Commodity forex pairs can be used to identify currency pairings between countries that export raw material. In addition to the US Dollar, commodity forex pairs also include the Canadian Dollar, Japanese Yen, Brazilian Real, Norwegian Krone, Russian Ruble, Mexican Peso, and South African Rand.

In general, commodity currencies are highly correlated to the country's import-export trade. This is especially true of emerging economies that heavily depend on local raw materials pricing. There are many other factors that can affect currency values. The economy's GDP plays a role as well. If the economy is lagging, people may have fewer resources to purchase commodities.

One of the most common ways to trade commodities is through futures contracts. A futures agreement is an agreement between the buyer and seller for the purchase of a commodity at a predetermined price in the future.

A forex commodity is a basic product, such as oil. It can be traded for currencies or other goods. These are typically used for regular purposes, although they can be traded in speculative markets. Forex traders can trade commodities using a variety of strategies. Some traders are more focused on the analysis of the supply and demand of major commodities. Some trade more directly, like buying stocks in corporations related to commodities.

Commodity markets can be volatile and abrupt, so you need to be prepared for that. Check with government departments or private research firms to find out about the demand and supply of commodities. You could also search for index funds or mutual funds that are invested into companies that are involved within the commodity industry.

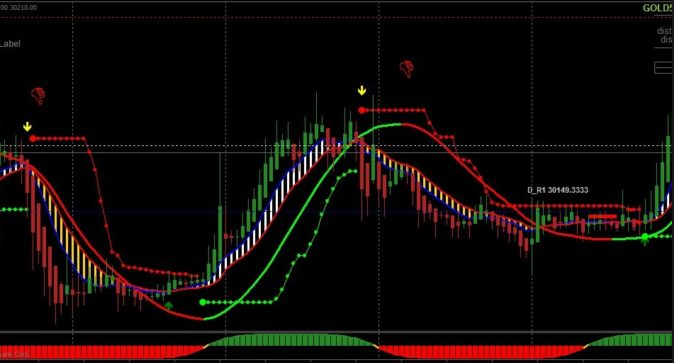

A step-by-step trading plan is essential for traders who want to make a profit from the commodity forex pairs. They should be disciplined as well as keep an eye out for the market. They should also develop an exit strategy.

Profitable commodity currency pairs are possible, but it's important to stay focused and understand all the variables that can affect them. Inflation, deflations, tariffs and armed conflict can have an effect on commodity prices. The price of oil, for instance, has fallen by 30% in the last month. You should therefore be able to see how oil affects the currency you use.

Other variables that can influence the prices of commodities are economic protectionism, subsidized production, and environmental protection. There are also industrial regulations that could affect the production of commodities. It is important to evaluate the country's economic performance and the raw material prices.

Although commodity currencies have low liquidity, they can still be manipulated by speculators. Speculators can manipulate the derivatives price by buying the asset, then hedging it and then selling it back later. Hedging is dangerous and traders need to be aware of its dangers.

Traders need to be aware of differences between major and minor commodity currencies. Although minor currencies can be linked to the country's resources, they don't show the same degree of sensitivity when it comes to pricing raw materials.

FAQ

Where can I invest and earn daily?

Investing can be a great way to make some money, but it's important to know what your options are. There are many other investment options available.

One option is to buy real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals might be, it is crucial to thoroughly research every type of investment before jumping in. Each asset has its risks and rewards. You should closely monitor your investments and know when to sell and buy accordingly. This will help you maximize your earnings and reach your financial goals.

How can I invest bitcoin?

Although investing in Bitcoin may seem complex, it's actually not as difficult as you think. All you need are the right tools and knowledge to get started.

There are many options for investing. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You also need to decide where to store Bitcoin. There are many choices, such as cold storage, exchanges or custodians. Depending on your risk appetite, goals, and other factors, certain options might be more appropriate than others.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. You should also keep up to date with market news and developments in order to stay abreast of the latest crypto trends.

Last but not least, develop a plan that will allow you to invest in Bitcoin according to your experience and have reasonable expectations of returns. This will help you be more successful long-term.

What is the best forex trading system or crypto trading system?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading allows you to invest in different currencies. It is a great option for beginners. Forex trading is easier than investing in foreign currencies upfront.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

It is important to research both sides of the coin before you make any investment. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is important to be familiar with the various types of trading strategies that are available for each type. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded on exchanges like any other form of money and has been the subject of speculative investments due to its dramatic price swings over time.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Forex, which can be unstable and cause large losses if not managed well, is an investment that should not be taken lightly.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Because of the limited supply and regulations around cryptocurrencies, prices can fluctuate. But forex markets move more consistently so investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

What are the disadvantages and advantages of online investing?

The main advantage of online investing is convenience. Online investing makes it easy to manage your investments from anywhere on the planet with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Online brokerages often offer lower fees than traditional brokerages. This makes it easier for investors start with smaller amounts of capital.

Online investing comes with its own set of disadvantages. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment comes with its own risks and rewards. It is crucial to thoroughly research each one before you make a decision. There might be restrictions or a minimum deposit required for certain investments.

Frequently Asked Question

What are the different types of investing you can do?

Investing is a way to grow your finances while potentially earning money over the long term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into two groups: common stock and preferred stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans made by investors to governments and companies in return for interest payments. The bond will expire on its maturity date. Bonds provide more stability and less risk than stocks, but the returns are typically lower than those of stocks.

Mutual funds can be described as pooling investors money together to spread investment risks and diversify investments over a wide range of securities. This includes stocks, bonds, and other commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Statistics

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

External Links

How To

What precautions should I take to avoid online investment scams?

Protect yourself. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Avoid high-pressure sales tactics, promises of guaranteed returns and offers that sound too good to be true. Unsolicited email or phone calls should not be answered. Fake names are often used by fraudsters. Never trust anyone based solely on their name. You should thoroughly investigate investment opportunities and do your research on the person offering them.

Never invest in cash on the spot, in cash or by wire transfer. Any offer that requires these payment methods should be regarded as a red flag. Never forget that scammers will try any means to steal your personal data. You can prevent identity theft by being aware of various online phishing schemes as well as suspicious links that are sent via email and online ads.

It is also important that you use secure online investment platforms. You should look for sites that have good reputations and are regulated by Financial Conduct Authority (FCA). Secure Socket Layer (SSL) encryption technology is recommended to protect your data over the internet. Make sure you understand the terms and conditions of any site or app you use before investing, including any fees or charges that may be applicable.