If you want to trade nfts, then there are a few things you need to know. First, you need to connect your wallet to the OpenSea platform and then you can start searching for NFTs to purchase or bid on. Once you find a token you like, you can either purchase it at a fixed price or place an offer.

OpenSea allows you to purchase NFTs at fixed rates. However, there are other options. You may also wish to make an offer. This option can be used to acquire rare tokens or those that are difficult to find. However, you'll need to pay a fee to OpenSea for doing so, and it can be difficult to win an auction.

NFT trading (on OpenSea) is a great option if you want to take advantage the burgeoning market of non-fungible crypto tokens (NFTs). NFTs (non-fungible tokens) are digital assets that are not mineable and can't possibly be manipulated. They can be used to create games, social media, or gamification.

OpenSea has the world's largest NFT exchange and provides a wide range of tools for traders to trade NFTs. They support many blockchains, such as Ethereum and Polygon.

OpenSea allows you to trade NFTs by connecting your cryptocurrency wallet. You can either use a MetaMask wallet or download an app like MetaMask Plus to do this.

Once you've connected your wallet, you'll see an option to "Add to Collection" or "Place Bid." Clicking on the latter will allow you to place a bid on the NFT and specify the amount of money you'd like to spend. If you win, the NFT will transfer to your wallet.

OpenSea allows you to easily sell NFTs. Sellers can accept offers on NFTs and then decide to sell them at their chosen price. They'll also collect a small fee, but this fee is significantly lower than the fees charged on other platforms.

After you've sold your NFTs on OpenSea, the transaction will be recorded on the Ethereum blockchain. This means that you can use Etherscan to verify your ownership of the NFT.

The blockchain is the public ledger of all transactions that occur on the network, so you can check if your NFT has been sold on any other exchanges or marketplaces. This can be a good way to verify your NFTs' ownership and ensure that you haven't sold them in error.

OpenSea Mobile app makes it easy for you to keep track your NFTs. You can connect your account to the app and search for NFTs from the past. Or, you can tap on the "Discover” button to uncover new assets.

OpenSea's platform is the largest in the market and has been a pioneer in NFT trade for years. OpenSea offers both buyers and sellers a large selection of NFTs across a variety of blockchains. It also offers services such as user support and gamification that can help people find the right NFTs.

FAQ

Which is harder, forex or crypto.

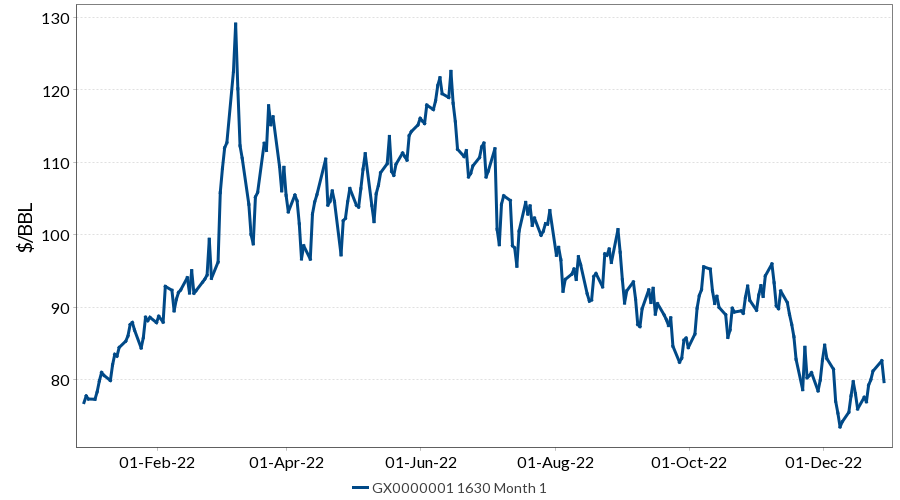

Forex and crypto both have unique levels of complexity. The new blockchain technology makes crypto a little more complicated in terms of fundamental understanding. Forex, on the other hand has a proven trading infrastructure and has been around for many years.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. You can gain an advantage over your competitors by researching historical trends in the markets in which it trades.

