. Common stock grants an individual the right to own a company. It also gives voting rights at shareholder meetings and the possibility of earning dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds involve pooling investor money together in order to spread investment risk and diversify investments over many different types of securities including stocks, bonds, and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

The cash equivalents can be products such as Treasury bills and money market deposits, CDs, and commercial paper. These products usually mature within one to three years, which means they are less susceptible to default or declines in value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection begins with you. You can prevent yourself from being duped by learning how to spot scams, and how fraudsters work.

Be wary of offers that seem too good to be true, of high-pressure sales tactics and promises of guaranteed returns. Never respond to unsolicited phone calls or emails. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before making any commitments, investigate all investment options thoroughly and independently.

Never invest money immediately, in cash, by wire transfer, or on the spot. Any offer to pay using these payment methods must be rejected. Remember that scammers will do anything to obtain your personal information. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Also, it is important to invest online using secure platforms. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.