AutoTrade refers to automated trading systems in Forex markets. These systems are also known to be algorithmic or expert advices. They are generally programmed to analyze market announcements and major news and then to follow predetermined rules when entering or exiting trades. Autotrading saves traders time and effort as well as helps them avoid losing money. To maximize your trading opportunities, it's crucial to choose the right autotrading program for you.

Forex trading is easier when an automated platform is used. Although there are obvious benefits to this type of technology, it can be difficult to decide if it is worth investing in.

There are many available programs. It is important to evaluate whether the programs offer good customer support and technical support. You may not be able to find the right program for you. Some programs can be more costly than others.

Myfxbook Autotrade is an application that allows traders the ability to choose from hundreds if automated trading systems. The systems have been designed by Forex traders with many years of experience. They use proven strategies to generate signals, and are based on trading styles of all types.

Myfxbook provides a demo account that allows you to try the AutoTrade platform. There are many risk management options.

For serious Forex traders, automated software can be an invaluable tool. If you're interested in purchasing an autotrading system, you'll need to decide how much capital you want to invest. This will depend on how much risk you're willing to accept and how much time you have to spend watching the markets.

There are many great platforms for autotrading, but they also have a lot of scammers. You should read the reviews carefully before buying.

An autotrading software system automatically syncs with your trading accounts. This is another important feature. You can choose a broker and a binary options broker to use. After registering, you'll receive confirmation emails to Gmail address and Yahoo email addresses. The login page also allows you to request forgotten passwords.

Make sure your system is always profitable if you are considering purchasing an autotrading platform. Apart from analysing data and testing it, it is also crucial to devise a trading strategy. A trading strategy is a set or criteria that will be used by the system. It includes a target and stop-loss level.

You should look for an organization that will allow you to test the platform for free when you search for an autotrading system. For an automated trading system to be activated, most brokers will require you to pay $250. It's also important that you find a system that provides technical support if your goal is to become a professional trader.

FAQ

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex (or foreign exchange currency trading) involves highly leveraged investments. Participants speculate on the value one currency relative to another. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Due to the small number of units and existing regulations around cryptocurrencies, cryptocurrency prices can be unpredictable. Forex markets are more stable so investors have greater control over their investments. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

Is Cryptocurrency an Investment Worth It?

It's complicated. It is complicated. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which trading platform is best?

