Whether you're just starting out or you're an experienced investor, there are many online stock trading platforms to choose from. You need to find the platform that will maximize your returns. There are many platforms available, but there are a few that stand out as the best. Finding the right broker is key. Not only will you need to choose the right platform but also a broker with an excellent reputation and great customer service.

TD Ameritrade offers an easy-to-use platform, competitive rates, and a host of educational tools. This stockbroker is known to be straightforward and a good place to begin investing. The education center offers tutorials and videos as well as a webinar that can teach you how to trade stocks. They even offer a mobile application. The interface is easy to use and clean. The platform also offers a desktop version to traders who desire more flexibility.

InteractiveBrokers is an established stockbroker that specializes only in international markets. They allow trading in stocks and bonds, futures, options, and other assets. There are more than 100 types of orders available and their pricing structure transparent. They are not the most expensive broker.

Stocktwits is one of the most widely used stock trading apps. Stocktwits has a stock scanner and news highlights. It also features an alerts system that can be customized. Plus, it can sync with your brokerage account. You can also chat with other investors about specific stock pages. A comprehensive section on cryptocurrency is also available in the app. The app allows you to view the most popular stocks and watch live trading sessions. You can even trade paper with it.

You need to decide if long-term or day trading are for you. There are many low cost options. Many brokerage firms offer no-commission trades. Some may offer managed options. Day traders can also choose to invest in derivatives. You can leverage your portfolio while earning huge returns through derivatives.

Investors Underground is a better option if you are looking for a comprehensive experience. Nathan Michaud started this stock trading academy in 2004. They have a proven track record and offer a path to investment success. Their membership includes live trading, pre-market broadcasts and trade recaps. This is a unique feature that sets them apart from other providers. Their price is also very affordable. This course is unmatched in its entirety.

If you're looking for an investing course that's easy to use and won't break the bank, look into the Udemy portfolio. A lot of courses are taught via pre-recorded lessons, which cover a range of techniques. You can also ask questions and receive free training. Even better, most courses are suitable for beginners.

You might have heard about some of the best online stock trade sites, but they may not be right for you. Your financial situation will dictate which brokers are best for you.

FAQ

Frequently Asked Question

What are the different types of investing you can do?

Investing can help you grow your wealth and make money long-term. There are four major types of investment: stocks, bonds mutual funds, cash equivalents, and stock.

There are two kinds of stock: common stock and preferred stocks. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. While preferred stock does not grant voting rights, it gives owners ownership rights and fixed dividend payments. This provides investors with an income stream that is reliable.

Bonds are loans from investors made to governments or companies in exchange for interest payments until the bond expires on its maturity date. Although bonds are more stable and less risky than stocks they offer a higher return than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Professional managers manage mutual funds. Their expertise is used to make profitable investments according to pre-set criteria like risk level and desired return rate.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Is Cryptocurrency an Investment Worth It?

It's complicated. It's complicated. Although cryptocurrency has gained popularity over the last few years, it depends on many factors as to whether it will prove to be a profitable investment. There is always risk in investing in cryptocurrency markets. They are volatile and unpredictable.

There are also potential gains if one is willing to risk their investment and do some research.

Because cryptocurrency assets move independently from traditional stock markets, portfolio diversification can also be possible with cryptocurrency investments.

The final decision comes down to individual risk tolerance and knowledge regarding the cryptocurrency market. If you have the means to make an informed decision about this asset class and don't mind taking risks, then yes - investing in cryptocurrencies is absolutely worth considering.

Which is more safe, crypto or forex

Forex trading and cryptocurrency are two highly risky investments. The rewards and the risks can be very different.

The shorthand crypto, or cryptocurrency, is a digital money that has been created using code from blockchain technology. It can be traded as any other type of money on exchanges, and has been the subject for speculative investments because of its dramatic price swings.

Forex, also known as foreign exchange currency trade, is high-leveraged investment that involves participants speculating on the value and relative strength of one currency. Due to its high risk, Forex can be an unstable investment that could result in large losses if not properly managed.

While both Forex (Cryptocurrency) and Forex (Forex) have their pros and cons, Cryptocurrency tends be more volatile than Forex. Prices for cryptocurrencies are unpredictable because of the limited availability of units as well as existing regulations. On the other hand, forex markets tends to move more steadily and investors have more control. The decision about which of Cryptocurrency or Forex is more secure will be based on the individual's risk appetite and their previous experience with each investment option.

What are the advantages and disadvantages of online investing?

Online investing is convenient. You can manage your investments online, from anywhere you have an internet connection. Online trading allows you to access market data in real time and trades from anywhere. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

However, online investing does have its downsides. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Online trading platforms might not provide the same level security as traditional brokerages. Investors need to be aware about the potential risks. Online trading can be more complex and difficult than conventional investing. Before you begin, make sure to thoroughly understand the markets.

You should also be aware of the different investment options available to you when investing online. Investors have many choices: stocks, bonds or mutual funds. Each investment has its risks and rewards. Before you decide which type of investment is best for you, it is important that your research is thorough. There may be restrictions on investments such as minimum deposits or other requirements.

How do I invest in Bitcoin

Investing in Bitcoin can seem complicated, but it's not as hard as you think! You only need the right information and tools to get started.

You need to be aware that there are many investment options. To gain exposure to Bitcoin you can either purchase it directly or use an exchange to trade.

You will also have to decide where to store your bitcoin. There are many options such as exchanges, wallets, custodians and cold storage. Some options may be better suited than others depending on your risk tolerance and goals.

