A16z is an venture capital firm located in Menlo Park. Its portfolio includes early stage investments in mobile communications, e-commerce, gaming, and enterprise IT. It is also a major investor in Facebook and Twitter as well as Airbnb.

A16z is the largest venture capital firm in the world. Marc Andreessen founded the company in 2009 with Ben Horowitz. It has been a part of many of most significant and successful investments made over the past few years including Airbnb, Skype (GitHub), GitHub, Twitter and GitHub.

In 2014, A16z led a $57 million Series B round in Optimizely, which is a cloud-based enterprise management SaaS. A16z also led a Series B round of $21 million in Figma, which is a web3 platform that allows team collaboration and a $50m Series D round at Roblox, a virtual-reality game developer. Other notable investments include $450 million in a seed round for Yuga Labs, a cloud CAD software company, and $80 million in Onshape, a cloud computing infrastructure company.

A16z has invested in several companies involved in developing crypto/blockchain technology. A16z Crypto Investments is one of its latest investments. This company invests in companies at the early stages as well as infrastructure that will support layer 1 and 2. The portfolio includes CryptoKitties (Dfinity), and PeerStreet.

OpenCoin is one of the earliest cryptocurrency companies to have venture capital. The company is located in San Francisco. OpenCoin has become one of the most prominent players in crypto. In April 2013, the company was acquired by a16z.

A16z also made other investments in crypto, as did many other venture capital companies. BuzzFeed (Onshape), Medium, and Databricks are some other notable companies that a16z have invested in. A16z has also invested in companies like uBiome, Stack Exchange, Honor, Inc., Okta.

A16z is also a leading investor in blockchain-related companies. Paradigm Venture Capital was also founded by A16z, which invests in encryption technologies. They have made investments in a crypto fund worth $300 million and a new crypto custodian called Entropy.

Another of the firms on a16z's list of investments is Polychain Capital. This fund is the first to manage a $1 billion in assets. It is supported in part by Sequoia Capital (Tiger Global Management) and Union Square Ventures (Union Square Ventures).

A16z is an investor in various crypto/blockchain startups, including Dfinity. Imply. Smartcar. A fourth crypto fund was announced by the firm, and it will be worth $4.5 million. The majority of this money will be used in seed investments. Layer 1 infrastructure and layer 2 infrastructure will get the rest.

Andreessen, Horowitz (or "a16z") is one of the biggest investors in the crypto and blockchain industry. Besides crypto, a16z has invested in startups such as Netflix, Facebook, GitHub, Airbnb, and Twitter. A16z is not only an investor in the startup industry, but also one of the largest investors in consumer and fintech businesses, like Coinbase or Uber.

FAQ

Frequently Asked questions

What are the four types of investing?

Investing can help you grow your wealth and make money long-term. There are four major categories: stocks (bonds), mutual funds (mutual funds), and cash equivalents.

There are two kinds of stock: common stock and preferred stocks. A common stock allows an individual to have a share of the company. It includes voting rights at shareholder's meetings and the ability to earn dividends. The preferred stock gives you ownership rights, but no voting privileges. Investors also have the option to receive fixed dividend payments.

Bonds are loans by investors that are made to governments or businesses in exchange for interest payments. Bonds offer greater stability and lower risk than stock, but they have higher returns than stocks.

Mutual funds combine investor money to spread investment risk and diversify investments. They can be used to pool capital across many securities such as bonds, stocks, and commodities. Professional managers oversee mutual funds and use their expertise to pick profitable investments that fit pre-set criteria. These include risk tolerance or potential return.

You can find cash equivalents in products like Treasury bills or money market deposits or certificates of deposit (CDs), which usually mature in one or two years. They are also less likely to be defaulted or lose value. This type is best for conservative investors, who don't mind taking high risks but still desire a greater return than deposits at low-interest banks accounts.

What are the advantages and drawbacks to online investing?

Online investing has one major advantage: convenience. You can manage your investments online, from anywhere you have an internet connection. Online trading is a great way to get real-time market data. Many online brokerages charge lower fees than traditional ones, which makes it easier to start investing with less money.

