Online investment companies offer many advantages over the traditional route. They offer low fees and high convenience. Some offer educational resources to help you get the most from your money. There are many options available to them, including SIPPs, ISAs or international trading. There are also some drawbacks to investing online. These are some of the most prevalent.

It is important that you find the best online investor company. The platform's features should be well understood and you need to be familiar with them. Many platforms charge fees, while others have no fees to create a basic account. It is a good idea to check out several providers' websites. Seek out promotions, bonuses and other incentive offers. A large account may qualify you for a free trial and other incentives.

An online investment company must provide excellent customer service. TD Ameritrade, for example, offers traders free trades and a huge toolkit. You do not need to open an accounts and the commissions you pay are low. You may prefer to use a traditional brokerage if your goal is to invest in IPOs or other high risk investments.

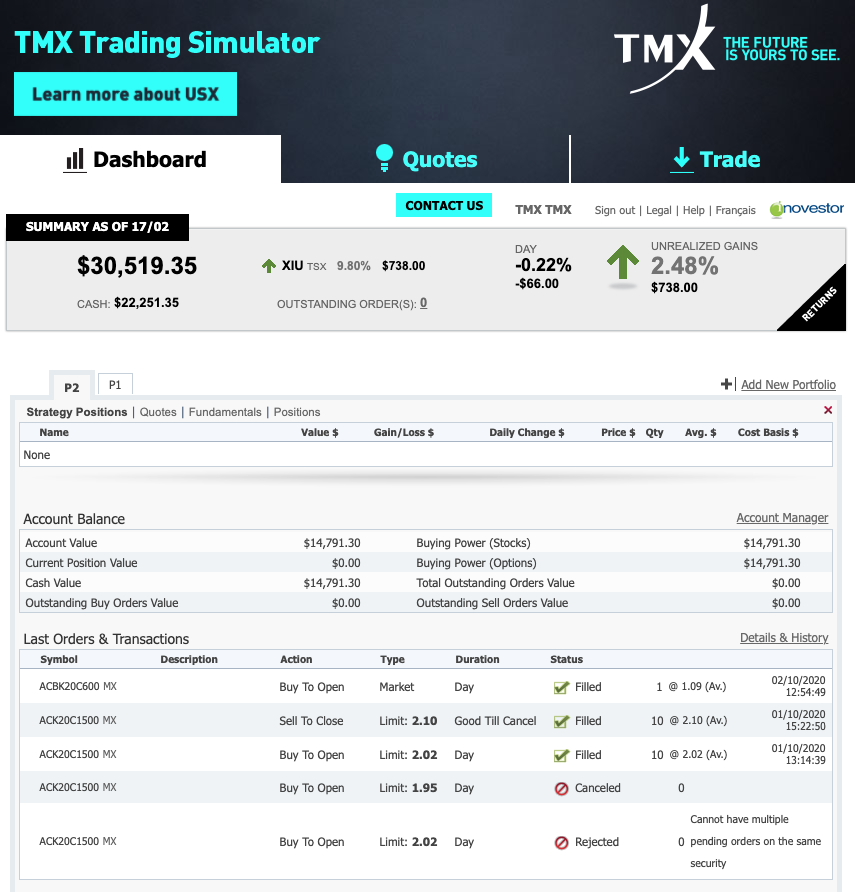

Personal Capital is an online company that helps you manage your money. The dashboard provides a central place for monitoring your portfolio performance, setting budgets, and looking for ways to increase savings. It also offers financial education and tools that can help you stay on track.

Intelligent Portfolios by Schwab is a comprehensive service. It includes both the risk assessment and the automatic rebalancing. However, it does charge a small fee, especially for a balance over $100,000. The service is well worth the effort.

Motif is another comprehensive service. This platform is unique among online investment companies as it provides an affordable, low-risk option. Its automated investment process is one of its best features, and it helps investors get into the market. This feature allows investors to take part in the startup's initial investment.

FutureAdvisor is another online investment option. This site is focused on saving for retirement and caters to clients who have an existing online investment account. They offer automated investment, but the best part about their site is that advisors can create action plans for clients. Depending on the plan you choose, you will be able to watch your advisors trade, check on their advice, and get a better understanding of your portfolio.