The next step is to research additional information you might need in order to be confident about your investment decisions. Before you start investing in cryptocurrencies, it is important to learn the basics and understand how they work. With that said, make sure you keep track of market news and developments so you can stay up-to-date with crypto trends.

Finally, create a plan for investing in Bitcoin based on your level of experience and set reasonable expectations for returns - this will give you a better chance at success long-term too!

What is the best trading platform for you?

Many traders may find it challenging to choose the best trading platform. It can be overwhelming to pick the right platform for you when there are so many options.

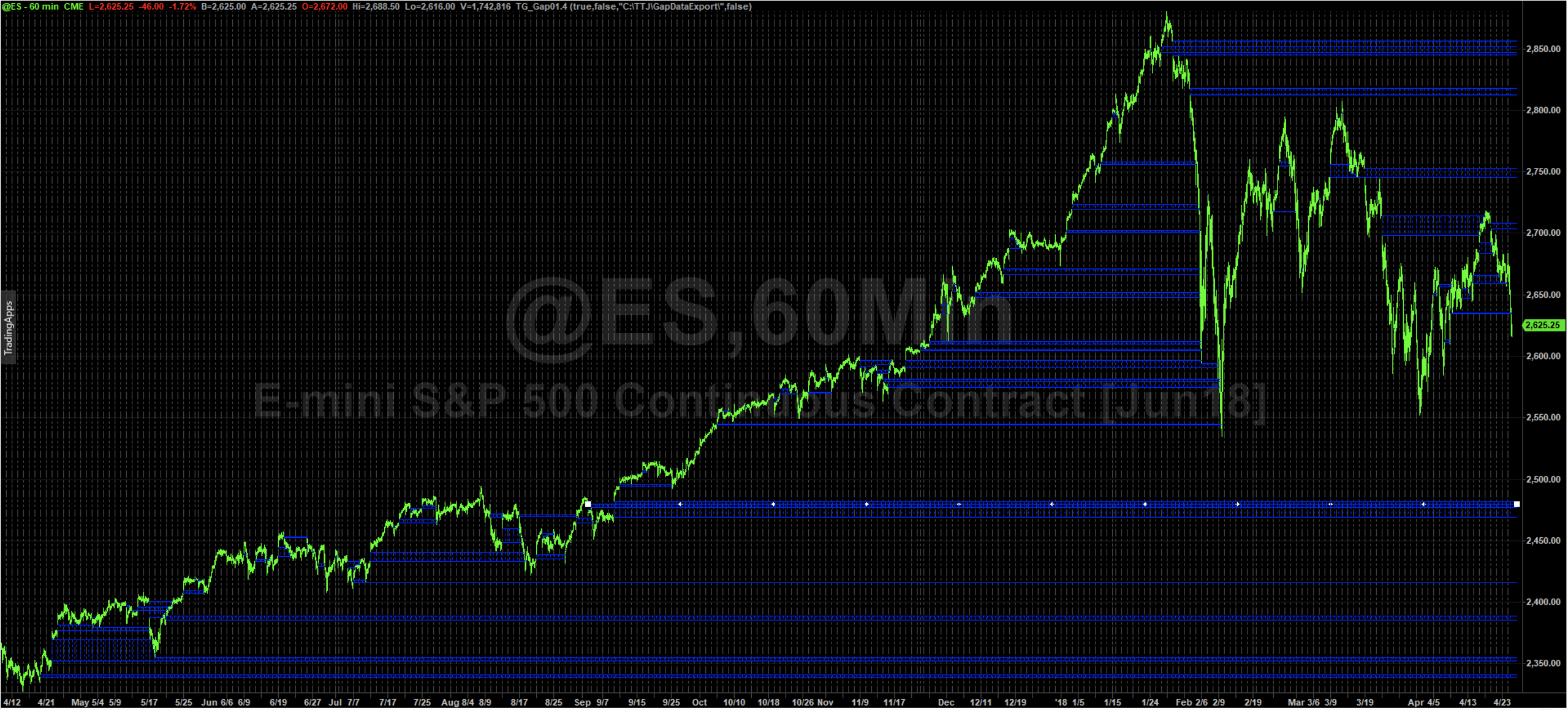

The best trading platform should include the features you are looking for, including advanced chart analysis tools as well as real-time data from the markets and sophisticated order execution capabilities. It should also offer an intuitive and user-friendly interface.

It should offer a variety account types and affordable fees. They should also be able to provide reliable customer services and educational resources. Demo accounts and free trials are a great way to test virtual money before investing any real money.

When looking for a trading platform, consider what type of trader or investor you are - whether you're passive or active, how often you plan to trade, and your desired asset class mix. These factors will help you narrow down the search for the right platform.

After you have found the right platform for you, you should look at additional features like stock screening tools and backtesting capabilities. Alert systems are also available. Make sure your platform has the right security protocols to protect your data against theft or breaches.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

External Links

How To

Do I need to consider other options or is it safer to keep my investment assets online?

Money can be complex but so can the decisions about how to store it. A strong security system is essential for your valuable assets. There are several options.

Online storage allows for easy access from any device. You can also keep an eye on your investments quickly and easily. But, you should be aware that electronic breaches can happen when you use digital options.

A physical form of money like cash or gold can be safer, but it's more difficult to track and requires higher levels of protection and storage.

You may also consider traditional banking options or investing accounts. Self-storage facilities allow you to safely store precious metals, gold, or other valuables away from your home.

You might also consider looking into specialist investment firms that provide secure custody services, specifically tailored to protect large asset portfolios.

Your decision is final. Which one works best for your needs and offers the security and safety you need to protect your investments?