Investors are worried about inflationary pressures and the stock market's current state. Sentiment is being affected by inflation concerns and a deep inversion of the yield curve. Traders anticipate a Federal Reserve interest rates increase in February.

Although the S&P 500 has been under pressure, the broader market appears to be on the brink of another bearish market. Investors are watching a number of tech company earnings reports and the Federal Reserve’s rate decision.

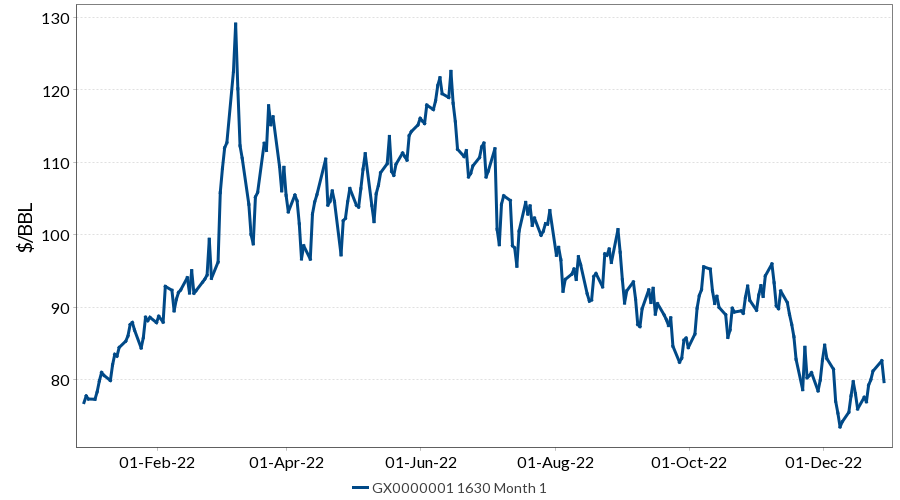

Stock market has returned to the red, following a recovery last week. The Dow Jones Industrial Average fell more than 250 point today as a wide variety of stocks fell. As a result, the blue chip index fell for the first time in six trading days. Consumer staples were amongst those performing poorly, while the materials sector was strong and the energy sector rebounded.

The 10-year Treasury yield was at a 4-year high, putting pressure on the market. The yield is still below the 3.5% level that marked the peak in the bull market. Investors are still waiting to see whether the Fed will raise the federal funds rate by a quarter of a point.

Despite the selloff, the Fed continued to signal multiple interest rate hikes in 2022. It is likely that the Fed will eventually shift the interest rate to a quarter point, but that could take some time. Investors continue to place great importance on the Fed’s soft landing narrative.

Today's report confirmed that the United States enjoyed much stronger economic growth than originally expected. The economy grew at an annual rate of 4.2 percent in the fourth quarter of 2018. The market still needs to see data on manufacturing and job openings. Friday's jobs report for December will be available. This report should provide investors with a better understanding of the state of the economy.

The Fed's decision to end its stimulus program last year started to bite. The economic slowdown has put companies at risk of losing their margins. It is easy to see why stocks have been in a slump the past few months.

Among the biggest losses of the day were Tesla (TSLA) and Devon Energy (DEC), which reported lower-than-expected quarterly deliveries. Boeing (BA), however, reported sixth consecutive quarter of losses. Another major player, Microsoft (MSFT), issued a dire sales warning, as the company is seeing softer cloud revenue. Spotify (SPOT) also announced layoffs.

During the final hour, the market reversed its slide, as it mostly recovered. However, the tech-heavy Nasdaq was put under immense pressure. Several tech stocks, including Adobe and Apple (AAPL), were affected by the decline.

Other big losses included Walt Disney (DIS), which reported a disappointing opening weekend for 'Avatar: The Way of Water.' 3M (MMMM) and Nike (+NKE) saw positive changes. On Monday, the communications sector was the strongest performer, with Netflix reporting strong subscriber growth and Facebook reporting strong performance.

FAQ

Is Cryptocurrency a Good Investing Option?

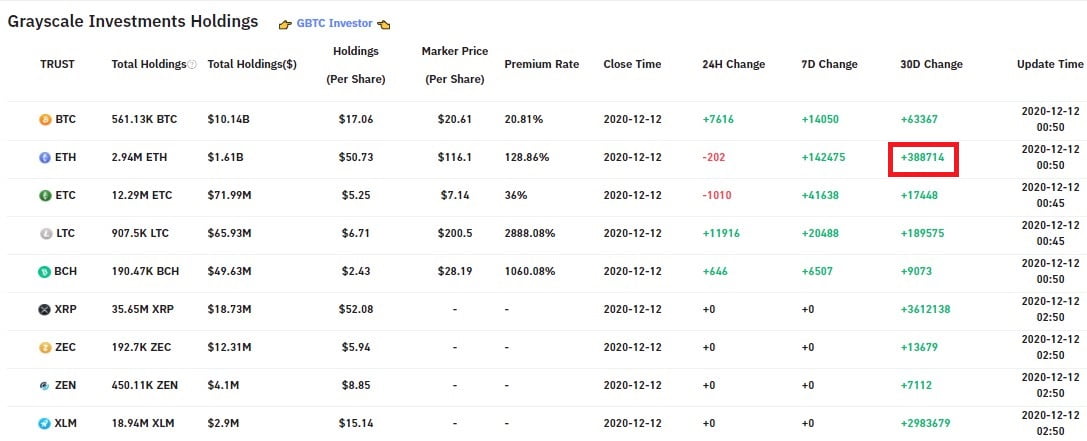

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. On one hand, the cryptocurrency market is highly volatile and unpredictable so there's always a risk involved when investing in them.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

How do I invest in Bitcoin

Although it may seem difficult to invest in Bitcoin, it is not as complicated as you might think. You only need the right information and tools to get started.

First, you need to know that there are many ways to invest. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Which is safe crypto or forex?

Cryptocurrency and Forex trading are two types of highly risky investments that vary greatly in terms of rewards and risks.

Crypto, short for cryptocurrency or digital currency, is a digital coin that was created by a piece code using blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which trading website is best for beginners

It all depends on how comfortable you are with online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers take the guesswork out of choosing companies and give solid recommendations that can help you build a portfolio steadily over time. Many brokers provide interactive tools to show you how trades function without risking any money.

On the other hand, if you want more control over your investments and have a bit of knowledge already, there are plenty of sites that allow you to trade independently. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Where can i invest and earn daily?

Although investing can be a great investment, it's important that you know your options. There are other ways to make money than investing in the stock market.

One option is to buy real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. It is possible to diversify your portfolio with ETFs mutual funds, bonds, and specialty fields like cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

How can you protect your financial and personal information while investing online?

Security is essential when investing online. To protect your personal and financial information, you need to be aware of the risks associated with online investments and take steps to minimize them.

Begin by paying attention to who you are dealing on investment platforms and apps. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds or provide personal data, make sure to research the background of all companies and individuals with whom you are working.

Make sure to use strong passwords, two-factor authentication for all accounts, and make sure you are regularly checking for viruses. Auto-login settings should be disabled on all your devices to make sure that your accounts are protected from unauthorized access. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. A variety of passwords is a smart idea for each account. This will prevent any breaches in the other accounts. Last but not least, make sure to use VPNs when investing online. They're often free and easy!