Betterment is another no-fee service. There are two types of no-fee services offered by Betterment: Basic and premium. Premium includes all the benefits of Basic as well as a variety of consulting services and in-depth whitepapers. However, the Basic plan doesn't have a minimum investment requirement.

Wealthfront is another online investing company that deserves a look. It offers a user-friendly interface that is great for starting. There are many ETFs available to choose from and you can use them to build an ESG portfolio. You can also use the site's extensive blog to get valuable information.

FAQ

What are the benefits and drawbacks of investing online?

The main advantage of online investing is convenience. You can access your investments online from any location with an internet connection. Online trading is a great way to get real-time market data. Online brokerages typically charge less than traditional brokerages. This makes investing easier, especially if you have a smaller amount of money.

However, there are some drawbacks to online investing. It can be difficult to get personal advice and guidance online, because you don’t have a broker or financial advisor to guide you. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

When considering investing online, it is also important that you understand the types of investments available. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Is Cryptocurrency Good for Investment?

It's complicated. Cryptocurrency has become increasingly popular over the past few years, but whether or not it will be a successful investment depends on numerous factors. One, the cryptocurrency market can be volatile and unpredictable. This means that there is always risk when investing in them.

You can also make a profit if your risk is taken and you do your research.

Because cryptocurrency assets are not subject to traditional stock market movements, they can be used as a portfolio diversification tool.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Which is harder, forex or crypto.

Forex and crypto both have unique levels of complexity. In terms of basic understanding, crypto may be slightly more difficult because it is new and related to blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

Trading cryptocurrency is more risky than forex. It's because the crypto markets can change in an unpredictable way over short time periods. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

