Forex leverage is a valuable tool for traders who want to make profit without putting all their trading capital at risk. This powerful tool can have devastating consequences for a trader's financial health. For forex traders who are new or experienced, it is crucial to fully understand the pros and cons of this method before they dive in.

Sound risk management is key to trading success. This includes minimizing leverage and hedging risks. One of the most important things to remember is that the more leverage a trader uses, the more risks they are likely to take. High leverage can also make traders feel richer than they really are. To use too much leverage in your trading can cause an imbalance in your trading relationships. Additionally, it can increase the chance of Stop Outs that can lead to volatility.

While leverage is one of the most common tools in FX trading, it needs to be used with care. Excessive leverage can lead to disastrous results, so it is essential to know exactly what you are getting into before you start using it. A leverage calculator will help you determine how much of your own funds you can borrow to enter a trade.

When there is a clear advantage, leverage is generally a good idea. One example is using a 10 to 1 leverage ratio to help you get exposure to trade size. However you should be cautious about how many of your own funds are you willing to take on.

Your broker is often able to provide forex leverage. Your broker can let you know how much leverage your broker and account type allow. Be aware that the maximum leverage you can use varies from broker to brokerage and country by country.

Your potential profit will be affected by the size of the position you hold. A trader who has a margin balance of US$100,000. can hold a position up to US$500,000 in USD/JPY. Similarly, a trader with a balance of only US$1,000 can place a position of up to US$10,000 in the EUR/USD and the same for the GBP/USD pairs.

Taking advantage of leverage is an exciting way to expand your market exposure and earn some extra money. It can also be dangerous. Traders should be aware of potential margin calls and other red flags. Keep in mind, however, that the best leverage is one that suits their trading style and is most risk-tolerant.

For example, a ten to one leverage ratio is similar to a 10% deposit on a home. A similar leverage ratio can be used to get $10,000 in foreign currency. However, it could lead to a devastating loss.

FAQ

Which forex trading platform or crypto trading platform is the best?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading is easier than investing in foreign currencies upfront.

But crypto trading is a great alternative because it offers almost instant returns as prices can fluctuate quickly due volatility. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

Both cases require that you do extensive research before investing. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

