There are many reasons you should invest your cryptocurrency funds. They are very affordable to buy. Moreover, they can also be extremely profitable over the long term. It is important to evaluate your investment goals and objectives to determine the right crypto.

The Best Cryptocurrency for Investing in 2021

These cryptocurrencies are the most affordable and have the ability to grow in value over time. There are many factors that influence the value of cryptocurrencies, including their technology, team or community, hype, and how they are perceived by others.

1. Dogecoin

Despite its satirical origins, DOGE has become one of the top penny tokens and cryptocurrencies to invest in. This is because the coin has a huge following, support from influential personalities, and the potential for expanding use cases as announced recently.

2. Monero

Due to its user base and market cap, Monero is a good choice for investors who want a cheap crypto that can provide them with privacy features. It is also a great choice for people who want to diversify portfolios.

3. Uniswap

UNI is Uniswap's native token. UNI was launched originally as part of the DeFi sector. It is fast and allows for cheap transactions. It supports smart contracts and is therefore ideal for developers building dApps.

4. Solana

Solana, a blockchain platform that hosts distributed applications (or DApps), is called Solana. Its underlying crypto is highly scalable and strong and its development team is solid.

5. MEMAG

MEMAG, which has its tokens on pre-sale, is currently the most promising play-to earn crypto. This makes it a great crypto investment, and its presale will likely sell out quickly.

6. C+Charge

C+Charge, a penny cryptocurrency to invest in is the right coin. Its upcoming CEX listing is expected to make it one of the fastest-growing cryptocurrencies in the space.

7. THETA

Another successful project, this is an excellent addition to the list for cheap cryptocurrencies to purchase in 2021. The underlying blockchain of the project is designed for video streaming and delivery.

8. Ether (ETH)

Ethereum is the 2nd-largest cryptocurrency in terms of market cap. It has experienced a lot more success over the years. This is due to the fact that it was first to offer smart contracts which allow developers to create dApps via its network.

9. Basic Attention Token (BAT)

BAT is a crypto that has the potential to increase in price over time. Its technology is a combination blockchain and DLT. It's the perfect choice for those looking to invest into a future-proof cryptocurrency platform. Its ICO is soon to begin so you should act now.

FAQ

Is Cryptocurrency a Good Investing Option?

It's complicated. It's complex. While cryptocurrency has grown in popularity over recent years, the success of an investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

On the other hand, if you're willing to take that risk and do your research, there are potential gains to be made based on events like Initial Coin Offerings (ICOs) and shifts in the marketplace.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Frequently Asked questions

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. To get started, you only need to have the right knowledge and tools.

It is important to realize that there are several ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. To stay on top of crypto trends, keep an eye out for market developments and news.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

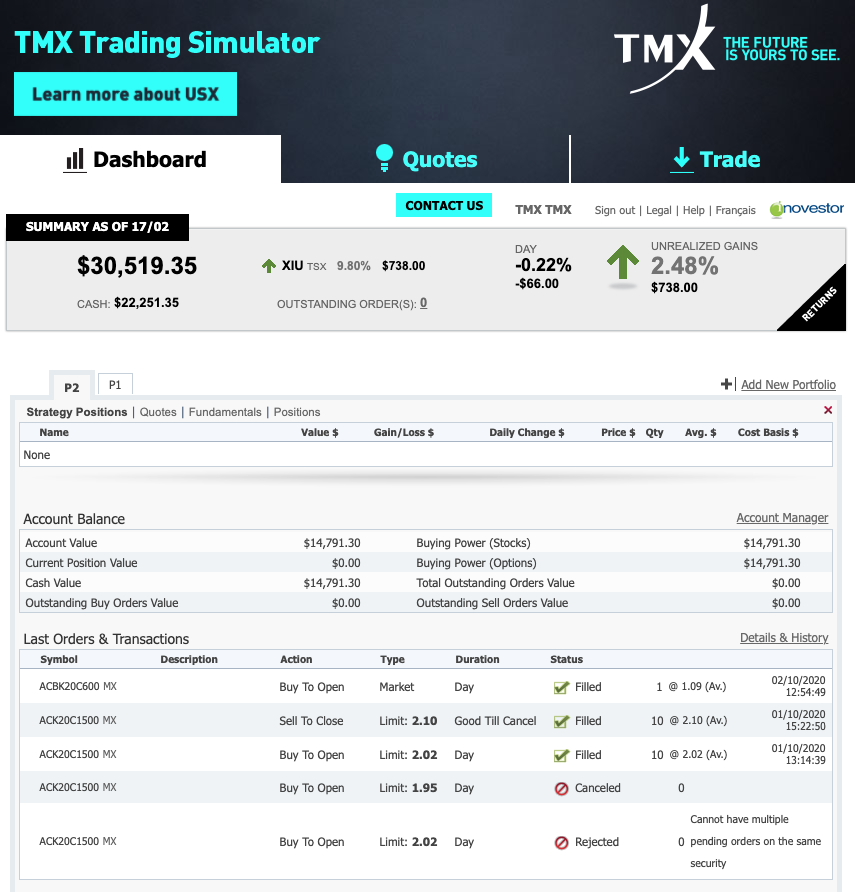

Which trading platform is the best for beginners?

It all depends upon your comfort level in online trading. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers can take the guesswork and help you build your portfolio by making solid recommendations. Many brokers provide interactive tools to show you how trades function without risking any money.

You can also trade independently if your knowledge is good enough. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

No matter which route or method you choose, you should always read customer reviews before making a decision. This will allow you to get an overview of the service and experience at each site.

What are the advantages and disadvantages of online investing?

Online investing offers convenience as its main benefit. You can manage your investments online, from anywhere you have an internet connection. You can access real-time market data and make trades without having to leave your home or office. Additionally, many online brokerages offer lower fees than traditional brokerages, making it easier for investors to get started with smaller amounts of money.

However, there are some drawbacks to online investing. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What precautions do I need to take to avoid being a victim of online investment frauds?

Protection starts with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Do not answer unsolicited emails and phone calls. Fraudsters often use fake names, so never trust someone just based on their name alone. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Keep in mind that fraudsters will try everything to get your personal details. Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

Secure online investment platforms are also essential. Sites that are licensed by the Financial Conduct Authority and have a strong reputation should be considered. Secure Socket Layer or SSL encryption is an option that protects your data as it travels via the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.