Although penny stocks can be a great way to quickly make money, they can also prove dangerous if your aren't familiar with the basics. This is why it's important to use a broker that has the tools you need to trade them safely and profitably.

E*Trade

E*Trade provides a number of free stock-trading apps for beginners. There are no minimum account requirements and no commissions. E*Trade is also one of the most popular penny stock trading platforms, offering streaming quotes and real-time data. It also has a stock screening tool.

Fidelity

Fidelity will help you find the best penny stock trader for you, no matter if you're trying to trade them as a hobby or for extra income. Fidelity's financial advisors will help you define your trading goals and create a trading plan.

Fidelity charges no fees to buy or sell penny stocks. This makes it a popular choice for savvy investors. A variety of research and trading tools are available to help you get to know the market.

Charles Schwab

It is important to find a broker who offers direct market access when trading penny stocks. The quicker a broker can execute trades, the better. This means that trades are sent immediately to live markets, which is particularly helpful in volatile markets such the penny stock exchange.

Interactive Brokers

Designed for active traders, IB's mobile app is easy to navigate and offers a range of research tools and order types. This platform also allows you to purchase OTC stocks, which is an excellent option for people who wish to enter the penny stock market.

Choose a Broker With the Best Features

Brokers who specialize in penny stocks can offer a variety of services that will help you maximize your profit. They should have a high volume of penny stocks, fast and accurate executions, low trading costs, and a robust research suite to help you determine which penny stocks will be most profitable for you.

Before you signup with a pennystock broker, consider how much risk and reward you are willing take on. Some brokers require that you deposit a minimum amount. Others will allow traders to start trading with a very small amount.

A few brokers will let you open a penny-stock account with no investment. This allows you to get started and see how you like the platform. These accounts can be used to begin investing in penny shares and test out the platform before you invest.

Fidelity Active Trader Pro offers a more sophisticated platform. The platform includes several research tools like the Idea Hub tool which analyzes your trades before sending them.

Charles Schwab's StreetSmart edge platform is also worth a look. It has customizable dashboards that allow you to track stocks and exchanges. It offers customizable charts to help you assess history and risk, as well as the ability to create custom orders that can be viewed immediately.

FAQ

Where can you invest and make daily income?

It can be a great method to make money but it's important you understand all your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. You may also consider diversifying your portfolio with bonds, ETFs, mutual funds, or specialty fields like cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

Which is better forex trading or crypto trading.

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. You will need to invest a lower amount upfront. Additionally, forex markets are worldwide and available 24/7.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

In both instances, it is crucial to do your research prior to making any investments. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is also important to understand the different types of trading strategies available for each type of trading. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Is Cryptocurrency an Investment Worth It?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

You can also make a profit if your risk is taken and you do your research.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

What are the advantages and disadvantages of online investing?

Online investing is convenient. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Online trading is a great way to get real-time market data. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing has its limitations. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Finally, online trading can be more complex than conventional investing, so it's essential to understand the markets and develop a sound strategy before getting started.

When considering investing online, it is also important that you understand the types of investments available. Investors have many choices: stocks, bonds or mutual funds. Each investment comes with its own risks. You should research all options before you decide on the right one. You should also consider the fact that some investments might require a minimum deposit, or may have restrictions.

Which trading website is best for beginners

It all depends on your level of comfort with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Plus, most offer interactive tools to demonstrate how trades work without risking real money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

No matter what route you choose to take, it is important that you read reviews from customers before making any commitments. They will provide insight into how each site treats customers and give you an idea of the overall experience.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex is a well-established currency with a stable trading infrastructure.

In terms of cryptocurrency trading, there are more risks when compared to forex, due to the fact that crypto markets tend to move in unpredictable ways within short periods of time. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need to understand the dynamics between foreign exchange pairs, such as how prices move based on news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

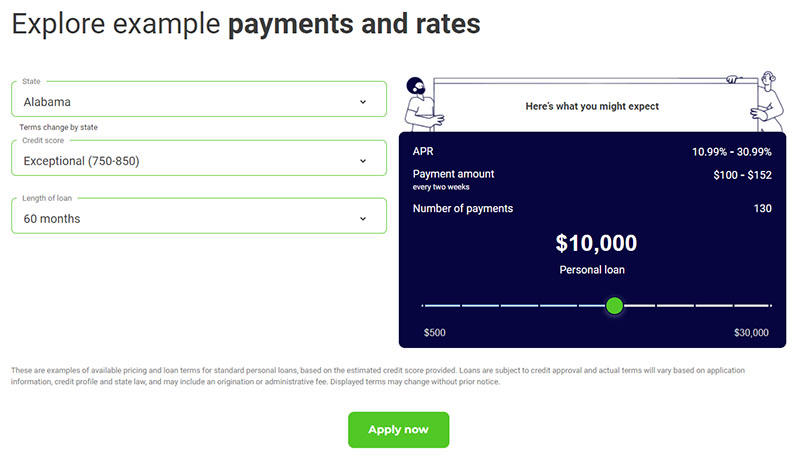

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

Online investing requires research. Make sure you research the company behind the opportunity. Also, ensure they are registered with the relevant financial authorities. Additionally, look out for any industry regulations or restrictions that could apply to your investments.

Review past performance data, if possible. Look for current customer reviews online to get a sense of how customers have experienced the investment opportunity. Do you believe it is too good to true? Be wary of claims that promise future success or substantial returns.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before you sign up for an account, verify the fees and commissions that may be applicable to your tax. Do your due diligence and make sure you get what you pay for. You should also have a clear exit plan in place in case things don't go as planned. This can help to reduce your losses in the long-term.