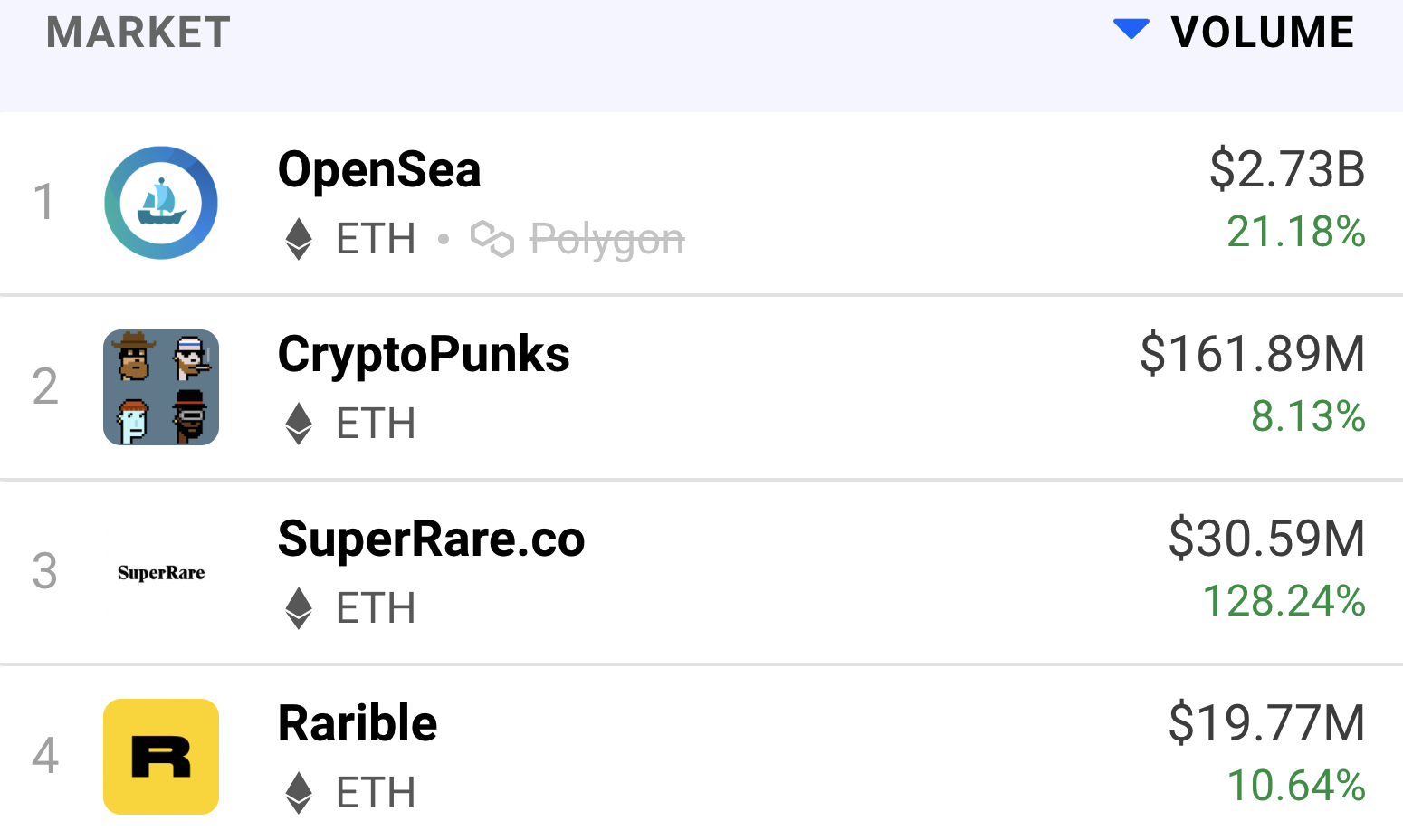

A nftmarketapp is a digital marketplace where non-fungible coins (NFTs) can be traded. These virtual items can be traded and created using blockchain technology. These digital goods can include music, art, games, and even virtual real property. The market for these assets is growing rapidly, and it has the potential to reach an estimated $3 billion in 2021.

NFTs are a relatively new concept that has caught the attention of investors. These are a great way to invest crypto-economy because they offer several benefits. These benefits include:

Authenticity- NFT platforms keep immutable records on blockchains. This makes it possible for only vetted sellers to sell their products. This ensures that buyers can rest assured that they are getting genuine assets and not clones or counterfeit copies.

Variety - NFT platforms offer a wide range of unique products thanks to the influx in new creators. With ease, users can purchase anything from artworks and virtual real estate.

Signing Up - NFT marketplaces can vary slightly from site to site, but most require you to register an account or connect a supported wallet. You can do this either directly on the platform or through a mobile application.

Wallet support - NFT marketplaces may offer support for several blockchain wallets, such as MetaMask. These wallets will let you store your NFTs securely once they have been bought.

Best NFT Trading Platform Binance

The Binance NFT marketplace allows users to buy, trade, and sell NFTs. The platform uses smart-contracts and supports multiple currencies such as ETH.

It also includes a unique feature called 'Mystery Box' that allows users to purchase NFTs which are completely randomised, and at a lower price.

The Binance NFT market is also connected to the main Binance exchange. This allows you to withdraw and deposit fiat currency easily. You can deposit funds using credit cards, debit cards, and PayPal, and the exchange offers a number of features to make trading easy.

Top NFT Creators - Makersplace

You can promote your digital art on many NFT sites. These sites offer a great way for you to reach a large audience and increase visibility on the internet.

