Check the security of your trading site before you trade NFTs. This is especially true when you want to buy collectibles. If you're buying from a reputable company, you can expect to receive a safe, secure, and high-quality NFT. Even the best NFT trading site can be scammed.

A private crypto wallet is one of the best ways to protect your NFTs. A good idea is to keep your tokens on a device like Ledger. That way, you can have the security of knowing that they are kept off of a public marketplace.

Another option is to purchase NFTs on a curated marketplace. These markets will pre-screen projects and artists involved. Many of these websites include a community of artists and traders. These websites allow you to not only purchase and sell NFTs; you can also collaborate on projects and support each other.

Some curated NFT marketplaces include SuperRare and Rarible. Both offer a wide variety of high-quality digital collectibles. You can browse through thousands upon thousands of NFTs in order to find the one that suits you best. They charge a small fee but are not as well-known and curated as the other stores.

NFT markets may require you to create a profile with KYC information prior to you can make a purchase. For some users, this can be a red flag. You might need to place a bid if you want to purchase an NFT from a celebrity. NFT websites allow buyers to make offers. However, sellers and buyers can also accept fixed-price sales.

NFT is gaining popularity. Some of the biggest companies in the centralized crypto trading industry are developing their own NFT trading platforms. Binance is one company that is well-known and has a huge market for NFTs. GameStop is also looking to enter the NFT market.

You can also search NFT traits by fashion or sports memorabilia. You might be able filter NFTs using gold fur, or a particular style. NFT marketplaces offer the ability to purchase NFTs through Apple Pay or credit cards.

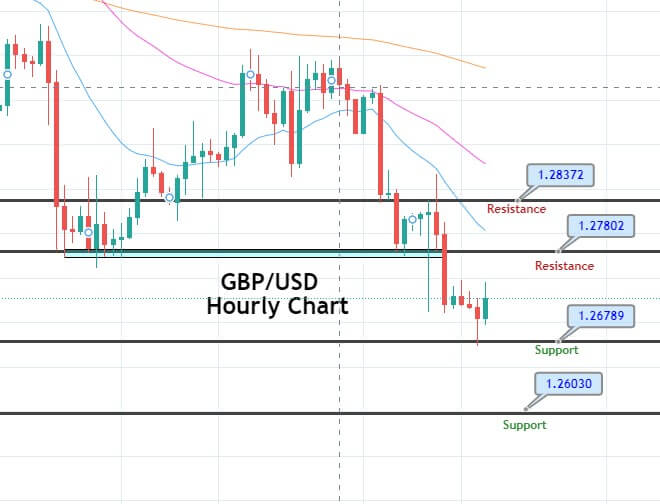

The trading volume is another important aspect to consider when designing your trading website. A large trading volume indicates that the site is active and has a lot of users. A low trading volume means that the site isn’t as active. In order to visualize the trading volume in graph form, it is a good idea. Also, a site's daily trading volume is a good indicator of its reputation.

Another consideration is how easy it's to use. Many NFT sites require customers register with KYC information and to connect their crypto wallets. These sites also require customer service contact information. If you experience any difficulties with your account contact customer care.

FAQ

How can I invest Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You just need the right knowledge, tools, and resources to get started.

The first thing to understand is that there are different ways of investing. To gain exposure, you can either buy Bitcoin directly or trade it on an exchange.

It is also important to choose where your bitcoin will be stored. There are many options, including wallets, exchanges and custodians. You may choose one option or another depending on your goals and risk appetite.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which is harder crypto or forex?

Each currency and crypto are different in their difficulty and complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex is a well-established currency with a stable trading infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. Researching the historical trends of the crypto markets can help you gain an edge on your competition if you are looking to trade in cryptocurrency.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. It also requires an acute understanding of technical indicators that can indicate buy or sell signals. Another factor to consider is leverage. When trading currency pairs that have high volatility, traders are putting their capital at risk.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Cryptocurrency: Is it a good investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. One thing is certain: the cryptocurrency market can be unpredictable and volatile so investing in it will always come with risk.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

It really boils down to each individual's tolerance for risk and knowledge about the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Frequently Asked Question

What are the 4 types of investing?

Investing is a way to grow your finances while potentially earning money over the long term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock gives an individual ownership right of a company, including voting rights at shareholders' meetings and the potential to earn dividends. A preferred stock, however, gives an individual ownership right but without voting privileges. It also offers fixed dividend payments which provide investors with a steady income stream.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. It can be confusing to choose the right one, with so many options.

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When searching for a trading platform, think about your trader/investor type. Consider whether you're active, passive, or both. Also, think about how often you plan on trading and the asset mix you would like. These factors will help you narrow down the search for the right platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. You should also ensure that your chosen platform offers appropriate security protocols to protect your information from theft and breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

How do forex traders make their money?

Forex traders can make a lot of money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders make trading plans that they stick with when trading. This helps them reduce their risk exposure, while still finding profitable opportunities. It is important to manage risk. Many new traders are too eager to make quick profits and not have a long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Forex trading requires discipline. You need to establish rules that limit your losses. Leverage entry signals and other strategies can increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

External Links

How To

How do I confirm the legitimacy of an investment opportunity online?

Online investing requires research. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

You should understand the investment risk profile and be familiar with the terms. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. You should ensure that you are getting the terms and services you have paid for by doing due diligence checks if necessary. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.