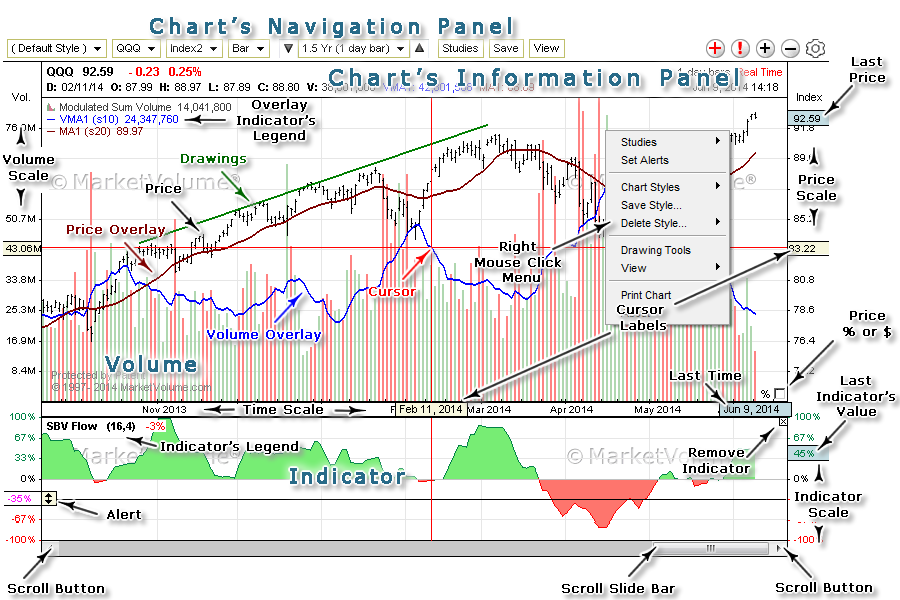

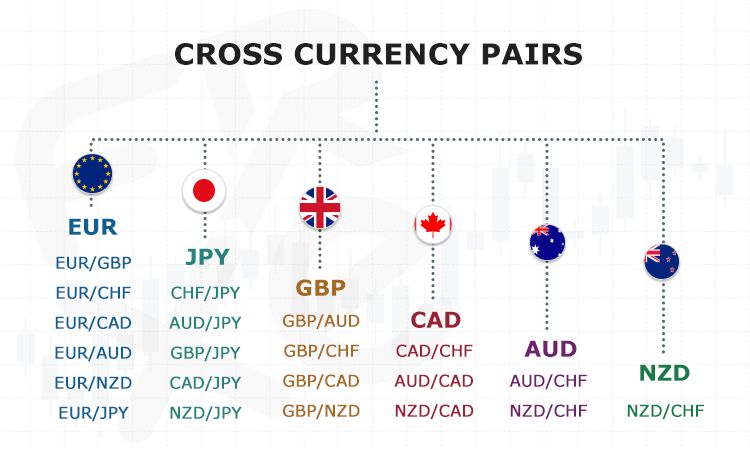

Forex traders need a good understanding of the dynamics between foreign currencies pairs. For instance, they must be able to see how prices respond to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Overall, both forex and crypto require attentiveness, solid research skills, and a clear strategy to make successful trades consistently.

Most Frequently Asked Questions

What are the four types of investing?

Investing is a way for you to grow your money and possibly make more long-term. There are four major categories of investing - stocks, bonds, mutual funds, and cash equivalents.

Stocks can be divided into preferred and common stock. A common stock is an individual's ownership of a company. This includes voting rights at shareholder meetings as well as the ability to receive dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

These cash equivalents are products like Treasury bills, money-market deposits, certificates or deposit (CDs), as well as commercial paper. They usually mature in one year or less and have minimal risk of losing their value or going bankrupt. This type of investing is mostly suitable for conservative investors who don't want to take high risks but still seek a little bit more return than depositing money at traditionally low-interest bank accounts.

Where can I find ways to earn daily, and invest?

Investing can be a great way to make some money, but it's important to know what your options are. You don't need to invest all of your savings in the stock exchange - there are many other options.

One option is to invest in real property. Investing in property may provide steady returns and long-term appreciation. It also offers tax benefits. Consider diversifying your portfolio by investing in bonds, ETFs or mutual funds. You might also want to consider specialty fields such as cryptocurrency.

If you are looking for daily income and short-term profits, then you should consider investing in stocks that pay dividends. You can even trade online using day trading strategies if you feel comfortable with the risks involved.

Whatever your investment goals may, it's important that you research all types of investments before investing. Every asset has its own risks. You must keep an eye on your investments, recognize when you should buy or sell them so that you can maximize your earnings while working towards your financial goals.

How Can I Invest in Bitcoin?

Investing in Bitcoin can seem complicated, but it's not as hard as you think! All you need are the right tools and knowledge to get started.

The first thing to understand is that there are different ways of investing. You have the option to buy Bitcoin direct, trade on an exchange, or gain exposure using a financial instrument called a derivatives contract.

You'll also need to decide where you will store your Bitcoin - there are many options available such as wallets, exchanges, custodians, and cold storage. There are many options available, but some might be more appropriate than others, depending on what your goals and risk appetite are.

Next, find any additional information that may be necessary to make confident investment decisions. It is essential to understand the basics of cryptocurrency and their workings before you dive in. To stay on top of crypto trends, keep an eye out for market developments and news.

Create a plan for investing Bitcoin based upon your level of experience. Set reasonable expectations for returns. This will increase your long-term success.

Statistics

- Schwab Security Guarantee, Schwab will cover 100% of any losses in your Schwab accounts due to unauthorized activity. (schwab.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

How can you protect your financial and personal information while investing online?

When investing online, security is crucial. Online investments pose risks to your financial and personal data. Take steps to reduce them.

Begin by paying attention to who you are dealing on investment platforms and apps. You want to work with a company that has positive customer reviews and ratings. Before you transfer funds to them or give out personal information, do your research.

Strong passwords and two factor authentication are recommended for all accounts. Regularly scan your devices for viruses. You can disable auto-login settings to ensure that no one has access to your accounts without you consenting. You can protect yourself against phishing by not clicking on emails from unknown senders, never downloading attachments, and always checking the security certificate of a website before entering any private information.

You can ensure that only trusted people have access your finances. This includes deleting bank applications from any old devices and changing passwords every few month if you can. Notify identity thieves of any account modifications, such account closure notifications or emails asking for additional information. You should also use different passwords to protect each account from being compromised. Last but not least, make sure to use VPNs when investing online. They're often free and easy!