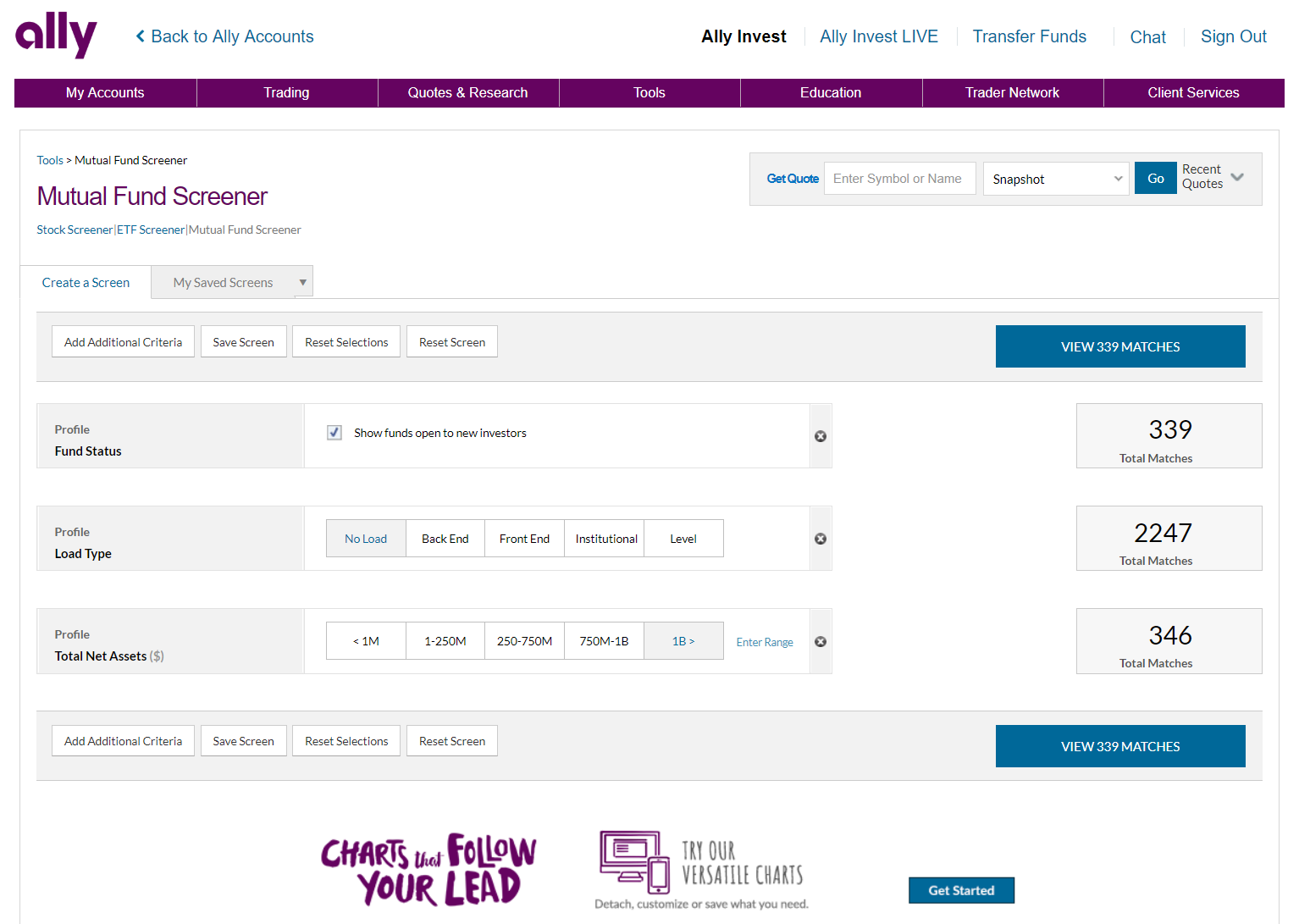

For many traders, choosing the best platform to trade on can be difficult. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platforms should provide the features you want, including advanced chart analysis tools, real time market data, and advanced order execution capabilities. It should also feature an intuitive, user-friendly interface.

You should have access to a range of account types, competitive fees, reliable customer service, and educational resources. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? Understanding these factors will help narrow down your search for the best trading platform for your needs.

Once you've identified the platform that's right for you, make sure to look into additional features such as stock screening tools, backtesting capabilities, alert systems, and more. Also, make sure that the platform you choose has appropriate security protocols in order to protect your data from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Do forex traders make money?

Yes, forex traders are able to make money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn't easy but with the right knowledge and strategies, it's possible to generate consistent profits over time. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can increase their chance of generating long-term profits by maintaining good records, learning past trades and paying attention to other aspects of trading.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

How can I invest Bitcoin?

While it can seem daunting to invest bitcoin, it is really not that difficult. All you need is the right knowledge and tools to get started.

First, you need to know that there are many ways to invest. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. Learning the basics of cryptocurrencies and how they work before diving in is important. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Final, make a plan to invest in Bitcoin. This will be based on your experience level and allow you to set reasonable expectations for return. You'll have a better chance of success over the long-term.

Which is more difficult, forex or crypto?

Both forex and crypto have their own levels of complexity and difficulty. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. To be successful in crypto trading, you should research the historical trends in the market where it trades to gain an advantage.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is also an important factor to be considered, since traders can risk their capital as well as additional borrowed funds when trading currency pairs of high volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Online investing requires research. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Be aware of any industry regulations and restrictions that may be applicable to your investments.

Review past performance data, if possible. To get an idea of the customer experience with the investment opportunity, look online for reviews. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Make sure you understand the risks involved in the investment. Also, be familiar with the terms. Before you open an account, check what fees and commissions might be taxed. Do your due diligence and make sure you get what you pay for. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.