merrill edge crypto is an online brokerage that is part of the Bank of America financial services platform. It provides a range of investment tools and perks for its customers, including ETF and stock trades that are commission-free. It integrates seamlessly with Bank of America accounts, making transfer of funds easy.

Merrill Edge doesn't support cryptocurrency trading directly, but you can buy cryptocurrencies with a broker like Grayscale Bitcoin Trust (GBTC), Arkk Invest or Microstrategy. These platforms provide low trading fees, and are regulated under FinCEN in order to offer digital currency trading.

A crypto portfolio monitor helps you keep track and organize your investments in a straightforward and efficient manner. It can help you track price movements and identify profit or loss.

It is worth noting cryptos are volatile assets that are hard to predict. There are some ways that you can reduce the risk but it is important to do your research prior to investing in cryptocurrency.

A platform that does not charge trading fees or high deposits is considered the best for crypto trading. It also offers wide spreads on a variety of crypto assets and boasts industry-leading spreads. This is why eToro is a popular choice for many crypto investors.

It also gives you the ability to follow other traders' trades. This feature can help you learn from successful traders, and it can also be a great method to quickly build your cryptocurrency portfolio.

You can also choose to invest in stocks with strong blockchain presences such as IBM. IBM Blockchain, the company's dedicated division, invests in hundreds and thousands of blockchain ventures.

Merrill Edge accounts don't allow you to invest in cryptocurrencies. However, you can trade stocks whose main focus is blockchain technology. This strategy can help to protect your crypto exposure while also ensuring a good return on investment.

Merrill Edge allows you to invest in other types of assets if stock trading isn't your thing. It offers a full-service brokerage platform that's geared toward beginner and intermediate DIY investors.

Merrill Edge has many research tools, in addition to the standard stock- and ETF trading capabilities. These include trading ideas, fundamental data and screeners.

There are also a variety of educational resources, including videos and webinars, to help you learn more about the markets. You can also contact advisors through the wealth management center.

The website is user-friendly, and you can login securely. You can set up alerts to receive information about certain prices and view historical data.

It is easy to sign up for a free trial account and start trading. Open an account using a bank or credit card.

Merrill Edge offers a range of trading options for stocks, ETFs, options, and mutual funds. These trades are free and offer low commissions, making it an attractive option for those who are just starting out in the market.

FAQ

Which is better, safe crypto or Forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. Because of its volatility, it can be traded on an exchange like any other money.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Crypto and Forex have their advantages and disadvantages but, overall, crypto tends to carry a greater level of risk compared to Forex. The limited supply of cryptocurrencies and the regulations that surround them around the globe make their prices unpredictable. However, forex markets are more steady so investors can have more control over what they invest. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

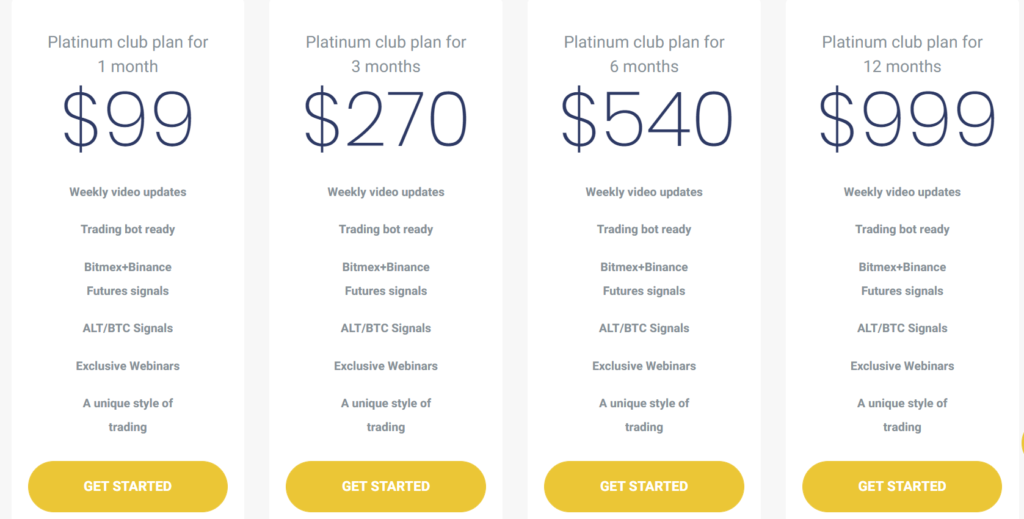

What is the best trading platform for you?

Many traders can find choosing the best trading platform difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. The interface should be intuitive and user-friendly.

It should also provide a variety of account types and competitive fees as well as reliable customer service and educational resources. You should look for demo accounts and free trials that allow you to practice with virtual money without risking your real cash.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Where can I earn daily and invest my money?

Investing can be a great way to make some money, but it's important to know what your options are. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is to invest in real property. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio might be a good idea.

You could also look into investing in dividend-paying stocks or peer-to-peer lending sites that allow you to lend money and receive interest payments from borrowers. Trading online with day trading strategies is also possible, if you are comfortable with taking on the risks.

Whatever your investment goals may be, it's important to do research about each type of investment before diving in head first as every asset carries its own set of risks associated with it. So that you can maximize your earnings, and achieve your financial goals, you must closely monitor all investments.

What are the pros and cons of investing online?

The main advantage of online investing is convenience. Online investing allows you to manage your investments anywhere with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complicated that traditional investing. Therefore, it is essential to fully understand the markets before developing a strategy.

You should also be aware of the different investment options available to you when investing online. There are many investment options available to investors. These include stocks, bonds and mutual funds as well as cash equivalents. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There may be restrictions on investments such as minimum deposits or other requirements.

Which is more difficult, forex or crypto?

Crypto and forex have their own unique levels of difficulty and complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This requires a deep understanding of technical indicators that can be used to indicate buy and sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Frequently Asked Question

What are the different types of investing you can do?

Investing can be a great way to build your finances and earn long-term income. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. While bonds have a greater stability and less risk than stocks stocks, their returns are often lower than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual funds. They use their experience to choose profitable investments based on pre-determined criteria, such as risk level or expected return rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection starts with you. Protect yourself by knowing how to spot fraudsters' tricks and learning how they work.

Do not fall for sales pitches that sound too good-to-be true or high-pressure tactics promising guaranteed returns. Do not respond to unsolicited emails or phone calls. Fraudsters use fake names often, so don't respond to unsolicited email or phone calls. Before you commit to any investment opportunity, make sure you thoroughly research the person who is offering it.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Keep in mind that fraudsters will try everything to get your personal details. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

It is also important that you use secure online investment platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.