Futures trading on agricultural commodities is a method of risk management. It allows farmers to sell their produce for a set price in the near future. These markets offer liquidity to traders, who can trade 24 hours a days. This market can be used by farmers to increase their earnings.

The Indian National Commodity and Derivatives Exchange Limited is the only Indian exchange that allows traders to trade commodity derivatives. It is managed by an independent board and has offices all over India. The exchange traded 27 commodity contracts as of March 2018, including 25 agrifutures.

Agricultural commodities are the main livestock and produce we use in our daily lives. These include dairy products and grains. Many of these products have a cycle that has an annual supply and need. There are many byproducts that can be used every day. Some of the most popular agri commodities in India include soya oil, crude palm oil, and wheat.

Agrifutures can be used to enhance the overall marketing performance for farmers. In addition, they can help in minimizing risks associated with the harvest season. Farmers can hedge their risk by selling a futures contract before the harvest date. This allows them to sell their produce at a fair price. They can even modify their cropping plan to reflect futures market price changes.

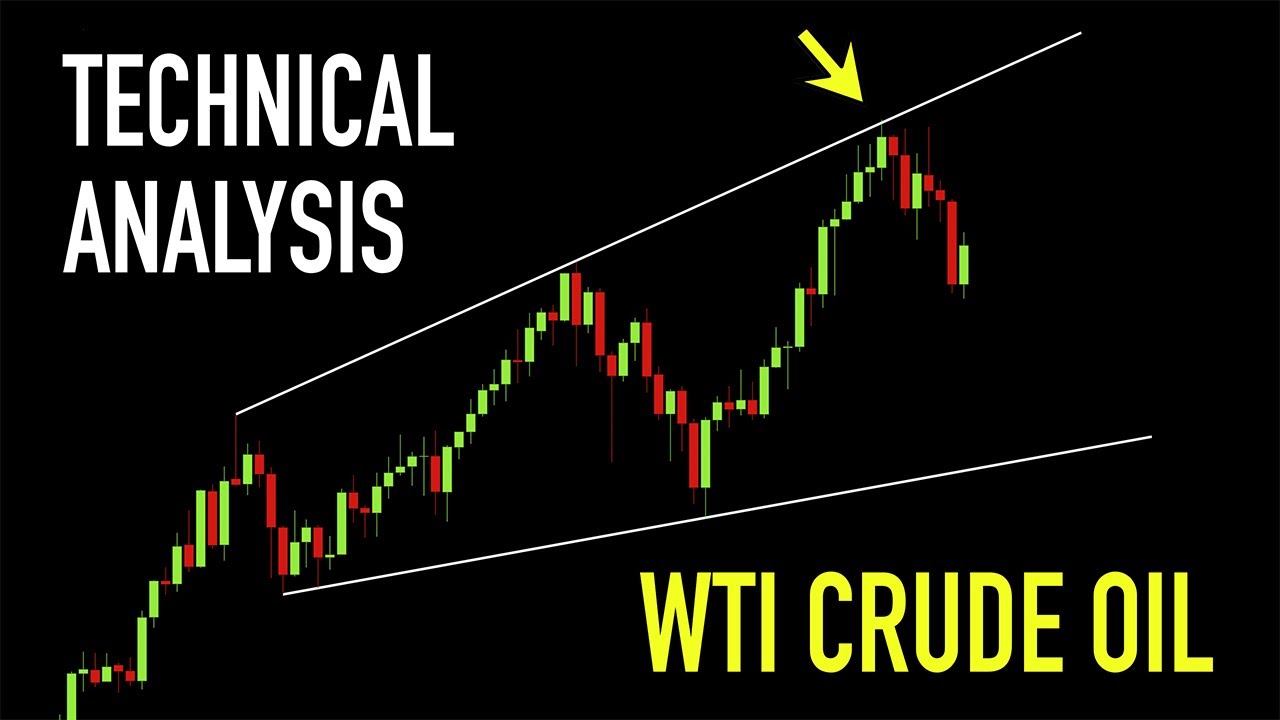

Futures trading in agricultural commodities is a profitable business, especially to farmers. It also comes with its share of risks. These risks are important to traders. Although there are many strategies available, it is best that you do your research before investing in any type of agrifutures. For instance, traders can consider the historic charts for the specific commodities that they are interested in.