These platforms can help increase exposure to potential buyers worldwide and collectibles lovers around the globe. These platforms provide tools that allow you to create, edit and publish your NFTs.

These platforms can also help you create a lucrative portfolio of NFTs that will increase in value over time. These platforms offer an easy-to use interface that makes selling, editing, creating and creating NFTs simple.

In addition to a range of NFTs available, these marketplaces also have a selection of digital collectibles and gaming products. These items can include weapons, costumes, or 'Axies’ - pets that are available in Axie Infinity.

FAQ

Which trading website is best for beginners

It all depends upon your comfort level in online trading. You can start by going through an experienced broker with advisors if this is your first time.

These brokers remove the guesswork from choosing companies and offer solid recommendations to help you build your portfolio. Many brokers provide interactive tools to show you how trades function without risking any money.

If you are more confident and have some knowledge, you can trade your investments independently on many websites. You can create your own trading platform, access live data feeds and use research tools like real-time analysis to make informed decisions.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Do forex traders make money?

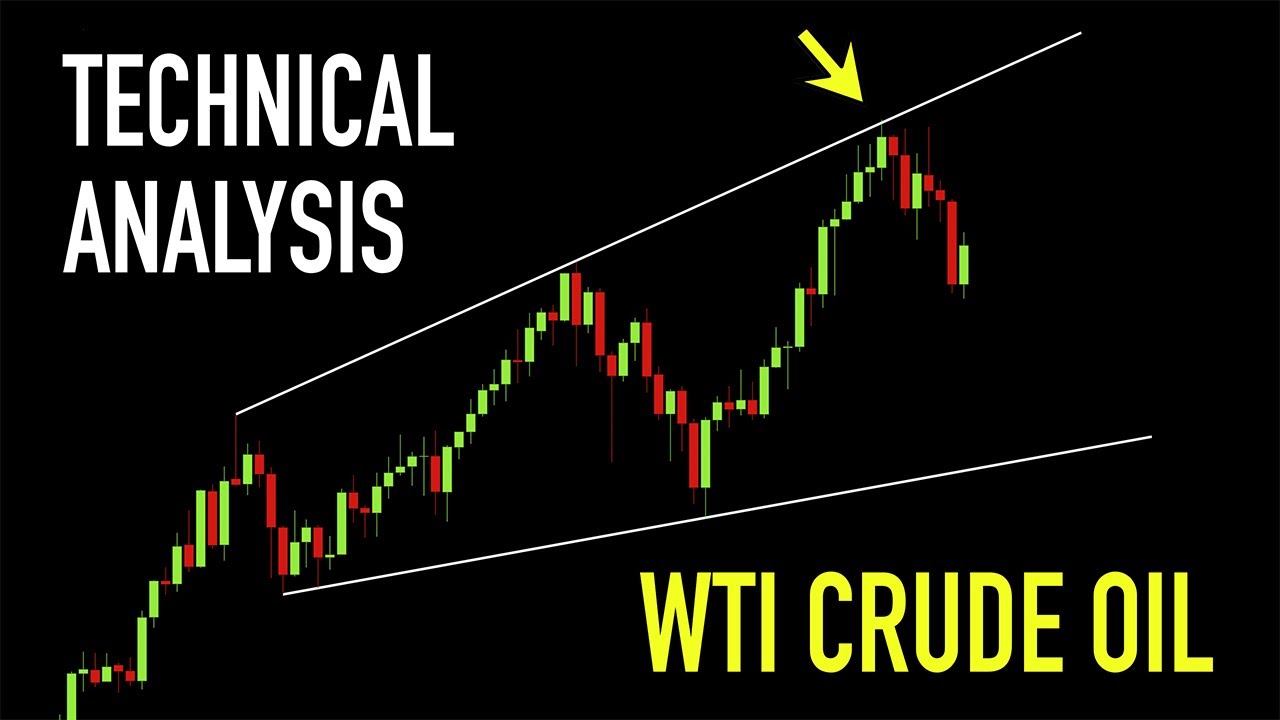

Yes, forex traders can make money. Although it is possible to make money in the short term, you will need to be patient and willing to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is essential to find a qualified mentor and learn about risk management before taking on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

By keeping good records, studying past trades and payments, and understanding platforms used for currency trades along with other aspects of trading, forex traders can improve their likelihood of generating profits over the long term.

Forex trading is all about discipline. Developing rules, such as what you are willing to lose on each trade, helps reduce losses and ensure success. Strategies like leveraging entry signals can help increase profits beyond those that could be achieved without the guidance of an experienced mentor.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. Crypto is more complex because it is newer and related to blockchain technology. Forex has been around since the beginning and has a solid trading infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

For both crypto and forex, it is important to be alert, do your research well, and have a strategy for making consistent trades.

Where can you invest and make daily income?

However, investing can be an excellent way to make money. It's important to know all of your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

First, you need to know that there are many ways to invest. To get exposure to Bitcoin, you can buy it directly, use an exchange or use a financial instrument, known as a derivatives agreement.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

The next step is to research additional information you might need in order to be confident about your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Cryptocurrency investments can also offer portfolio diversification benefits since these assets tend to move independently of traditional stock markets.

It comes down to each person's individual tolerance for risk and knowledge in relation to the crypto markets. If you can make an educated decision on this asset class and are comfortable taking risks, then investing in cryptocurrency is worth your consideration.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protect yourself. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Don't respond to unsolicited calls or emails. Fraudsters frequently use fake names. Don't trust anyone just because they are a person. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Don't forget to remember that "Scammers will attempt anything to get personal information." Be aware of the different online phishing schemes, suspicious links in emails and online ads that could lead to identity theft.

It's also important to use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.