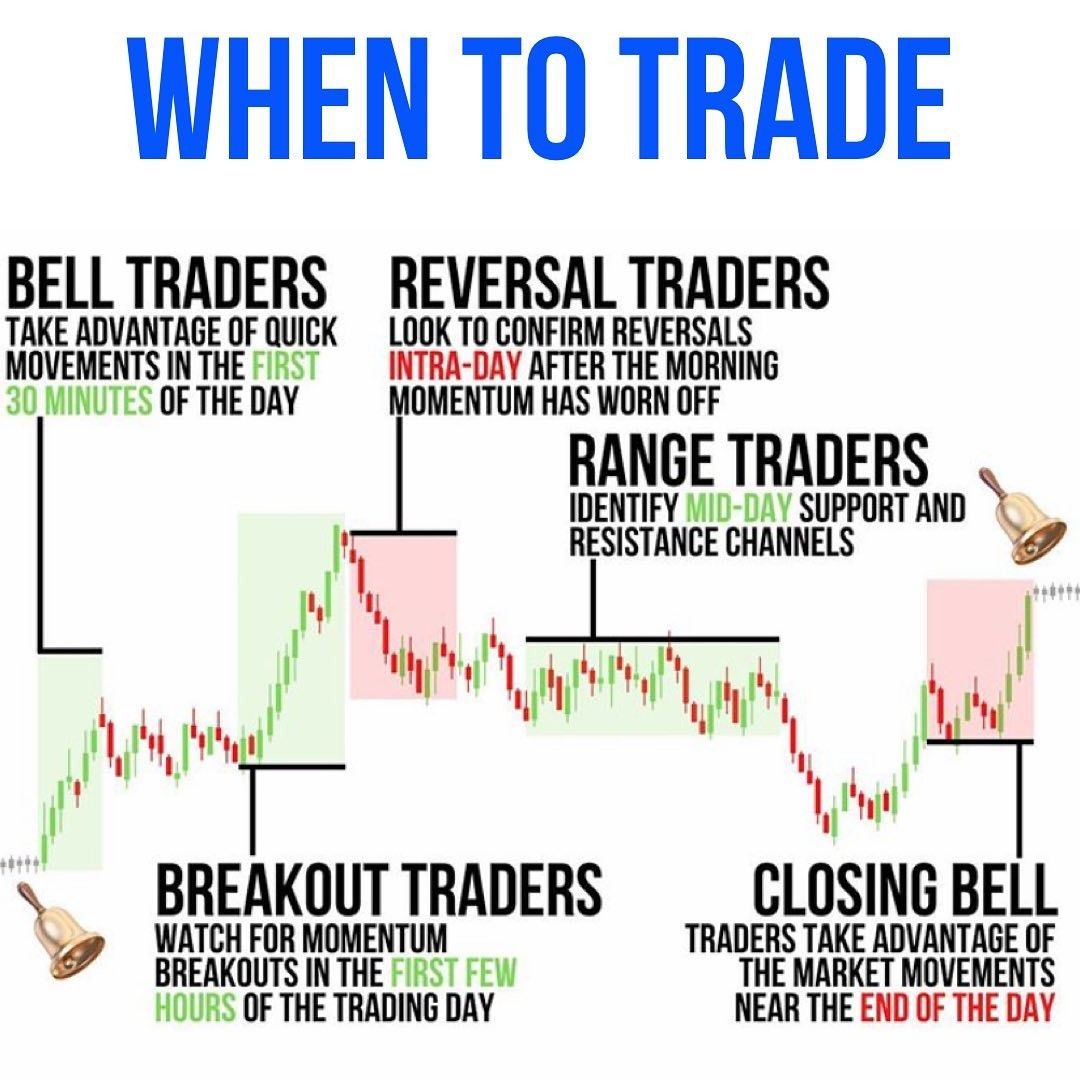

It is important to know the types of trading strategies you can use for each type. Forex traders might use fundamental or technical analysis to make decisions. Crypto traders, on the other hand, may use arbitrage and margin trading to maximize their profits. Additionally, some traders may opt for automated trading systems or bots to help them manage their investments. Before you invest, make sure to understand the risks associated with each strategy.

Frequently Asked Fragen

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four types of investing: stocks and bonds, mutual funds and cash equivalents.

Stocks can be broken down into common stock or preferred stock. Common stock gives you the opportunity to vote at shareholder meetings, and earn dividends. Although preferred stock grants ownership rights, there are no voting privileges. Fixed dividend payments offer investors an income stream and provide a reliable source of income.

Bonds are loans that investors make to governments or companies in return for interest payments. They expire at the maturity date and can be repaid with interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds are a way to pool investor money in order spread risk and diversify investments across many types of securities, including stocks, bonds and commodities. Professional managers manage mutual fund investments. They use their knowledge to choose profitable investments that meet pre-set criteria.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type investment is best suited for conservative investors who don’t want to take too many risks, but still want a bit more return than depositing in traditional low-interest bank funds.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need is the right knowledge and tools to get started.

You need to be aware that there are many investment options. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You must also decide where you will store Bitcoin. There is a wide range of options available, including exchanges, custodians, cold storage, wallets and exchanges. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, research any additional information you may need to feel confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Which is the best trading platform?

Choosing the best trading platform can be a daunting task for many traders. It can be overwhelming to pick the right platform for you when there are so many options.

The best trading platform should offer the features you need, like advanced chart analysis tools, real-time market data, and sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

Think about what kind of trader you are, whether you're active or passive, how frequently you intend to trade, and what asset class you want. These factors will help you narrow down your search to find the right trading platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Forex traders can make money

Forex traders can make a lot of money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. More successful traders are those who have a solid understanding of market fundamentals and technical analyses than those who rely on their luck or guessing.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is important to find an educated mentor and develop a working knowledge of risk management before risking real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders develop trading plans that they stick to when trading in order to reduce their risk exposure as much as possible while still finding profitable opportunities. This is crucial because many traders who are new to forex trading can be too aggressive and chase quick wins instead of following a consistent, long-term strategy.

Forex traders can increase their chances of making long-term profits by keeping records, understanding currency trading platforms, and studying past trades, payments, and by keeping accurate records.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Be persistent, learn from successful day trader and be persistent. Profitability in the forex market trading markets is dependent on whether you're managing funds for yourself or someone else.

Is it possible to make a lot of money trading forex and cryptocurrencies?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. It is essential to be able to spot trends and determine the best time for you to buy and/or sell.

Additionally, you'll need to learn how to recognize patterns in prices. These patterns will assist you in determining where the market is headed. It is important to trade only with money you can afford to lose.

It takes a combination of knowledge, experience, risk-management skills, discipline, and patience to build a profitable strategy that will lead to long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

It is crucial to do your research on cryptocurrency exchanges before you sign up for any wallet.

Forex trading is a complex business that involves forecasting fluctuations in currency exchange rates using technical analysis/fundamental analyses of global economic data. This type of trading requires specialized knowledge. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It's about taking calculated risks and being open to learning. The most important thing is to find the best strategy for you. You can make a lot trading forex and cryptos if you have enough knowledge and dedication.

Statistics

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

How can I check the legitimacy and authenticity of online investment opportunities?

Research is critical when investing online. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. You should also be alert for industry restrictions and regulations that might apply to your investments.

Review past performance data, if possible. Find customer reviews online to find out how people have felt about the investment opportunity. You should ask yourself if this sounds too good to be true. Also, be wary of claims that you can guarantee future results or significant returns.

Learn about the investment's risk profile and review the terms and condition. Before signing up for an investment account, make sure you know what fees or commissions may be subject to tax. Make sure you're getting what you paid for in terms of terms and services offered by conducting due diligence checks as necessary. Finally, ensure you have a clear exit strategy in case your investment doesn't go according to plan - this could help reduce losses in the long run!