Having an online trading account is a quick and simple process. If you are ready to trade, then you can offer or buy a futures agreement. Since these contracts are standardized, they don't have to be settled by delivery. However, you may want to hedge against an existing long position or offset a short position.

Another advantage of futures trading in agricultural commodities is that it breaks the grip of middlemen. This is especially true when it comes to small farmers. Most of these individuals rely on traditional marketing channels, which charge high commissions. Trading in futures can help them reduce their dependency on these middlemen and make a lot more.

You can find a lot of information online about agricultural futures trading. It is best to review historical charts to find the current price, trends, and other information. Be familiar with the agricultural cycle before you make a move. You should also be familiar with the differences between feed commodities and food commodities.

The most basic distinction between agri and food commodities is that they are not produced year-round. Most crops are planted only during specific times of the year. The weather can have a significant impact on supply and demand.

FAQ

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

You will also need to know how to identify patterns in prices, which can help you decide where the market is going. It is important to trade only with money you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Because cryptocurrency prices can fluctuate, it is important that you make sure your entry position and exit plan are compatible. If there is an opportunity to take profits or limit losses, then go for it.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Also, because forex trading involves predicting fluctuations currency exchange rates through technical/fundamental analytics of global economic information, this type trade requires specialized knowledge. It is therefore essential to have a solid understanding of the factors that affect different currencies.

At the end of the day though, it's all about taking calculated risks, being willing to learn continually, and mastering an effective strategy that works best for you. With enough dedication combined with this knowledge - you could potentially get very rich trading cryptos or forex if done correctly with proper education & research behind it!

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. Also, crypto trades can be cashed out quickly due to their liquidity.

In both instances, it is crucial to do your research prior to making any investments. Any type of trading can be managed by diversifying your assets.

Understanding the various trading strategies for different types of trading is important. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Automated trading systems and bots may also be used by some traders to help them manage investments. It is important to understand the risks and rewards associated with each strategy before investing.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are both highly risky investments with varying rewards and risks.

Crypto, shorthand for cryptocurrency is a digital currency made from code using blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex or foreign currency trading involves high-leveraged investments that allow participants to speculate on the relative value of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex and Crypto have their strengths and weaknesses, Crypto tends to be more risky than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Where can I invest and earn daily?

While investing can be a great way of making money, it is important to understand your options. You don't have to put your entire savings into the stock market - there are plenty of other options.

One option is investing in real estate. Property investments can yield steady returns, long-term appreciation, and tax benefits. Diversifying your portfolio may be an option, such as with ETFs, mutual funds or specialty fields like crypto, bonds, ETFs and mutual funds.

