Options such as call and put can help you make money trading stocks. They can be a great asset to your portfolio. They can also be risky. If you don't take care, you could end up with unworkable contracts. You can avoid losing your money by buying a well-crafted call and put.

Calls and put are similar in that both involve a seller and a buyer. A call allows the buyer to purchase a security at a particular price, on or before a given date. Alternatively, a put gives the seller the right to sell a specific security at a specified price at a certain time.

Calls and put options are based upon the same asset. However, they have different numbers of shares and prices. A put option is worth a few coins, while a option that covers the entire asset could cost thousands of dollars. They are not interchangeable, however. The key to understanding both types of investment is using the right terminology

An option that is well designed is not only a wise investment, but it can also amplify your returns. Buy a call, or put to reduce your margin requirements. You can also take advantage market movements. You can even use options to trade in the speculative markets. It is important to know how these investments work, and how to select them correctly.

It is important to look at the expiration dates when comparing options. Each option contract represents 100 units of the underlying stock. The Vega is the underlying security's intrinsic value. It also defines the strike price and time of expiration. The last one is not a Greek letter but it is meant to indicate how much an option should move if volatility changes.

Although calls or puts can be very profitable when the underlying asset is changed, it's possible to sell one of these options more often than buying. If an investor is concerned that the underlying assets will decline in value, they buy a put. If the underlying property increases in value, investors purchase a call.

The difference between them is in their respective responsibilities. A call option can be viewed as a single contract. It is the responsibility of the writer to ensure that the buyer exercises the option. However, a put option is a contract that requires both the seller and the buyer to meet the terms of the deal.

These are the most basic trades, but there are advanced strategies that go far beyond the call/put. If you're interested in investing in options, it's a good idea to consult a financial planner or professional to find out which strategy is best for you. Options are a fun and exciting way to earn big bucks, but they can be tricky to trade.

FAQ

Can forex traders make any money?

Yes, forex traders can earn money. While it is possible to achieve success in the short-term, long-term profits typically come from dedication and a willingness to learn. Market fundamentals and technical analysis are better than traders who rely only on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Experienced forex traders create trading strategies that they follow when trading to minimize their risk exposure and still find profitable opportunities. Risk management is key; many new traders can become too aggressive by chasing quick gains instead of having a consistent long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

However, regardless of whether you are investing your own capital or managing funds on behalf of someone else, persistence and learning from successful day traders are essential to being a profitable trader in forex markets.

