Commodity trading, also known as commodity futures, is a form of financial market that allows the selling and buying of certain commodities like oil, gold, or other metals. It is a very speculative form of trading that is highly volatile. Although it offers huge potential for profit, it can also cause large losses.

Commodity markets are global exchanges of commodities, which include agricultural products, energy and other natural resources. The supply and demand factors, along with seasonal changes, determine the commodity's price. Futures contracts, which are legal agreements used by traders in the commodity futures markets to fix prices and deliver goods at predetermined times in future, are used by futures contract holders.

A futures contract is able to be bought or sold at any time. It will settle through an RFCM (centralized trading warehouse). The buyer of a futures agreement deposits a predetermined amount of money (margin money), to the RFCM. This allows them trade the contract without having the legal minimum.

Options in the commodity markets are similar to options, but they don't require mandatory delivery. Instead, the option buyer is charged a premium to acquire the right to either buy or sell the underlying asset at a fixed price.

The premium paid by an option buyer is equal in value to the difference between the strike prices of the option contract and the underlying futures contracts. This is the "premium–to–strike ratio".

A put option on a futures agreement is another method of trading the commodity market. The buyer of an option can make a profit by selling their contract if it is less than the strike price at expiration.

This type of trading is very popular in the commodity market because it allows commodity investors to control large investments with relatively low capital. However, the trader must be careful to manage their leverage.

It can be a great way to get started in the commodities market and build your trading skills. It is a great way for you to diversify and earn a good amount of income.

There are several advantages to commodity futures trading, including:

- The ability trade on a liquid market. - The ability hedge risk and manage costs

Companies as well as speculators will benefit from the price discovery offered by commodity futures contracts. These contracts are beneficial for both speculators and companies. They allow them to make directional price predictions in the underlying assets. Companies, on the other hand, can use them to reduce their risk and fix prices.

These contracts are legally binding and regulated by the Commodity Futures Trading Commission, an agency of the U.S. government charged with regulating these markets and protecting consumers.

Investing in these contracts is very risky and should be done only by experienced investors who have sufficient capital to cover the risks involved.

FAQ

Which trading platform is the best for beginners?

Your level of experience with online trading will determine your ability to trade. If you're totally new to the process, then going through an established broker with expert advisors would be a great place to start.

These brokers eliminate the guesswork involved in choosing companies. They make solid recommendations and can help you build a consistent portfolio over time. Most brokers also offer interactive tools to show how trades work and help you avoid losing real money.

Many sites allow you to trade alone if you have some knowledge or want more control over your investments. They offer customized trading platforms, live feeds of data, and research tools such as real-time analyses to help you make well-informed choices.

Regardless of which route you take, make sure to check out customer reviews before making a choice - this will give you insight into the experience and service levels of each site before committing.

Which is best forex trading or crypto trading?

Both crypto and forex trading can make you money, but it really comes down to your investment goals.

Forex trading is easy for beginners and allows you to invest in different currencies. This requires a smaller initial capital, and forex markets can be accessed 24/7 around the world.

However, crypto trading can offer a very immediate return due to the volatility of prices. It is also easy to cash out tokens quickly, as crypto trades have high liquidity.

In both cases, it's important to do your research before making any investments. You can reduce your risk by diversifying assets. This will help you to be successful in any type of trading.

It is also important to understand the different types of trading strategies available for each type of trading. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

Do forex traders make money?

Forex traders can make a lot of money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. Traders who can understand market fundamentals, technical analysis and trading are more likely than those who rely exclusively on luck or guessing to succeed.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. It is crucial to find an educated mentor before you take on real capital.

Many traders fail because they lack a plan or approach. However, with discipline one can maximize his chances of making money on foreign exchange markets.

Experienced forex traders have trading plans they adhere to while trading. This allows them to lower their risk exposure and still identify profitable opportunities. The key to risk management is being able to see the big picture. New traders often chase short-term gains and lose sight of a long-term strategy.

Forex traders can make more money by keeping track of their trades and learning about past payments and trading platforms.

Having discipline really pays off in forex trading: developing rules such as how much money you're willing to lose on each trade helps minimize losses and ensure success; additionally strategies like leveraging entry signals often help increase profits beyond what could be achieved without guidance from an experienced mentor.

Ultimately though, being persistent and learning from successful day traders other methods--such as risk management techniques--are necessary for profitability as a trader in forex markets regardless if you're investing your own capital or managing funds for someone else.

Is Cryptocurrency Good for Investment?

It's complicated. The popularity of cryptocurrency has increased over the years. However, whether or not it is a good investment depends on many factors. The cryptocurrency market is volatile and unpredictable, so investors must be aware of the risks.

