The crypto market is an extremely volatile and fast-moving asset that can experience extreme volatility. There have been some heart-breaking drawdowns and wild volatility. It is important that you understand the risks involved in investing in crypto assets. Smart trading techniques are essential.

There are a few different types of crypto that you can invest in, including bond crypto and gold-backed crypto. Each type has its own risks and benefits, so it is important you take these risks into consideration when making any investment in crypto assets.

M1 Finance - Crypto

M1 is a personal finance platform that offers a wide variety of products to help clients manage their money. Its motto says "Yours to build" and focuses on helping people create wealth as they wish. It also provides a blog, extensive help and support to its users.

Makara Crypto

Makara, which is located in Seattle, is a robo advisor that allows you to diversify by combining multiple crypto assets into specific baskets. It uses a unique algorithm to match your portfolio to the crypto assets that fit your needs and objectives. This algorithm was initially developed by Strix Leviathan, a crypto hedge fund company. However, it has been spun off into its own company.

B21 (crypto)

Cryptos can add excitement to your investment portfolio. With B21, you can build and track your crypto portfolio via any device. Trade with advanced tools, such as limit orders, market orders, and market orders, on multiple markets and with your favourite coin pairs. Take advantage of favourable pricing as low 0.1% make fees and 0.25% keepers fees.

Acorns Blockchain

Acorns can help you invest your spare change in your day to make it more worthwhile. Their Round-Ups feature aggregates every purchase and invests any spare change. This will allow you to accumulate small amounts.

Acorns makes it easy to set up recurring payments from your bank account, which automatically increases your investment balances. This can be a useful tool for people who aren't sure how to start saving and investing, or if they need a little extra help in managing their money.

M1 Finance Crypto

M1 offers free consultations where they can explain how their platform works to help you reach your financial goals. You can also find a wide range of investment products from stocks and bonds to ETFs.

They will help determine how much you should allocate for each asset and how you can manage your risk. It's a simple process that is tailored to your individual needs and financial situation.

B21

B21 was designed with the idea of bringing the next 100,000,000 people onto cryptos. We are able to support both crypto withdrawals and deposits around the world. Our goal, to offer a safe, secure and convenient space for cryptos growth. Our team includes fintech experts who have decades of combined experience in the development of regulated payments products.

FAQ

Which is safe crypto or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. It is important to consider your own risk appetite, experience and knowledge with each investment option before deciding which Crypto or Forex is safer.

Forex traders can make money

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading is not an easy task, but it can be done with the right knowledge. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Which forex trading platform or crypto trading platform is the best?

Both forex and cryptocurrency trading have their potential profits. But it all depends upon your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both cases, it's important to do your research before making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

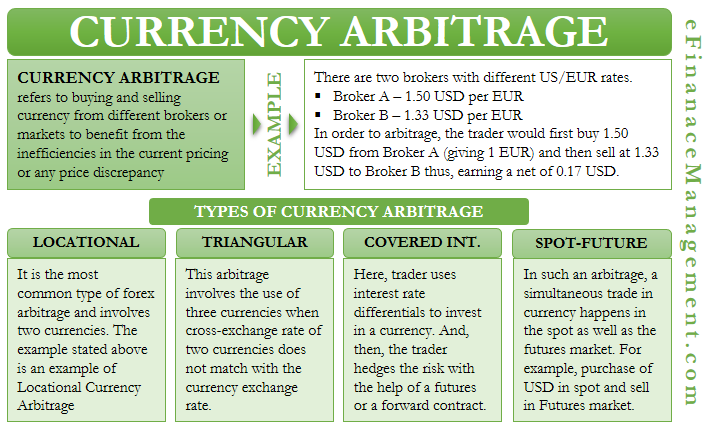

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. Automated trading platforms or bots are also available to assist traders in managing their investments. Before you invest, make sure to understand the risks associated with each strategy.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, gather any additional information to help you feel confident about your investment decision. It is crucial to know the basics about cryptocurrencies and how they work before investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

Where can I find ways to earn daily, and invest?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

One option is to buy real estate. Investing property can bring steady returns as well as long-term appreciation. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking to make short-term gains or generate daily income, consider investing in dividend paying stocks. Or you can look into peer lending platforms, where you loan money and get interest payments direct from the borrowers. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Frequently Asked Fragen

What are the different types of investing you can do?

Investing allows you to increase your financial resources and potentially earn money in the long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

Stocks can be broken down into common stock or preferred stock. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

Cash equivalents include products such as Treasury bills, money market deposits, certificates of deposit (CDs), and commercial paper which often mature within one year or less during which time they carry minimal risks of default or downturns in their value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Statistics

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How do I protect my online investment account from unauthorized access?

Online investment accounts require security. It's essential to protect your data and assets from any unwanted intrusion.

You must first ensure that the platform you're using has security. Two-factor authentication and encryption technology are some of the best security options to protect against malicious hackers. It is also important to have a policy that details how any personal data you share with them will regulated and monitored.

It is also important to choose strong passwords that allow you to access your account. You should limit the number and time spent logging in to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Finally, review your account activities periodically so that you are aware of any changes or irregularities in order to detect potential threats quickly and take immediate action if necessary.

Third, you need to know the terms of your online investment platform. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, do your research on the company you're considering investing with. Make sure they have a solid track record in customer service. Review and rate the platform and see what other users think. Finally, be sure to know about any tax implications that investing online can have.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.