Online investing is not without its challenges. Online investing can lead to difficulties in getting personalized advice and guidance. You don't have the support of a financial advisor, broker, or physical broker. Additionally, online trading platforms may not offer the same level of security as traditional brokerages, so investors need to be aware of the risks involved. Online trading is more complex than traditional investing. This is why it is crucial to be familiar with the markets and formulate a sound strategy.

It is also important for online investors to be aware of all the investment options. Investors have many options. There are stocks, bonds mutual funds, cash equivalents and stock options. Each type of investment carries its own risks and rewards, so it is important to research each option before deciding which one is right for you. Additionally, some investments may require a minimum deposit or have other restrictions that need to be taken into consideration.

Are forex traders able to make a living?

Yes, forex traders can make money. It's possible to make short-term gains, but the long-term benefits of forex trading are often based on dedication and a willingness for learning. More traders who are able to understand the market and can analyze technical issues will be successful than those who rely on luck or guesswork.

Forex trading isn’t easy, but it is possible to earn consistent profits over time with the right strategies. Before risking any real capital, it's important to find a knowledgeable mentor and have a working knowledge about risk management.

Many traders fail because of lack of a systematic plan or approach. However with discipline, one can increase their chances of making profit in the foreign currency (forex) markets.

Forex traders who are experienced create trading plans to help them reduce their risk exposure while still finding lucrative opportunities. A good risk management strategy is essential. Some traders become too aggressive in pursuit of quick wins, instead of developing a consistent long term strategy.

Forex traders can increase their long-term profitability by keeping detailed records, studying past trades as well as payments and understanding platforms that facilitate currency trading.

In forex trading, discipline is key. By setting rules about how much you will lose on each trade, you can minimize losses and increase your chances of success. Additionally strategies such as leveraging entry signals can often increase profits.

The bottom line is that you must be persistent and learn from successful day traders to make a profit trading forex markets. This applies regardless of whether your capital is invested or managed for another person.

Which forex or crypto trading strategy is best?

Both crypto trading and forex have potential for profit, but which one is right for you depends on your investment goals.

Forex trading involves investing in foreign currencies. This is an easy option for beginners. Forex trading requires less capital upfront and the forex markets are open 24 hours a day.

However, crypto trading can offer a very immediate return due to the volatility of prices. Crypto trades are also highly liquid, so cashing out your tokens quickly is possible.

Both cases require that you do extensive research before investing. Diversification of assets and managing your risk will make trading easier.

It is important to be familiar with the various types of trading strategies that are available for each type. For instance, forex traders may use technical or fundamental analysis to make their decisions. Crypto traders might use arbitrage, margin trading, or both to maximize profits. To help manage their investments, traders may use automated trading systems or bots. Before investing, it's important to understand both the risks and the benefits.

Which is more difficult forex or crypto currency?

Forex and crypto both have unique levels of complexity. Crypto may require a greater level of understanding due to its newness and connection with blockchain technology. Forex, however, has been around for quite some time and has a reliable trade infrastructure.

There are greater risks in cryptocurrency trading than forex. This is because crypto markets can move quickly and in unpredictable ways. It is important to research historical trends and learn from your peers if you wish to be successful at crypto trading.

Forex traders need to be able to comprehend the dynamics between foreign currency pairs. For example, how prices react to news. You also need to be able to read and understand technical indicators, which can signal buy or sell signals. Another important aspect to consider is leverage. Traders are exposed to additional risk when trading currency pairs with high volatility.

To be successful in forex and crypto trading, you need to be attentive, have solid research skills, and have a clear strategy.

Which trading platform is best?

Choosing the best trading platform can be a daunting task for many traders. There are many trading platforms out there, so it can be difficult for traders to choose one that is right for them.