However, if you are willing to take that risk, and do your research, then there may be potential benefits based on events such as Initial Coin Offerings (ICOs), and shifts in market.

The potential for portfolio diversification is also possible through cryptocurrency investments, as these assets can move independently from traditional stock exchanges.

In the end, it really comes down to an individual's personal tolerance for risk and knowledge related to the crypto market. If you are able to make informed decisions about this asset class, and are willing to take risks, investing in cryptocurrency is worth looking into.

Frequently Asked questions

Which are the 4 types that you should invest in?

Investing can help you grow your wealth and make money long-term. There are four main types of investing: stocks, bonds and mutual funds.

There are two kinds of stock: common stock and preferred stocks. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. Preferred stock also gives ownership rights but with no voting privileges, as well as fixed dividend payments that offer investors a reliable income stream.

Bonds can be loans made by investors to governments or companies for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds allow investors to pool their money together to spread investment risk, diversify their investments, and diversify across a variety of securities such as stocks, bonds, or commodities. Mutual funds are managed by professional managers who use their expertise to select profitable investments in accordance with pre-set criteria such as level of risk or desired gain rate.

There are many cash alternatives, including Treasury bills, money markets deposits, certificates-of-deposit (CDs) and commercial papers. These products often mature in one year, so they have very little risk of being defaulted on or losing value. This type of investing is best for conservative investors who aren't willing to take high-risk but still want a higher return than depositing money in low-interest bank accounts.

Which is more difficult, forex or crypto?

Forex and crypto both have unique levels of complexity. Because crypto is new and closely related to blockchain technology, it may prove more difficult for beginners. On the other hand, forex has been around for a long time and has a reliable trading infrastructure supporting it.

Cryptocurrency trading is more risky than forex. This can be due to the fact that cryptocurrency markets are unpredictable and move rapidly. If you want to succeed in crypto trading, researching the historical trends in the markets where it trades can give you an edge over your competition.

Forex traders should be able understand the dynamics among foreign exchange pairs. They need to know how prices shift based upon news and macroeconomic events. This also requires an in-depth understanding of technical indicators which can indicate sell or buy signals. The leverage factor is another important consideration. Forex traders who trade currency pairs with high volatility are at risk of losing their capital and may have to borrow additional funds.

Both forex and crypto both require attention, solid research skills and a clear strategy in order to consistently make profitable trades.

Statistics

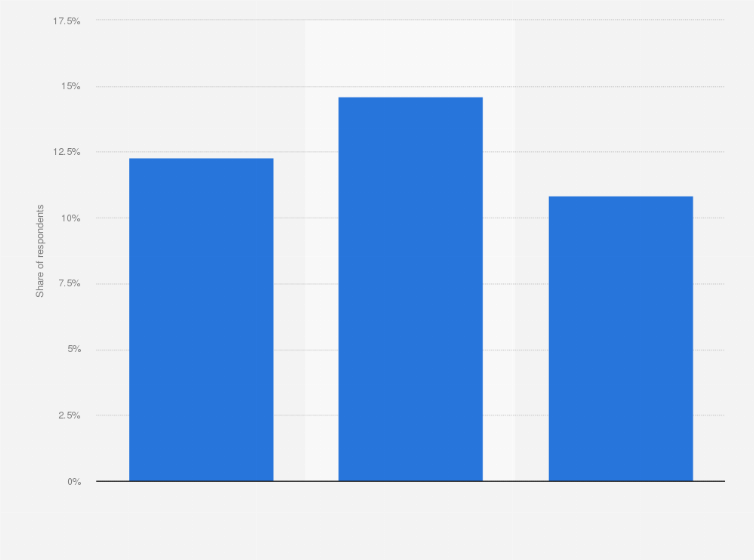

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- Effective since 12/16/2022, Schwab has 10.825% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- Fidelity's current base margin rate is 11.325%. (fidelity.com)

- Effective since 12/16/2022, Vanguard is 9.50% for debit balances of $500,000 to $999,999.99. (fidelity.com)

External Links

How To

How can I verify that an investment opportunity is legitimate?

When you invest online, it is crucial to do your homework. Look into the company behind the opportunity. Ensure that they have been registered with the proper financial authorities. Also, make sure to check for any industry regulations that could affect your investments.

Review past performance data, if possible. Check out customer reviews to see how others have experienced the investment opportunity. It's possible to make a good investment, but be skeptical of claims that guarantee future results.

Understand the risk profile of the investment and familiarise yourself with the terms and conditions. Before opening an account, confirm the exact fees and commissions on which you might be taxed. Conduct due diligence checks to make sure that you're receiving what you paid for. You should have an exit strategy that is clear in case something goes wrong with your investment. This could help you reduce your long-term losses.