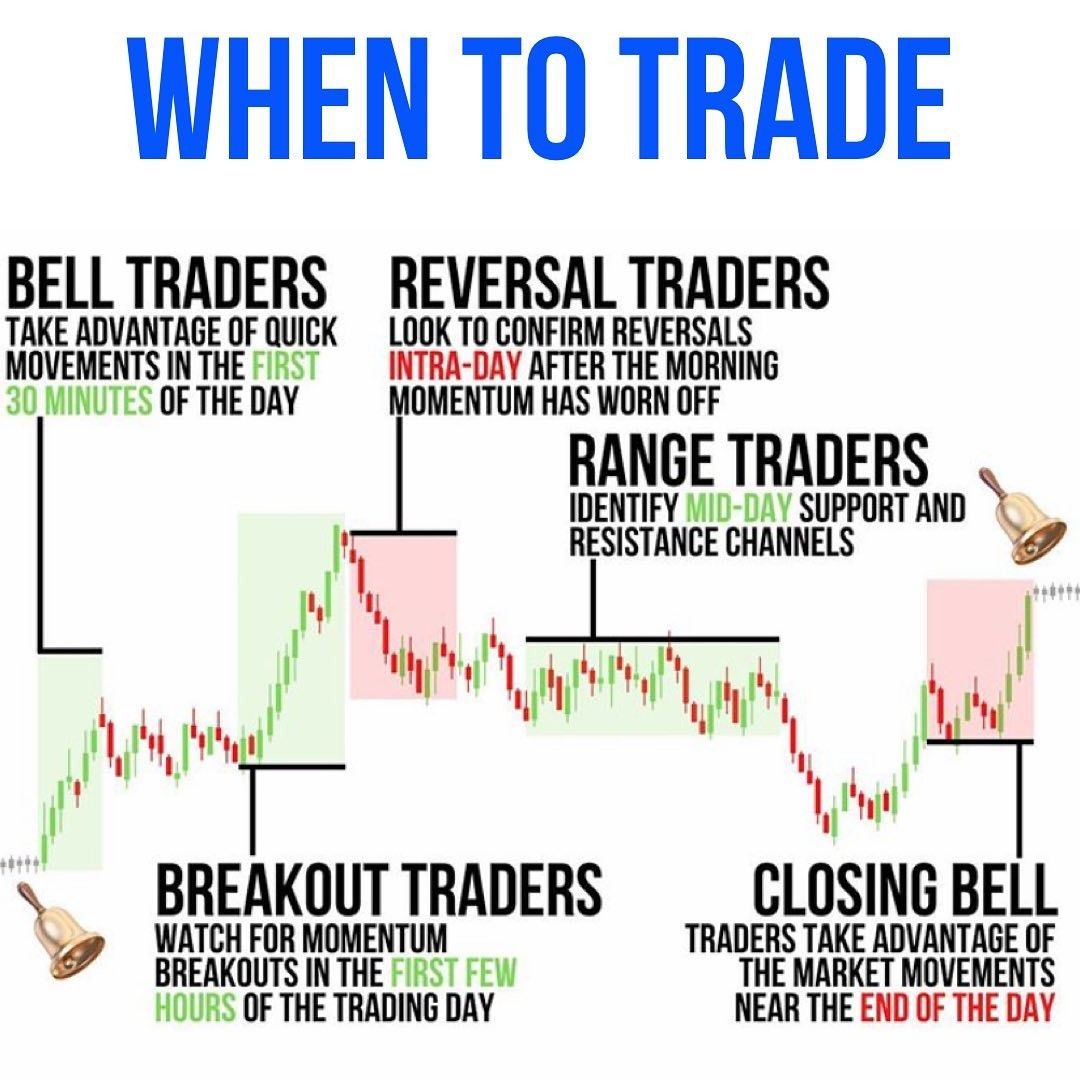

If you are looking for short-term income or daily profits, you might consider investing in dividend-paying stocks. You may also want to look into peer-to–peer lending platforms that allow you borrow money from other borrowers and receive interest payments on a daily basis. If you're comfortable taking the risks, you can also trade online with day trading strategies.

No matter your investment goals, it is important that you do thorough research on each type and investment before making any major decisions. Every asset comes with its own risks. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Forex traders can make money

Yes, forex traders are able to make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, it is important to be persistent and learn from successful day-traders in order to be profitable as a forex trader.

What are the disadvantages and advantages of online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Online brokerages are often cheaper than traditional brokerages. This allows investors to get started quickly and with less money.

However, online investing does have its downsides. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complicated than traditional investing. It is important to learn the markets and create a solid strategy before you start.

It is also important for online investors to be aware of all the investment options. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment comes with its own risks. You should research all options before you decide on the right one. There may be restrictions on investments such as minimum deposits or other requirements.

Statistics

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protection begins with you. To avoid being conned, learn how to recognize scams and understand how fraudsters operate.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Do not respond to unsolicited emails or phone calls. Fake names are often used by fraudsters. Never trust anyone based solely on their name. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never place money on the street, in cash or via wire transfer. This should alarm you if they insist upon such payment methods. Don't forget to remember that "Scammers will attempt anything to get personal information." You can protect yourself against identity theft by paying attention to suspicious links and phishing emails, as well as the many types of online phishing schemes.

You should also use safe online investment platforms. Look for sites that are regulated by the Financial Conduct Authority (FCA) and have a good reputation. Secure Socket Layer is encryption technology that helps protect data sent over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.