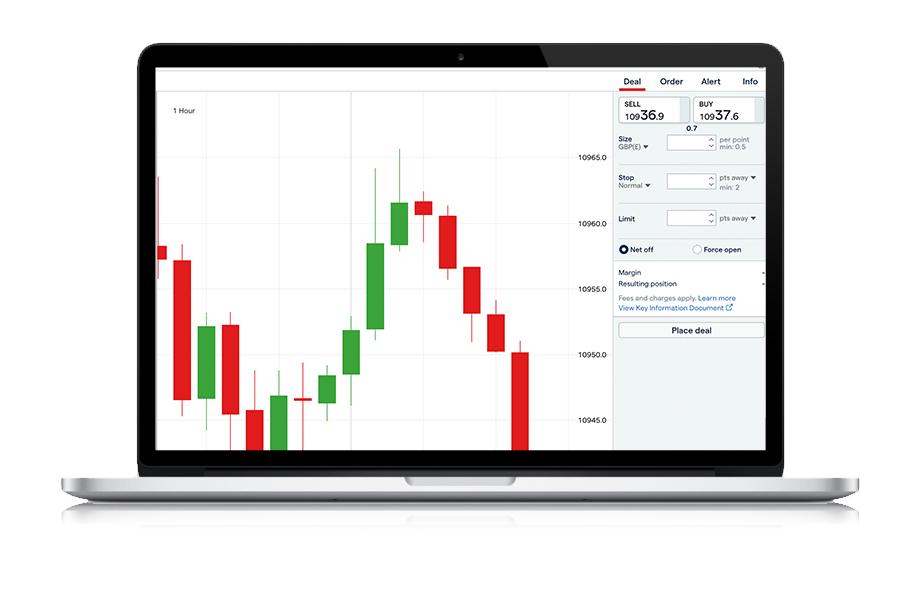

The best trading platform must offer all of the features that you need such as chart analysis tools and real-time market data. It should also have sophisticated order execution capabilities. It should also feature an intuitive, user-friendly interface.

It should offer multiple account types and low fees. You also need reliable customer service and educational materials. Look for platforms that offer demo accounts or free trials so that you can practice with virtual money before risking any of your own cash.

Consider your trading style when searching for a platform. This includes whether you are active or passive, how often you trade and what asset classes you prefer. This information will help you narrow down your search and find the best trading platform.

Once you have identified the platform that suits you best, it is time to explore additional features such backtesting capabilities and stock screening tools. Additionally, ensure your chosen platform provides appropriate security protocols in place to protect your data from breaches or theft.

MetaTrader 4/5, cTrader, eToro, ProRealTimeTrade FusionPlus500 NinjaTrader Webtrader InteractiveBrokers TD Ameritrade AvaTrade IQ Option Questrade Investopedia Trade Idea Xtrade Libertex Robinhood TD Ameritrade TD Ameritrade XCM ThinkOrSwim, to name a few.

Statistics

- Effective since 12/16/2022, Fidelity is 8.25% for balances over $1,000,000. (fidelity.com)

- 8.25% rate available for debit balances over $1,000,000. (fidelity.com)

- Call E*Trade for rates on debit balances above $499,999.99, as its rates are not published for anything above this amount; Effective since 12/16/2022, TD Ameritrade 11.75% for debit balances of $250,000 to $499,999.99. (fidelity.com)

- One pip typically equals 1/100 of 1%. (investopedia.com)

- Effective since 12/15/2022, E*Trade has 11.20% for debit balances of $250,000 to $499,999.99. (fidelity.com)

External Links

How To

What are my best options to avoid falling for online investment scams

Protection begins with you. It is possible to protect yourself against being duped by understanding fraudsters' tactics and learning how to spot them.

Don't fall for any offers that appear too good to pass up, high-pressure sales tactics or promises of guaranteed return. Don't respond to unsolicited calls or emails. Fraudsters are known to use fake names. Do not respond to unsolicited emails or phone calls. Investigate investment opportunities thoroughly and independently, including researching the individual offering them before making any commitments.

Never invest your money in cash, on the spot or by wire transfer. If an offer to pay with these methods of payment is made, you should immediately be suspicious. Remember that scammers will do anything to obtain your personal information. Avoid identity theft by being aware and alert to the various types of online scams, suspicious links sent via email, or advertisements.

Also, it is important to invest online using secure platforms. Look for sites with a good reputation and that have been regulated by Financial Conduct Authority. Check for encryption technology, such as Secure Socket Layer (SSL), which helps protect your data when it is sent over the internet. Before investing, ensure you fully understand all terms and conditions. This includes any fees or charges.