A currency pairing is a combination between two currencies that are traded together. Pairs include, for instance, USD/JPY/EUR/GBP. The paired currency’s value is calculated based on the base currency. These pairs can be scalped by traders looking to capitalize on fluctuations in their base currency.

Forex traders often examine different indicators in order to choose the currency to trade. You may see significant trading activity depending on which pair you are looking at. Regardless of what pair you are looking to trade, you should always consider a proper risk management strategy. This can make any pair easier to trade.

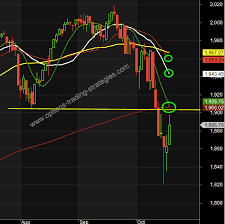

One of the most popular types of forex trading involves deciding whether or not to go long. This can be accomplished using a variety of tools, including charts and economic announcements. There are many factors that can affect currency prices. These include economic and political status, future hopes for the country and current positions of its residents. A trading plan and historical data are also important.

Traditionallly, the four most popular currencies are the US dollar, Japanese yen and Canadian dollars. These are the US dollars, the Japanese and Canadian yens, as well as the euro. While these are the most commonly traded pairs, they are not the only major currencies in the world. Other major pairs are the Australian and Chinese dollars, the Hong Kong dollars, the New Zealanddollars, the South African rand, the New Zealanddollar, and Chinese yuan.

Another common type of currency pair is the exotic pair. The exotic currency pair is more volatile than other types. They can be described as a combination of several currencies from different market sources. Some of these exotic pairs have higher spreads and are more risky. These pairs could be riskier and offer greater chances of profit.

Although exotic currency pairs might be more appealing than regular currency pairs, they can also prove more costly to trade. Before venturing into the exotic realm, it is essential to fully understand your market.

Major currency pairs can offer potential profits while being more stable and more volatile than the rest. They also offer greater liquidity and are simpler to trade. They are also more volatile because of the consensus among traders.

Traders will often choose to invest in the safest and liquidest currency pair during times when there is turmoil or tumult. The US dollar is a very stable currency, and it is widely considered to be a "safe haven." It might be a good idea to invest in a cross- or minor pair if you want to diversify your portfolio.

The best way to determine which pair to invest in is to compare the advantages and disadvantages of each. You will most likely prefer the majors if you're an experienced trader. On the other hand, beginners may find the minors more attractive. You should remember, regardless of your preferences and preference, that the main aspect of any currency is its economic or political stability. Consider other factors like the country's influence on agriculture if you trade for a living.

FAQ

What are the advantages and disadvantages of online investing?

Online investing has one major advantage: convenience. You can access your investments online from any location with an internet connection. Online investing allows you to have access to real-time market information and place trades without ever leaving your home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. For example, it can be difficult to get personalized advice and guidance when trading online, as you don't have a physical broker or financial advisor to help you make decisions. Online trading platforms can offer less security than traditional brokerages. Investors should be aware of these risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many options. They can choose from stocks, bonds, mutual funds and cash equivalents. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. There may be restrictions on investments such as minimum deposits or other requirements.

How can I invest bitcoin?

It can be difficult to invest in Bitcoin. But it isn't as hard as you think. To get started, you only need to have the right knowledge and tools.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Depending on your risk appetite and goals, some options might be more suitable than others.

Next, you should research any additional information necessary to feel confident in your investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. It is important to keep abreast with developments and market news so that you are up-to-date on crypto trends.

Finally, you should create a plan to invest Bitcoin based in your level of expertise and set reasonable expectations about returns. This will ensure that you have a greater chance of long-term success.

Which forex trading platform or crypto trading platform is the best?

Both forex and crypto trading offer potential profits. However, it all depends on your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. Forex trading is easier than investing in foreign currencies upfront.

The upside is that crypto trading provides a quick return, as prices can change very rapidly due to volatility. The liquidity of crypto trading means that you can quickly cash out your tokens.

In both cases it's crucial to do your research before making any investment. Any type of trading can be managed by diversifying your assets.

It is also important to understand the different types of trading strategies available for each type of trading. To maximize their profits, crypto traders can use arbitrage or margin trades to maximize their gains. Forex traders may use either technical analysis or fundamental analysis to assist them in making decisions. Some traders might also opt for automated trading systems, or bots, to manage their investments. Before you invest, it is important to fully understand the risks and benefits of each strategy.

Which trading site is best suited for beginners?

It all depends on how comfortable you are with online trading. It is a great idea to start with an established broker that has experienced advisors, if you are new to online trading.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Many brokers provide interactive tools to show you how trades function without risking any money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They provide customizable trading platforms and live data feeds. You can also access research resources such as real-time statistics to help you make informed decisions.

You can find customer reviews on any route, no matter what. These will give insight into the experience and level of service at each site before you commit.

Where can I earn daily and invest my money?

It can be a great method to make money but it's important you understand all your options. There are many other investment options available.

You can also invest in real estate. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Diversifying your portfolio might be a good idea.

If you're looking for shorter-term profits or daily income, you could try investing in stocks that pay dividends or look into peer-to-peer lending platforms where you lend out money and receive interest payments directly from borrowers on a daily basis. Online trading is possible if you're comfortable with the risks.

It doesn't matter what your investment goals are, it is important to research each type of investment before you dive in headfirst. Each asset has its own set of risk factors. Make sure you closely monitor any investments and recognize when to buy and sell accordingly so you can maximize your earnings and work towards achieving your financial goals!

Can one get rich trading Cryptocurrencies or forex?

If you have a strategy, it is possible to make a lot of money trading forex and crypto. You need to be aware of the market trends so you can make the most of them.

Knowing how to spot price patterns can help you predict where the market will go. It is important to trade only with money you can afford to lose.

It also requires a combination of experience, knowledge, risk-management skills, and discipline in order to be able to develop a profitable strategy for long-term success.

Prices for cryptocurrencies are volatile. The key is to ensure your entry position meets your risk appetite.

Before signing up for any platform or wallet, it is important to research potential exchanges and coins as cryptocurrency markets are not regulated.

Additionally, since forex trading involves predicting fluctuations in currency exchange rates through technical analysis/fundamental analysis of global economic data this type of trading needs specialized knowledge acquired over time. Knowing the current conditions that affect different currencies' currency exchange rates is vital.

It is all about taking calculated risk, learning constantly, and finding an effective strategy that works for you. With enough dedication, knowledge, and proper education, trading forex or cryptocurrency can be very lucrative.

Statistics

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1% or the number in the fourth decimal point. (investopedia.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I ensure the security of my online investment account?

Online investment accounts require security. Protecting your assets and data from unwanted intrusion is essential.

You must first ensure that the platform you're using has security. You should look for two-factor authentication and encryption technology to ensure maximum protection against hackers or other malicious actors. You should also have a policy that describes how your personal information will be monitored and controlled.

Second, ensure strong passwords are used to gain account access. Also, limit the time you spend logging in to public networks. Avoid clicking on unfamiliar links or downloading software that is not recommended. This could lead to malicious downloadings and compromise of your funds. Check your account activities regularly to be alert of any unusual activity.

Third, you need to know the terms of your online investment platform. Make sure you are familiar with the fees associated with investing, as well as any restrictions or limitations on how you can use your account.

Fourth, make sure you do thorough research about the company before investing. Review and rate the platform and see what other users think. You should also be aware of the tax implications when investing online.

These steps will ensure your online investment account is protected against any possible threats.