There are many charting programs that traders can use. Some systems are intended for professionals, while others are meant for traders who are looking for more advanced insight into the market.

Many of these software programs allow you to customize many of the features and tools. This can make software more useful for traders.

Futures, Stocks and Forex

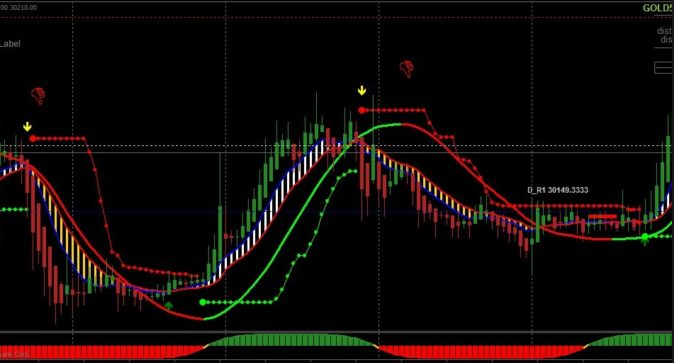

There are many technical indicators, charts, and patterns available in these programs. These can be helpful in identifying possible trading opportunities.

These programs are available for download for free. You can also access them through a web application or an app made for mobile devices. These programs can be especially useful for people who want to keep in touch with the market at all hours.

These programs also offer the ability to back test and automate trades. This allows traders to be more confident with their strategies and not rely on trial and error. It also increases their chances of making a profit.

Investing is complex and difficult. It is crucial to have a reliable charting platform. This will help to understand market movements and determine the likely outcome.

Trading View is an online charting service that offers a wide range of tools and features. This is a popular option for traders who use multiple devices.

Three accounts are available for Trading View: Basic, Premium, and Pro. The Basic account can be used for all of your trading needs. While the Premium account offers more advanced features and more data, it is more expensive.

The Basic account only allows one chart per layout. It can only hold up to three indicators. But it is a great place to get started with the tool. It can also provide server-side alerts, global data, and other features.

MultiCharts is a great program for traders who wish to expand their horizons. This platform has been around since over 20 years.

It offers a variety of features, which are ideal for both novice and expert traders. The company also offers live support and video tutorials to help traders with their questions.

Trend Trader Pro - A popular and highly effective trading program designed for people who want more profits in the Forex market. It has a variety of features and has been created by a highly experienced trader. It has been extensively tested by thousands and can help traders achieve consistent, profitable results in the forex markets.

The course Learn How to Trade the Market covers all aspects and topics of trading. It helps traders find the right setups, build trading strategies, and manage their open positions. It also provides an understanding of the psychology of trading and how to improve it.

FAQ

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Try out demo accounts or free trials to see if you like the idea of using virtual money.

You should consider your type of investor or trader when looking for a trading platform. For example, are you active or passive? How often do you plan to trade? What asset class mix would you like? This information will help you narrow down your search and find the best trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

Some of the most popular trading platforms include MetaTrader 4/5 (MT4/MT5), cTrader, eToro TradeStation ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader Interactive Brokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade FXCM ThinkOrSwim App Store just to name a few!

Which is harder crypto or forex?

Crypto and forex have their own unique levels of difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

What is the best forex trading system or crypto trading system?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. Managing your risk through proper diversification of assets will go a long way with any type of trading you choose.

It is important to know the types of trading strategies you can use for each type. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before investing, it is important that you understand the risks as well as the rewards.

Where can I earn daily and invest my money?

However, investing can be an excellent way to make money. It's important to know all of your options. There are other ways to make money than investing in the stock market.

You can also invest in real estate. Investing in property can provide steady returns with long-term appreciation and tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. To maximize your earnings and help you reach your financial goals, make sure to closely track any investments.

What are the pros and cons of investing online?

Online investing has the main advantage of being convenient. Online investing allows you to manage your investments anywhere with an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

Online investing is not without its challenges. Online trading can make it difficult to receive personalized guidance and advice, since you don't have access to a financial advisor or broker to assist you with your decisions. Online trading platforms may not offer the same level or security as traditional brokerages. Investors must be aware that there are risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

You should also be aware of the different investment options available to you when investing online. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each investment comes with its own risks. You should research all options before you decide on the right one. Some investments may also require a minimum investment or other restrictions.

Most Frequently Asked Questions

What are the 4 types?

Investing can help you grow your wealth and make money long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investment is for conservative investors who do not want to take on high risk but still seek higher returns than traditional low-interest bank account deposits.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are the best ways to avoid investing online scams?

Protection begins with you. By brushing up on how to spot scams and understanding how fraudsters' tricks work, you can protect yourself from getting duped.

Pay attention to offers that look too good for you, such as high-pressure sales tactics and guarantees of returns. Do not answer unsolicited emails and phone calls. Fake names are often used by fraudsters. Never trust anyone based solely on their name. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest money on the spot, in cash, or by wire transfer - if an offer insists upon these methods for payment, it should raise a huge red flag. Lastly, always remember "Scammers will try anything to get your personal information". You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

It's also important to use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer is encryption technology that helps protect data sent over the internet. Before you make any investment, read and understand the terms of any website or app that you use.