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. Leverage is another factor that must be taken into account, as traders risk not only their capital but also additional borrowed funds when trading currency pairs with significant volatility.

Forex and crypto both require keen research skills and attention to ensure successful trades.

Which is the best trading platform?

For many traders, choosing the best platform to trade on can be difficult. There are so many platforms available, it can be difficult to decide which one is best for you.

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It must also be easy to use and intuitive.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. This will help you narrow your search for the right trading platform.

Once you have chosen the platform that is right for you make sure you look at other features such stock screening tools, backtesting capability, alert systems and many more. Make sure you have the appropriate security protocols in place for your data to prevent theft or breaches.

MetaTrader 4/5 (MT4/MT5) and cTrader are some of the most well-known trading platforms.

Which is better, safe crypto or Forex?

Two types of high-risk investments, cryptocurrency trading and forex trading, are highly risky and can bring you great rewards but also huge risks.

Crypto, short for cryptocurrency, is a digital currency created from a piece of code through blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, or foreign exchange currency trading, involves highly leveraged investments in which participants speculate on the value of one currency in relation to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto have advantages and disadvantages, but crypto generally carries more risk than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Therefore when determining which between Crypto and Forex is safer it would depend on one's own risk appetite as well as their experience with each investment option before making a final decision.

Can one get rich trading Cryptocurrencies or forex?

You can make a fortune trading forex and crypto if you take a strategic approach. If you want to make real money in forex and crypto markets, it is important to keep up with the latest trends and to know when the best time to sell or buy.

It is also important to understand how to spot trends in prices. This will help you to predict the direction of the market. Trading with money you can afford is a good way to reduce your risk.

You will need to have experience, knowledge and skills as well as discipline to create a long-term profitable strategy.

The volatility of cryptocurrency prices is a problem. It is important to ensure that your entry position matches your risk appetite and exit strategy. This means that you should take profit or limit losses if you have the opportunity.

Researching potential cryptocurrency exchanges and coins before signing up is vital, as they are not well-regulated and can pose significant risks.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. A solid knowledge of the conditions that affect different currencies is essential.

It all comes down to taking calculated risks, learning continuously, and finding the most effective strategy for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Is Cryptocurrency Good for Investment?

It's complicated. It is complicated. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

The advantages of cryptocurrency investments for portfolio diversification are also available, since they tend to be independent from traditional stock markets.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Are forex traders able to make a living?

Forex traders can make good money. It is possible to succeed in the short-term but long-term success usually comes from hard work and willingness to learn. Traders who understand market fundamentals and technical analysis are more likely to be successful than those who rely solely on luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders lose their money because they don't have a well-planned strategy or plan. But with discipline, you can maximize your chances of making a profit in foreign exchange markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

Statistics

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can my online account be secured?

Online investment accounts must be secure. It's vital that you protect your data, assets and information from unwelcome intrusion.

First, ensure the platform you are using is secure. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. A policy should outline how personal information shared with them will be managed and monitored.

Secondly, always choose strong passwords for account access and limit your log in sessions on public networks. Avoid clicking on unknown links and downloading untested software. This can lead to malicious downloads, which could ultimately compromise your funds. You should also regularly review your account activity to ensure you are aware of any suspicious links or downloading unfamiliar software. This will allow you to quickly detect possible threats and take appropriate action.

Third, you need to know the terms of your online investment platform. You should be familiar with all fees and restrictions regarding how your account can be used.

Fourth, ensure you research the company that you are considering investing in and make sure they have a track record of providing excellent customer service. Review and rate the platform and see what other users think. You should also be aware of the tax implications when investing online.

You can make sure your online investment account remains secure and protected from all possible threats by following these steps.