How can I invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

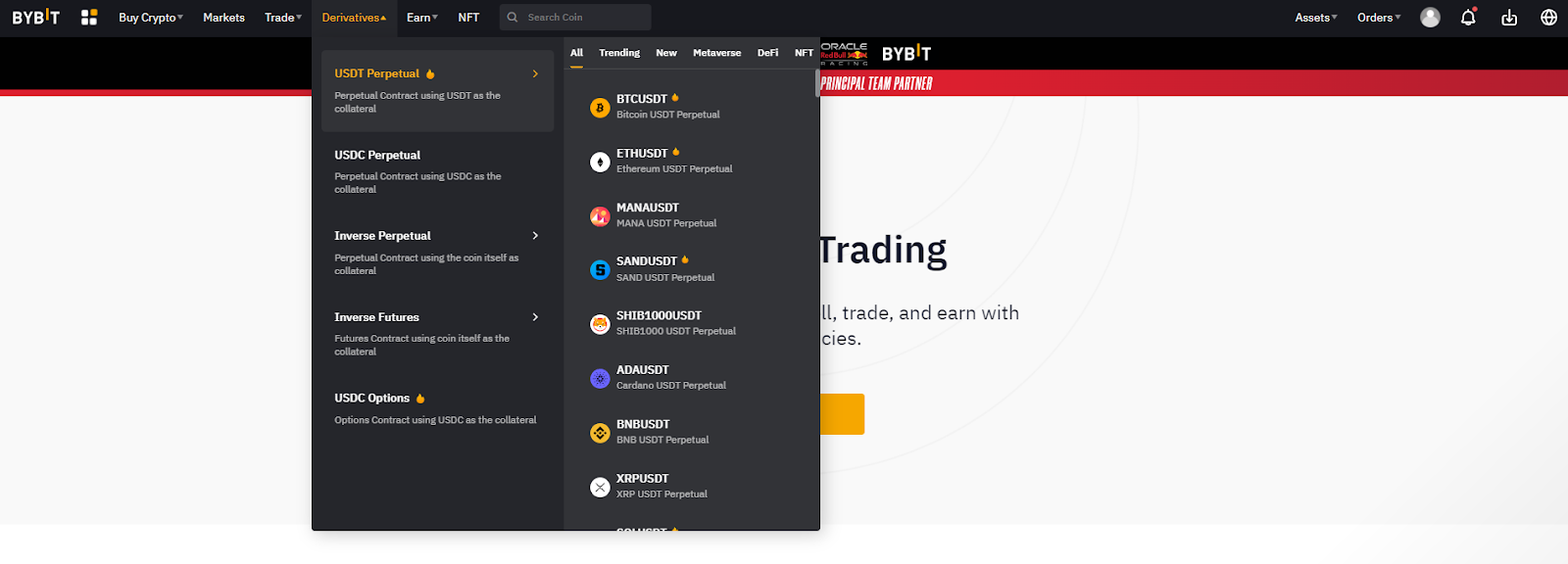

It is important to realize that there are several ways to invest. You can purchase Bitcoin directly, use an exchange to trade, or use a financial instrument known as a derivatives contract to gain exposure.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

Next, find any additional information that may be necessary to make confident investment decisions. It is important to be familiar with the basics of cryptocurrency and how they function before you begin investing. Keep an eye on market developments and news to stay current with crypto trends.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Is Cryptocurrency Good for Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

If you're willing and able to take the risk and research properly, there are many opportunities to make money based upon events like Initial Coin Offerings and market shifts.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

It all comes down ultimately to an individual's risk tolerance and knowledge of the crypto market. If you're able to make informed decisions and are open to taking risks, then investing is definitely something worth considering.

What are the advantages and drawbacks to online investing?

Online investing offers convenience as its main benefit. Online investing allows you to manage your investments anywhere with an internet connection. Access real-time market data, and make trades online without leaving your office or home. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, there are some drawbacks to online investing. Online investing is not without its challenges. For instance, you may find it difficult to obtain personalized advice or guidance online as there are no financial advisors or brokers to help you make your decisions. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Stocks, bonds, mutual funds, and cash equivalents are all options for investors. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. Some investments may also require a minimum investment or other restrictions.

Which is safer, cryptography or forex?

Forex trading and cryptocurrency are risky investments. They have varying returns and potential risks.

Crypto, which is shorthand for cryptocurrency, refers to a digital currency that was created using code and blockchain technology. It can trade on exchanges just like any money, and has been the subject speculative investment because of its drastic price swings.

Forex trading or foreign currency currency trading is a highly leveraged investment in which participants speculate about the value of one currency relative to another. Forex can pose a risky investment, and can result in significant losses if they are not managed properly.

Both Forex and Crypto both have their benefits and drawbacks. However, Crypto has a higher risk of losing money than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. Before making a decision on which investment option is safer, one should consider their risk appetite and previous experience with each option.

Which forex or crypto trading strategy is best?

Forex and crypto trading both have their opportunities for profits, but which one is best for you really depends on your investment goals.

Forex trading is an investment in currencies. This option is accessible to beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

Crypto trading, on the other hand, offers a fast return because prices can fluctuate very quickly due to their volatility. You can cash out your tokens quickly because crypto trades are highly liquid.

It is important to research both sides of the coin before you make any investment. Any type of trading can be managed by diversifying your assets.

Understanding the various trading strategies for different types of trading is important. For example, forex traders may use technical analysis or fundamental analysis to help them make decisions, while crypto traders may use arbitrage or margin trading to maximize their profits. Automated trading platforms or bots are also available to assist traders in managing their investments. It is important to understand the risks and rewards associated with each strategy before investing.

Statistics

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can I safeguard my personal and financial information online when I invest?

Security is essential when investing online. Protecting your financial and personal information online is essential.

You must be mindful of who your investment platform or app is dealing with. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds or provide any personal information, it is important to check the background of each company or individual that you are considering.

Use strong passwords and two-factor authentication on all accounts and check for viruses regularly. To ensure your account security, disable auto-login on all devices. Protect yourself from phishing by never clicking links in emails from unknown senders, not downloading attachments unless you know what they are, and always double-checking a website's security certificate before entering private information into a website form.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. Also, you should use different passwords on each account to ensure that any breach in one doesn't cause others to be compromised. Last but not least, make sure to use VPNs when investing online. They're often free and easy!